Key Insights

- Coinbase outages are now seen by many crypto investors as a bullish signal, because they historically coincide with Bitcoin price surges.

- Bitcoin’s recent surge to a new all-time high of $111,999 was partly fueled by strong market fundamentals.

- Coinbase added fuel to the speculation with a cryptic tweet during its downtime.

- Despite some skepticism about the recurring outages, the overall market sentiment is highly confident.

Bitcoin surged to a new all-time high of $111,999 early on July 10.

This came after Coinbase, one of the largest U.S.-based crypto exchanges, got hit with unexpected downtime.

However, instead of this event triggering fear or frustration, it sent ripples of excitement through the community.

For many seasoned investors, Coinbase going offline during a Bitcoin rally is no longer viewed as a red flag, and here’s why this event could be an unofficial bull market indicator.

“Full Send is Loading”

Just as news of Coinbase’s connectivity issues spread, so did speculation of a bullish breakout.

Crypto Twitter, in particular, started to show up with predictions and jokes, with most of them rooted in the belief that Coinbase outages have historically coincided with market upswings.

Coinbase outage sparks celebration | Source: Twitter

The market sentiment, which had been one of caution, quickly changed into a celebration.

Bitcoin shot up by nearly 2.5% within 24 hours and reclaimed the psychological $111,000 level before briefly peaking at $111,999 on Binance.

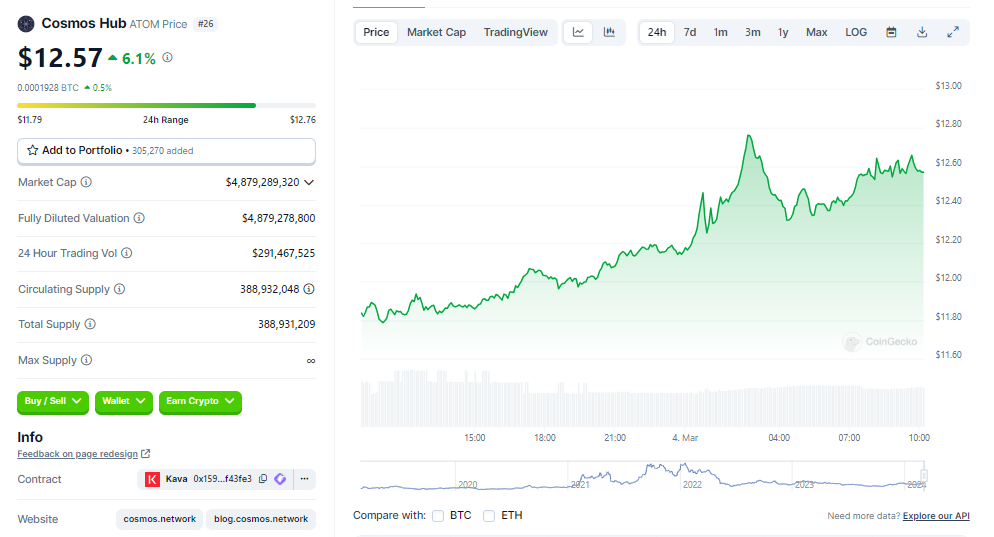

Market Optimism Backed by Real Fundamentals

However, more than internet memes and inside jokes, Bitcoin’s rally is also supported by strong market fundamentals.

Just a day before the price breakout, the U.S. Federal Open Market Committee (FOMC) released meeting minutes.

These minutes hinted at a possible interest rate cut in the upcoming July 30 meeting, which added fuel to an already bullish setup.

At the same time, institutional interest in crypto is also on the rise. On July 9 alone, Bitcoin spot ETFs recorded $218 million in net inflows.

Coinbase outage and ETF flows | Source: Twitter

This marked the fifth consecutive day of positive inflows, with the Ethereum ETF market also netting around $211 million in net investments.

This further confirmed the massive institutional appetite for crypto assets.

Coinbase’s Tweet Adds to the Drama

While all of this was ongoing, Coinbase itself posted a mysterious tweet that simply featured a single Bitcoin symbol.

This post had no caption and no explanation and for the average observer, this may have seemed odd.

However, the crypto “OGs” took this to mean that Coinbase was sending a subtle nod to what was unfolding.

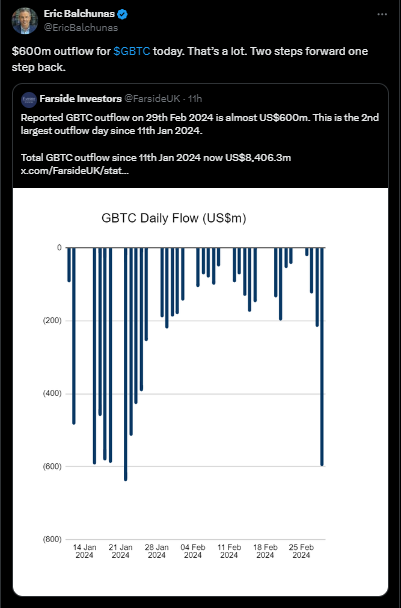

However, not everyone was amused.

Skeptics questioned the recurring pattern of Coinbase outages that always seemed to “coincide” with surges in trading activity.

Some suggested that the exchange might be deliberately going offline to manipulate sentiment.

Critique of Coinbase’s outages | Source: Twitter

Overall despite the criticism, many traders now see these outages as a legitimate part of the Bitcoin bull market lore.

Bullish Momentum Shows No Signs of Slowing

Bitcoin’s new all-time high is more than just a price milestone. It now shows that investors are becoming more and more confident in the market.

From retail traders riding the meme wave to institutional investors pouring hundreds of millions into ETFs, the appetite for digital assets is clearly on the rise.

As Coinbase’s latest downtime incident adds yet another chapter to crypto history, the community is once again reminded of just how speculative this space can be.

In this scenario, a glitch is no longer just a technical issue. Instead, it has become a signal, a meme, and a reason to strap in for the next leg up.

If the current momentum continues, we may be looking at a fresh new high for Bitcoin and most of the altcoins.

Overall, Bitcoin’s journey this year is quickly becoming one for the history books.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.