Key Insights

- Bitcoin price surged this week, after a large whale accumulation.

- Analysts seem to be predicting further growth for Bitcoin, as the end of the retracement comes into view.

- The large 52,000 $BTC single-day accumulation indicates that big investors are buying Bitcoin massively.

- The Bitcoin halving is approaching and is expected to drive Bitcoin’s price further up.

- Technical indicators show a strong rebound, with Bitcoin trading above its 20-day EMA. $BTC could reach $75,000-$81,000 soon.

Bitcoin’s recent uptick has come as a surprise to investors across the market.

After several calls for a crash to $45,000, the star cryptocurrency appears to have made an effortless rebound from $60,775 and is now trading solidly above the $70,000 mark.

Could the widely circulated FUD about a pre-halving crash be over? Or are we seeing the warning signs of a larger market decline?

Here’s a good way to look at the current state of Bitcoin, and what it could mean for crypto in general.

Is This the End of the Retrace?

This question might be hard to answer. However, analyst, Michaël van de Poppe in a X post, stated that “If $68K continues to hold, we’ll sweep the highs at the all-time high pre-halving”

Bitcoin’s rally prediction

Bitcoin did hold above $68,000, leading to the current rally we see in the charts.

Van de Poppe went further to say that he expects another peak from here, bringing further opportunity for investors to jump in on $BTC and the altcoins.

Moreover, analyst Rekt Capital made a similar observation about Bitcoin’s behaviour in a separate tweet.

If this ends up being the end of the Pre-Halving Retrace…

Then Bitcoin will have almost equalled the 2020 Pre-Halving Retrace

Bitcoin pulled back -18% in this cycle whereas BTC retraced just over -19% in 2020$BTC #Crypto #Bitcoin pic.twitter.com/a6G92JbbmY

— Rekt Capital (@rektcapital) March 25, 2024

The analyst noted that if this turns out to be the bottom of the current retracement, this cycle’s pullback would be identical to the -19% pre-halving retrace we saw before the 2020 bull cycle.

This short retrace from Bitcoin points towards a potentially explosive bull market for the cryptocurrency.

The Rebound and Accumulation Phenomenon

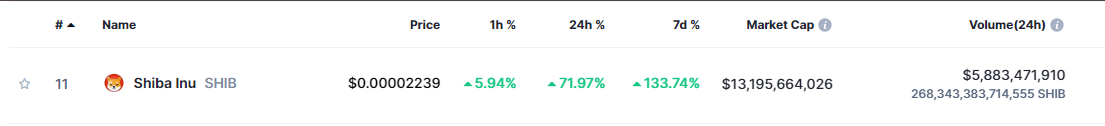

This week, right before Bitcoin hit the new $71,000 ATH again, we saw one of the most massive single-day whale accumulations in Bitcoin’s history on Sunday.

According to blockchain data aggregator, Santiment the whales (holding between 10 and 10,000 BTC) somehow staged a coordinated accumulation and raked in a staggering 51,959 BTC in a single day.

Bitcoin’s price chart

This move from the whales caught the shrimp and fish off guard. And considering how this tranche of Bitcoin was worth a staggering $3.4 billion, the massive Bitcoin buys represented a staggering 0.263% of Bitcoin’s total available supply bought—in just one day.

Approaching the BTC Halving

All of this is without mentioning the upcoming Bitcoin halving, scheduled to happen sometime around 19 April.

This event is set to be a catalyst for Bitcoin’s growth, and we are already seeing its effects.

At the time of writing, Bitcoin is up by around 6.11%over the last day and is trading at around $70,951 after hitting an intra-day high of $71,000.

The behaviour of the whales, as well as the current behaviour of Bitcoin’s price, shows that the optimism in the market is growing once again and that the big players are betting on a positive outcome.

Bitcoin at the moment, is trading on top of its 20-day EMA and appears to have rebounded strongly off its $60,775 high.

From the looks of the chart above, we might be looking at another pre-halving Bitcoin peak just waiting to happen, with the price targets being anywhere between $75,000 and $81,000.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.