Key Insights

- The crypto market saw a slight decline in the last 24 hours but remains relatively stable.

- Somehow, the fear and greed index has decreased further from 34 to 30 today, indicating fear and, therefore, incoming buying opportunities.

- Toncoin, Helium, Dogs and Notcoin gained, while MultiversX, Bittensor, Aave and Bonk lost value.

- The liquidations were relatively mild, with bulls suffering more losses than bears.

- Both Bitcoin and Ethereum are showing bearish signs, but a bullish comeback is possible as long as crucial breakdowns do not occur.

The crypto market has moved slightly downwards over the last 24 hours but remains largely unchanged, with a 0.81% decline.

Bitcoin currently trades at around $56,400, with Ethereum back below $2,400 and a crypto heatmap that looks like this:

The crypto market’s heatmap

Interestingly, the crypto fear and greed index has slid further downwards again into fear territory, with a reading of 30/100 compared to yesterday’s 34/100.

This shows that market participants are becoming increasingly fearful, and some good buying opportunities might turn up soon.

The crypto market’s heatmap

So far, some of the biggest gainers in the market include Toncoin, Helium, Dogs, and Notcoin, all of which have experienced price increases of between 3.64% and 6.82% over the last 24 hours.

On the flip side, some of the biggest losers include MultiversX, Bittensor, Aave and Bonk, all of which have declined between 5% and 6.8% over the last 24 hours.

The crypto liquidation heatmap

The crypto liquidations show a relatively mild liquidation score over the last 24 hours, the same as yesterday.

The market has collectively lost around $78 million in the last 24 hours, with the bulls suffering the worst of it.

While the bears lost $23.27 million, the bullish losses come in at around $54.4 million, which shows that the market favours the bears today.

Investors should consider approaching the market with caution, with this being said.

What Next For Bitcoin?

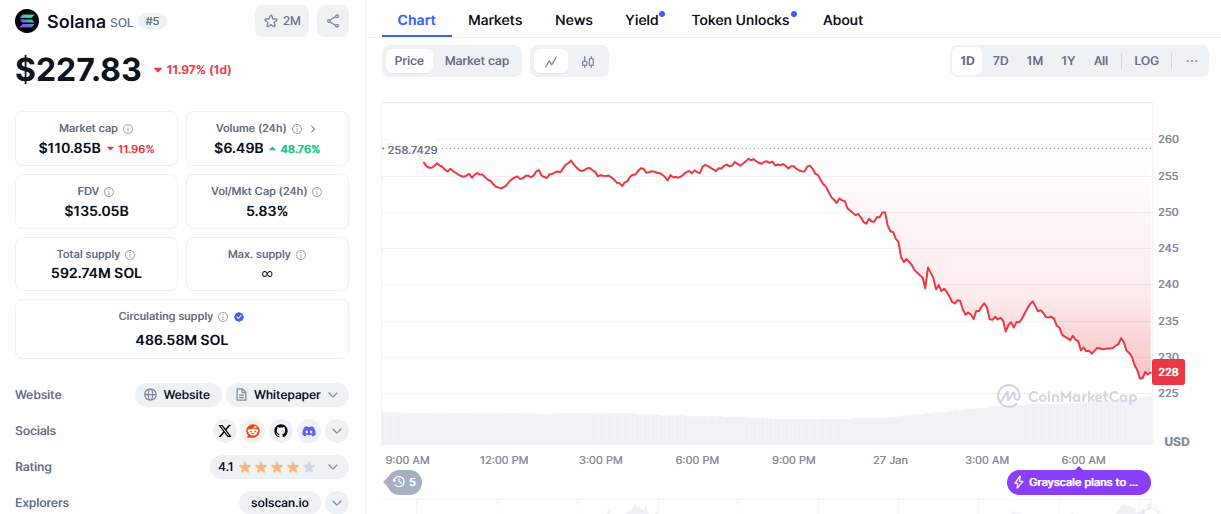

Bitcoin’s candlestick from Thursday this week was a long, bearish one.

The interesting part about this candlestick is that it covered the long lower wick of Wednesday’s candlestick, indicating that the bears might be considerably stronger in this scenario.

Bitcoin’s price performance

Bitcoin also closed underneath the $56,500 zone yesterday, which is another indicator of bearish strength.

The RSI on the daily charts shows slightly bearish neutrality, which indicates that the bulls could still stage a comeback.

However, the major invalidation of a bearish outlook on Bitcoin would be a break above its 25-day EMA around $59,333—which appears to be a long way up.

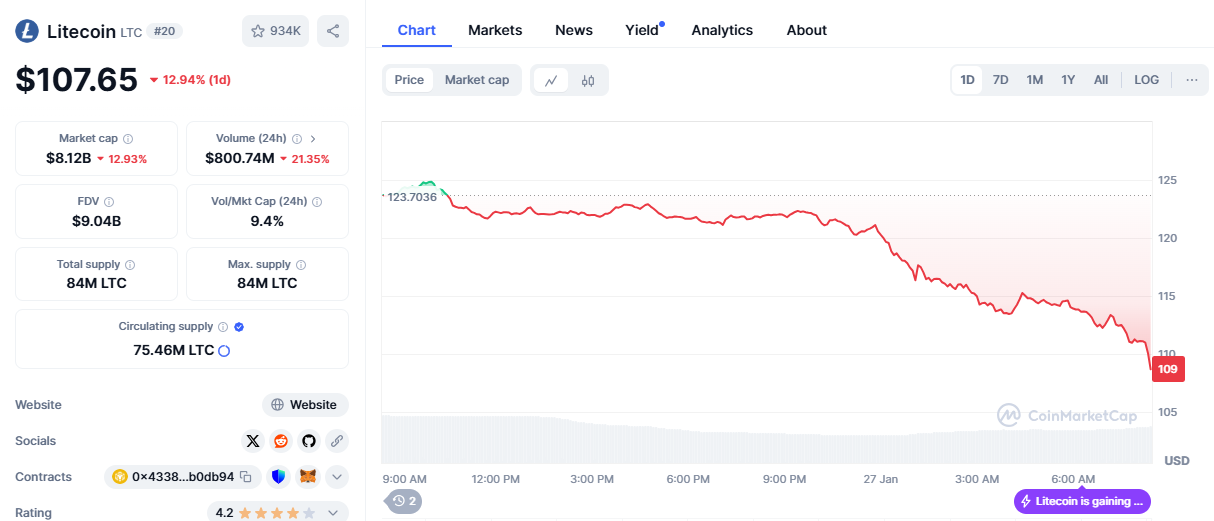

Can Ethereum Hold Itself?

Like Bitcoin, Ethereum’s candlestick for Thursday was considerably long and bearish, covering the lower wick of Wednesday’s candlestick.

However, unlike Bitcoin, Ethereum’s Thursday’s candlestick was unable to completely engulf Wednesday’s.

Ethereum’s price performance

Considering Ethereum’s price’s proximity to the bottom of the channel shown above, this might be one of the bears’ first signs of exhaustion.

With this being said, investors should watch out for what happens at $2,306 because a break below would result in a crash towards the $2,100 – $2,000 mark.

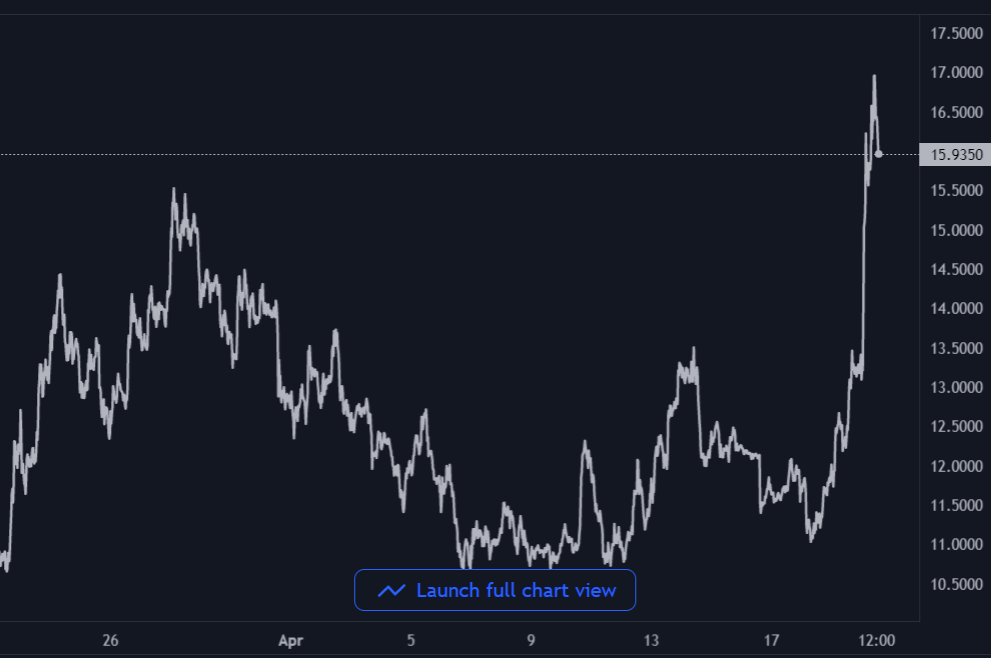

Watch Out For Helium (HNT)

Helium made the list in yesterday’s version of this report, and the outlook for the cryptocurrency is playing out nicely.

The charts show that after a period of consolidation between $6.28 and $7.45, the cryptocurrency has broken out and is aiming for higher highs.

Helium’s price performance

The Fibonacci extension tool shows relatively strong resistance at $8.9, and investors should plan accordingly.

If things go well and we see a breakout from this price level, the next available resistance is even higher up around $11.2.

However, if we see a rejection from $8.9, the next viable support sits at around $7.45.

What’s Happening With Toncoin?

Telegram Founder Pavel Durov spoke for the first time since his arrest a few weeks ago.

Naturally, fundamental price movers like these have notable effects on crypto, and Toncoin has emerged as one of the biggest gainers today, with a 7.33% price increase.

Toncoin’s price performance

As shown above, we have a clean rebound on Toncoin, from the descending trendline it was starting to form after the initial arrest.

The Fibonacci extension tool shows that a strong resistance sits at around $5.2, which indicates that investors should be wary of this price zone.

If we do see a break above this price level, though, the cryptocurrency should be set to retest its 25-day EMA somewhere around $5.6, depending on the strength of the bulls.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.