Key Insights

- Bitcoin and the broader crypto market have crashed massively in the past week.

- There are ongoing fears of a recession and a possible interest rate cut by the Federal Reserve.

- Bitcoin’s market dominance has increased despite the ongoing decline, and analysts are predicting a further crash in Bitcoin’s price.

- In sum, this is the largest three-day sell-off on the crypto market over the last year.

The first week of August has thrown the stock and crypto markets into a bloodbath, with Bitcoin and other major stocks leading the crash and pulling the remainder of the markets down with them.

As more talk of an ongoing recession hits the United States, we now have double-digit losses across the financial markets and billions of dollars worth of liquidations wiped off the slates.

Here are some of the biggest things to know about the crypto market in particular and what analysts expect might come next:

1. 17% Market Crash: What Happened With Bitcoin at $50K?

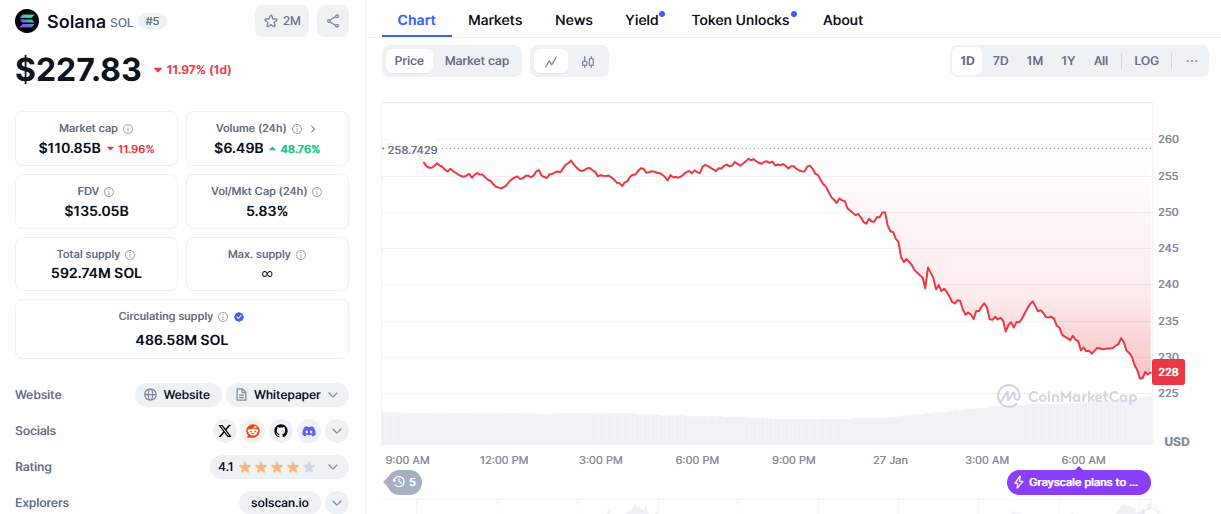

At the time of writing, Bitcoin’s price plummeted straight down, dipping below the $50,000 zone for the first time since February of this year.

The ongoing decline caught the majority of the market unaware, and Bitcoin, in particular, has lost around $18,000 in less than a week!

Bitcoin’s ongoing decline

However, amid the ongoing decline, Bitcoin’s market dominance has been on the rise, soaring to around 58%, amid the broader market collapse between Sunday and Monday.

As it stands, the total market cap has taken a severe hit, falling from around $2.16 trillion to around $1.76 trillion.

In particular, the dump started on 5 August, when Bitcoin hit an intra-day low of around $49,351 before recovering slightly to the $51,000 zone.

$1 billion wiped off the board

Coinglass data now shows that Bitcoin alone was responsible for $379 million worth of liquidations, with Ethereum following closely behind with $355 million.

The total market also saw around $1.1 billion worth of liquidations, $933 million of which came from the bulls alone.

Furthermore, Ethereum also experiences an intra-day decline of around 20% within a mere two hours while writing.

2. The Largest Crypto Wipeout

The most recent crash in Bitcoin and the general market is notable, considering it is now the largest three-day sell-off in the crypto market over the last year.

According to data from TradingView, the crypto market has lost around $500 billion in value since Bitcoin’s rejection of $70,000.

Furthermore, this decline also came with a 4% decline in the S&P 500 equities.

The crypto fear and freed index from CoinMarketCap, which peaked at around 53 on 3 August, has now gravitated downwards towards the 31 fear level.

This indicates a dramatic shift in market sentiment and can either be a buy signal or a sign of even worse dips to come.

The fear and greed index

On the other hand, analysts like Peter Brandt mentioned something interesting in a recent tweet.

According to the analyst, further declines in Bitcoin are a “possibility”, and the crypto market might be poised for further decline.

Crazy Sunday to end a crazy prior week to start an even crazier week to come

— Peter Brandt (@PeterLBrandt) August 5, 2024

According to the chart attached to the analyst’s tweet, a Bitcoin decline towards the $30,000 zone remains possible.

“I deal in possibilities, not probabilities and NEVER certainties,” Brandt says. “Crazy Sunday to end a crazy prior week to start an even crazier week to come.”

Which is Latin for “get ready for even crazier price action to come.”

3. The US Fed Is up on Its Toes—Interest Rate Cuts Soon

The recent turbulence across the stock and crypto markets has put tremendous pressure on the US Federal Reserve.

Recall that last week, the FED chose to maintain its high interest rates and only hinted at a possible decline in September.

This is because the market expects a rate cut before the announcement of the hawkish stance.

However, according to the CME FEDWatch tool, the ongoing market panic has pushed speculators into a continuation of its rate-cut expectations.

99% chance of an interest rate cut

The tool shows that expectations have shifted dramatically, with bettors in favour of a rate cut pushing up their odds from 22% to a staggering 99%.

In summary, the FED is being pressured to cut its interest rates, which will lead to better liquidity in high-risk assets like crypto.

“If there is enough pain in asset prices, we could get an emergency rate cut to calm the market.” Anthony Pompliano speculated in a recent tweet, “Very unlikely, but the Fed has a lot of options with rates at over 5%.”

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.