Key Insights

- Bitcoin investors are getting tired of the current market conditions, which are characterized by low volatility and a lack of price movement.

- The amount of money flowing into Bitcoin is increasing, but it is still not enough to sustain a bull market.

- The average cost basis for BTC holders is rising, which means that most investors are buying at a higher price than they would like.

- Bitcoin’s volatility has suffered in recent months, and this is making it difficult for investors to make profits.

- A large majority of BTC holders are still at losses on their holdings, which is preventing them from selling.

Bitcoin and the general crypto market have been trading in a literal range for the past few months, and investors may be getting tired, according to a new article published by Glassnode.

One of the biggest allures of cryptocurrencies is their relative volatility.

With crypto, investors can jump into the market with a (relatively risky) trade, make some (relatively quick) profit and head back out again when they’ve had enough.

However, what happens when this same market continues to drag its feet for months on end, refusing to break out from ranges that continue to narrow down as the days go by?

Glassnode has a pretty good answer to that.

Investors Are Getting Tired

This might be the simplest way to put things.

In a recent article published by Glassnode, the amount of money pouring into Bitcoin is entering a very shallow climb.

Citing the realized cap metric on BTC, Glassnode explains that “investors simply ain’t investing†anymore.

Glassnode notes that over $16 billion in value ( representing a 4.1% increase over the last month), has flowed into BTC since January.

This seems like an impressive figure. But is it enough?

No.

The chart above shows Bitcoin’s realized cap as calculated by Glassnode.

Glassnode observes that the climb of BTC’s realized capital is quite shallow, and is a shadow of the steep rise we saw during the 2021-22 uptrend.

Glassnode says that while enough capital is flowing in, the pace is still incredibly slow, compared to the cryptocurrency’s performance in the past.

BTC’s Rising Cost Basis

Here’s a little background information:

Cost basis is defined simply, as the original price an asset is bought for.

According to Glassnode, the realized cap we mentioned earlier, can be divided into two components:

- The Long-Term Holder component

- The Short-Term Holder component

Interestingly, Glassnode mentions that the STH “cohort” has seen its wealth increase by $22 billion this year alone.

This contrasts with their LTH neighbours, whose wealth has actually decreased by $21 billion.

Why is this happening?

Glassnode says that a likely cause may be that

- The Short term holders are chasing the market higher. In essence, this cohort shows that more people are willing to buy BTC at its current prices, raising the average cost basis for the cryptocurrency.

- On the other hand, BTC’s lack of volatility may be a likely cause for this declining average cost basis.

- Glassnode notes that the amount of BTC acquired for less than $24,000 in the first quarter of the year have now matured into long-term holder status.

As we can see in the chart above, the cost basis for short-term holders is up by more than 59% this year (sitting at about $28,600), while the average cost basis for the long-term holders is much lower, and is sitting at about $20,300.

What does all of this mean?

It means that most of the BTC holders at the moment, bought at a relatively higher price than others.

Bitcoin Volatility Has Suffered

BTC’s volatility issues are no longer a secret.

Citing the Bollinger bands on Bitcoin’s weekly chart, Glassnode notes that these bands are now separated by only 2.9%.

Bollinger bands, invented by John Bollinger, are one of the most potent indicators for determining a market trend.

When the Bollinger bands on an asset tighten on higher timeframes, it means that volatility is leaving the current trend. They are triggered when volatility reaches a six-month low and are one of the most important tools in a technical analyst’s toolbelt.

However, in a way, Bollinger band squeezes also happen when a massive breakout is underway.

Glassnode drew a comparison to a similar pattern in September 2016, when Bitcoin’s Bollinger bands were the same width apart.

Bitcoin went on to rally straight up from $604 to about $20,000 in 2018 as illustrated above.

So does this mean better days are coming?

Bitcoin’s Supply “Temperatureâ€

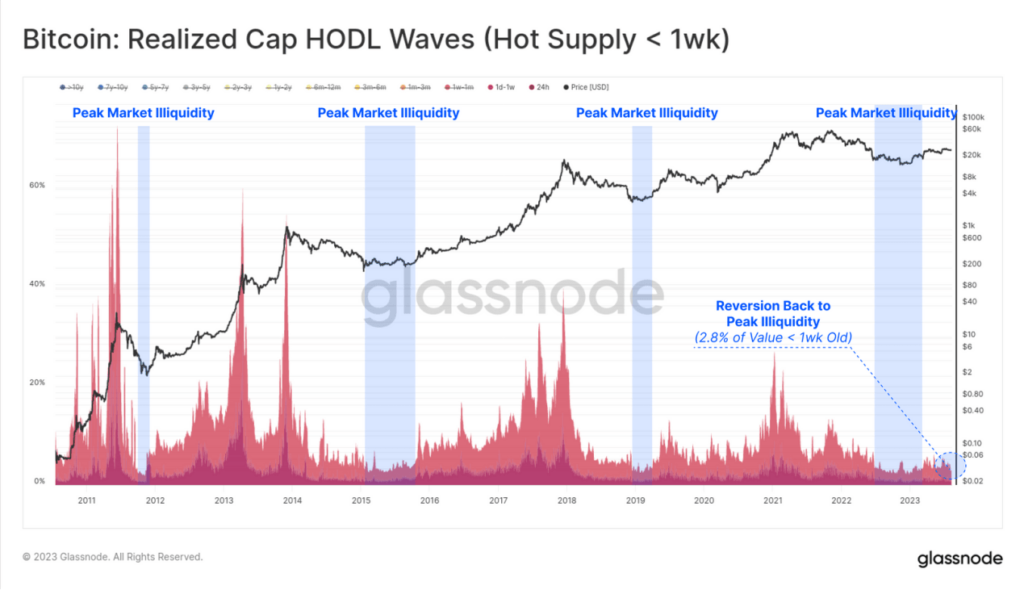

Relating “investor holding time†(or the last time a coin moved on-chain) to “temperatureâ€, Glassnode was able to make a pretty good guess about “investor convictionâ€.

The analytics company divides Bitcoin’s supply, according to how long they have been held, into:

- Hot Supply (held for less than 1 week):

Glassnode notes that the hot supply holders account for about 2.8% of all the invested Bitcoin.

Glassnode notes that investors who buy Bitcoin at its local peaks are to blame for raising the Hot Supply cost base.

Putting it all together, we can say that the people who are more willing to spend their Bitcoin, account for about 2.8% of the total circulating supply.

Another cohort in terms of Glassnode’s temperature scale is the:

- Warm Supply (supply held for 1 week to 6 months)

This cohort, according to Glassnode, packs a slightly harder punch than the hot supply holders.

According to Glassnode, they account for about 30% of the total circulating supply.

However, the article says, while the figures are impressive for the hot and warm spenders who are more willing to spend their coins, this leaves more than 65% of the supply to more mature long-term holders.

Glassnode notes that this similarity between warm and hot supply holders, the average cost basis for both are very similar.

This further supports the hypothesis that a massive amount of volatility is brewing for Bitcoin.

The final cohort Glassnode mentions are the:

- Single-Cycle Long-Term Holders (held for 6 months to 3 years).

These investors are highly seasoned HODLers, Glassnode says.

They are some of the HOLDers that have held on from before the last bull market, through the bull market, and fully through the current bear market.

If the harshness of the current bear market wasn’t enough to make these investors sell at losses, then one best believes that nothing else will.

Glassnode notes that these single-cycle investors’ cost basis is at $33.8K (compared to Bitcoin’s current price of under $30,000).

From this, we can conclude that the average member of this group still has an average unrealized loss of -13.3%.

We can make one simple conclusion from this.

Most people who are holding Bitcoin at the moment, are likely holding at losses and are unwilling to sell at these losses.

This indicates that the 2022 bear market still has a large part to play in the average Bitcoin owner’s spending and HODLing behaviour.

In Conclusion:

Glassnode’s article can be summarised into some of the following key points:

- Volatility in the crypto market is historically low, and more investors are holding, rather than spending

- Bitcoin’s current conditions resemble the bear market hangover seen in prior cycles.

- This low volatility on Bitcoin is leading to frustration, apathy and exhaustion, which is also seriously affecting its demand (and therefore, its price)

- Bitcoin’s Realized Cap (or inflow of money) is climbing, but only very slightly.

- And finally, a large majority of the Bitcoin market is still at losses on their holdings.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.