Key Insights

- The US Federal Reserve maintained interest rates at 4.25%-4.50% for the fourth consecutive time, as expected.

- The Fed’s updated forecast indicates fewer than two rate cuts in 2025 and a prolonged high-rate environment until 2027.

- Despite the hawkish tone, Bitcoin has shown resilience, as well as a divergence between price and declining Open Interest.

- Institutional investors are likely to rotate capital from riskier altcoins into more established assets like Bitcoin and Ethereum.

- The next FOMC meeting on July 31 will depend on June’s inflation and employment data.

The US Federal Reserve confirmed that it would maintain its interest rate at 4.25% — 4.50%.

This stands as the fourth consecutive pause since December of last year.

While speculators generally expected this move, the decision carries huge implications for the crypto market, where interest rate policy tends to dictate investor sentiment and capital flows.

In the wake of this development, Bitcoin has remained relatively stable near the $105,000 mark, while Ethereum hovers around $2,500.

However, a deeper look into this should show how this rate hold, combined with the Fed’s tone, could affect financial markets, including crypto.

A Cautious Fed Weakens Risk Appetite

The Fed’s decision wasn’t a surprise.

According to the CME FedWatch tool, there was a 99.9% probability that rates would remain unchanged before the Federal Open Market Committee (FOMC) meeting.

The central bank cited cooling inflation, a strong labor market, and the ongoing cross-border trade risks as reasons for its decision.

The interesting part, however, was the Fed’s updated economic forecast. So far, policymakers now expect fewer than two rate cuts in 2025, down from the two it previously predicted in March.

Only four FOMC members foresee any cut this year, and this indicates that there might be a longer-than-expected high-rate environment.

This could also suppress investor demand for speculative assets like crypto. According to the official dot plot as illustrated, the Fed sees rates staying high, well into 2026.

The official FED Dot Plot | Source: FED

Moreover, these rates will only gradually approach the long-term neutral rate of around 2.5% by 2027.

The long and short of it all is that monetary easing is still far off.

Bitcoin’s Mixed Response

Despite the Fed’s hawkish tone, Bitcoin has shown signs of resilience.

According to On-chain analytics platform CryptoQuant, there is an ongoing divergence between Bitcoin’s price and open interest (OI) on Binance.

While Bitcoin has repeatedly tested support near $104,000 and held firm, open interest has steadily declined. This means that the general market is currently in a general deleveraging trend (investors are using less and less leverage to trade).

This pattern can be healthy for Bitcoin over the long term. In fact, CryptoQuant’s analysts believe that historically speaking, whenever price finds solid support while OI drops, bullish breakouts tend to follow.

Analysis shows that a short squeeze to $106,000 could be incoming, especially with Binance’s order book data showing stacked ask liquidity around that level.

Capital Rotation and Institutional Sentiment

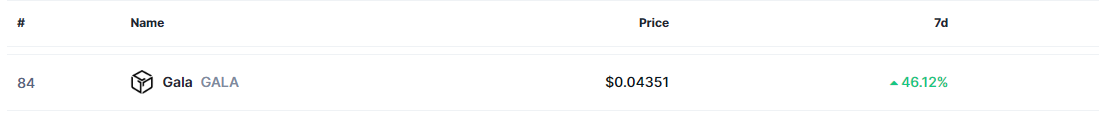

Considering the Fed signaling prolonged caution, capital is expected to rotate within crypto markets.

Institutional investors may shift some of their capital from riskier altcoins into more established assets like Bitcoin and Ethereum.

SUMMARY OF FED DECISION (6/18/2025):

1. Fed leaves rates unchanged for 4th straight meeting

2. Fed says uncertainty has diminished, but is still elevated

3. Fed lowers 2025 GDP estimate to 1.4%, lifts inflation estimate to 3%

4. Median Fed forecast shows 50 basis points of…

— The Kobeissi Letter (@KobeissiLetter) June 18, 2025

They could also opt for yield-generating tokens like staked ETH and tokenized U.S. Treasury products.

Bitcoin dominance will inevitably skyrocket soon and at the same time, assets like U.S. Treasury bonds will gain traction as a safer yield alternative.

So far, Inflation has fallen from 5.3% in July 2023 to just 2.4% in June 2025.

This means that this metric is getting close to the Fed’s 2% target. However, “sticky” inflation in services, and rising costs due to tariffs are keeping the central bank from declaring victory.

At the same time, President Donald Trump is publicly pressuring the Fed to cut rates faster, especially as the U.S. economy struggles with tensions like the Iran-Israel conflict.

Looking ahead, the next major inflection point will be the July 31 FOMC meeting.

Whatever happens then will depend on June’s inflation and employment data. Until then, investors should expect more strength from Bitcoin and possible shakiness from the altcoin market.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.