Cardano is one of the ten largest cryptocurrencies on the market by capitalization. With a market cap of 12 billion, ADA sits at the 8th position on the global crypto market cap rankings.

The cryptocurrency trades around the $0.355 zone at the time of writing and is 88% down from its all-time high of $3.10 in November 2021.

What Is Cardano?

Like Binance Coin (BNB), Tezos (XTZ), and quite recently, Ethereum, ADA is a proof-of-stake cryptocurrency. This means that it is used as a reward or payment system for the users of the Cardano network who participate in its staking pool.

ADA is named after the Italian mathematician Gerolamo ADA. However, the ticker symbol (ADA) is derived from the name of Augusta Ada King, Lovelace’s countess commonly referred to as Ada Lovelace. Ada Lovelace is also regarded as the first computer programmer.

ADA was developed in 2015 by Charles Hoskinson and launched in 2017.

Over the years, ADA is one of those cryptocurrencies that have earned a name for themselves as “Ethereum killers.â€

“Ethereum Killer” is a nickname given to cryptocurrencies and networks that have similar characteristics to Ethereum and pose a real threat to overtaking it in the future.

Other cryptocurrencies referred to as “Ethereum killers” include Solana and Polkadot.

Cardano has positioned itself as a “third generation platform,” in contrast to Ethereum being a “second generation platform.”

Following the deployment of the Alonzo hard fork in 2021, ADA became a smart contract platform, going further into the “Ethereum killer” nickname and inching closer to (possibly) overtaking the second-ranking cryptocurrency in the world.

Updates: Cardano Completes Its Vasil Upgrade

One year after the successful completion of its Alonzo upgrade, which introduced smart contract functionality to the platform, Cardano has successfully undergone another upgrade in 2022, dubbed the Vasil upgrade.

After several delays, the long-awaited Vasil upgrade finally went live in September 2022, only a week after Ethereum merged with the beacon chain and became a Proof of Stake cryptocurrency.

Named after Vasil Stoyanov Dabov, a Bulgarian mathematician and one of the prominent members of the Cardano community, the Vasil upgrade is expected to enhance the network’s throughput, block latency speeds, and efficiency.

It is also expected to introduce three key Cardano Improvement Proposals (CIPs), namely CIP 31, CIP 32, and CIP 33.

These CIPs are expected to improve the network by streamlining, on-chain data saving, and lower transaction speeds.

As of September 2022, there are now over 2000 Dapps on the Cardano smart contract platform, including some of the biggest:

- MinSwap, a Decentralized Exchange

- Ardana, a Defi profuct suite

- and Cornucopias, a Game-Fi centered decentralized application

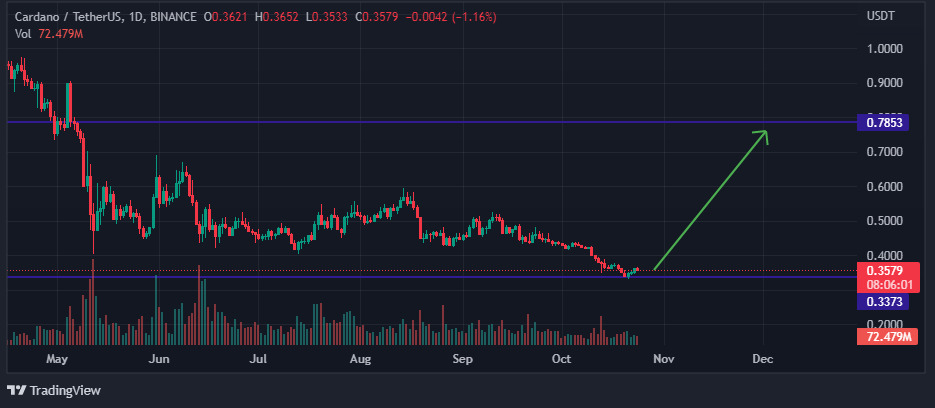

Cardano Price Analysis

Cardano is one of the worst-hit cryptocurrencies, affected by the crypto winter that lasted from November 2021 until date.

The cryptocurrency trades at $0.357 at the time of writing and is currently down more than 80% from its $3.1 high.

Cardano is trending up at the moment after hitting $0.3325. This level is a support it last tested in February 2021 before its ascent to its all-time high.

From a daily perspective, Cardano’s RSI shows slightly oversold conditions. This might indicate that Cardano may be ripe for longs, especially after hitting and bouncing off a major support.

However, it is important to enter trades like these with caution because a retest and even a break below these “major” support levels are still entirely possible, given the volatility and high risk involved in trading cryptocurrencies.

ADAÂ Price Prediction 2022

After hitting a low of around $0.3325, Cardano is starting to trend to the upside again, just like it did in early 2021, as illustrated by the historical chart above.

A similar bounce has happened, and if all goes well, 2022 might end on a good note for the crypto.

The bulls may finally step up, and Cardano may start to trend to the upside with minimal consolidation along the way.

And as far as 2022 goes, the prediction for Cardano is that the cryptocurrency may end the year between $0.55 and $0.78

ADAÂ Price Prediction 2023

As far as Cardano’s ascent to the $0.8 zone goes, the cryptocurrency may take the rest of 2022 and the first quarter to get there. However, Cardano is certainly bullish for 2023 and may trend further than anticipated.

As the next crypto cycle approaches, Cardano is expected to hold an average price of $0.7 – $1 in 2023.

Disclaimer: Voice of crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.info/da-DK/register?ref=V3MG69RO