Key Insights

- FTT is the best-performing cryptocurrency in the market over the last 30 days, with a 30% price increase within the last week.

- The number of active addresses for FTT has also spiked recently.

- There are rumours of a possible FTX relaunch, which could be driving up the price of FTT.

- FTT is currently at a special “buy the dip†zone, leading to its price action

In some ways, the crash of FTX/Alameda still ripples through the market to date.

When these two companies went down around this time last year, FTT (FTX’s native cryptocurrency) crashed by as much as 80% in a matter of days, bringing Bitcoin, Ethereum and the rest of the crypto market down with it.

However, quite recently, the tables have turned.

FTT, according to CoinMarketCap, is the best-performing cryptocurrency in the market over the last 30 days, by a wide margin.

FTT is so largely traded, that it has a $113 million trading volume over the last 24 hours, as well as more than a 30% price increase within the last week.

Why is this happening, and what major FTX updates can we use to explain all of this?

Let’s find out:

Let’s Go Over The Major Price Updates

This seems like the best thing to do for starters.

We established earlier, that FTT has been bullish on the daily, weekly and even monthly timeframes.

However, what we haven’t mentioned is the spike in metrics such as the number of active addresses over the last 7 days and the past month.

This means that more and more people have been transacting with the cryptocurrency as of late, explaining the intense spike in its price.

But why is this happening?

Here Are A Few Ideas: An Incoming FTX Reboot

Price surges in the crypto market always have a reason. And in the case of FTT, there might be two major reasons:

The first is the rumours of a possible FTX relaunch.

Companies coming back from the dead, especially after a scandal the size of November 2022’s collapse can be difficult to achieve.

However, this has not stopped FTX. According to reports, several parties are interested in buying the now-defunct exchange.

This happened after FTX reported that it had recovered about $7.3 billion in liquid assets. If these reports are anything to go by, we may see FTX reborn by mid-2024.

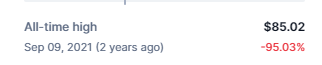

FTT is severely underpriced at this point and has declined by about 95% from its all-time high.

This explains why investors may be buying FTT. If we indeed see an FTX reboot, FTT is bound to rally to the upside by a wide margin, creating some very attractive “returns on investments†for investors.

Another Perspective: Binance’s Issues With The DoJ

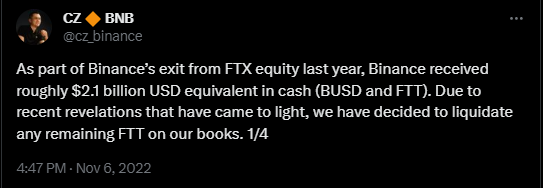

It is also interesting how FTT started to rally, shortly after Binance and its CEO had a run-in with US lawmakers.

FTT recorded nearly a 30% price rally from $3.65, less than 48 hours after former Binance CEO, Changpeng Zhao announced that he was stepping down.

Santiment even noted in this tweet, that FTT rallied for the second time in a matter of days after the Binance announcement.

In particular, FTT rallied so strongly because the 10 largest wallets simultaneously started accumulating about $12.8M worth of FTT within 19 days.

The inverse correlation between Binance and BNB is also worth mentioning, considering how Binance may have “unknowingly” sped up FTX’s collapse last year after its CEO announced that Binance would be selling its FTT holdings.

In particular, a Californian citizen even sued Binance and Zhao in October this year, for “attempting to harm†FTX in November last year.

FTT Pumps, BNB Dumps

BNB has been in a steady decline over the past week, compared to FTT’s bullishness.

The cryptocurrency began to rally initially, after the announcements that the DoJ was letting Binance off the hook if it paid a $4 billion fine.

However, after it was announced that Zhao would be stepping down as CEO, BNB aborted its attempts to break past $206 and simply declined to $224.

According to the charts, BNB may have found support at this point and may register a wave of bullishness in the coming week.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.