Key Insights

- Grayscale has applied with the US SEC to convert its Ethereum Futures Trust ETF into a tradeable ETF.

- However, Ethereum has been struggling in terms of price recently, with its YTD gains declining to less than 25%.

- According to a recent tweet from Colin Wu, Frog Nation’s former CFO, sifu.eth is betting $20 million against Ethereum in a derivatives trade Kwenta.

- Despite the bearish pressure from sifu.eth and other investors, Ethereum’s active addresses and deposits have spiked in recent days.

- Ethereum is currently facing resistance at $1,500. If it can break through this resistance level, it could lead to a rally up to $1,700 and beyond.

Grayscale, after Ark Invest and 21 Shares, became the latest company to submit a new Ethereum futures exchange-traded fund (ETF) application to the US Securities and Exchange Commission (SEC).

According to the 19 September filing, Grayscale formally asked that shares of one of its most popular Ethereum ETFs be listed and become tradeable.

Let’s go over what this means for Ethereum and everything you should know about its reaction to this new ETF

Grayscale Joins the Ethereum ETF Race

According to this document, Grayscale, known for running the largest Bitcoin fund in the world is now looking to convert its Ethereum Futures Trust (ETH) ETF into a tradeable ETF, in accordance with NYSE Arca Rule 8.200-E.

Given that several other financial institutions, including Volatility Shares, Bitwise, ProShares, VanEck, Roundhill, and Valkyrie Investments, have also recently submitted applications for Ethereum futures ETFs, this is bound to add much-needed support to the price of Ethereum, as more institutional investors join the fray.

Ethereum Turns Bearish as Former CFO Shorts $20 Million in ETH

According to CoinMarketCap, Ethereum’s YTD gains have declined to less than 25%, after surpassing the 65% mark when the price of the cryptocurrency stood at $2,100.

One of the possible reasons for Ethereum’s struggle in terms of price is how investors continue to sell the cryptocurrency, inflating its circulating supply and reducing its price.

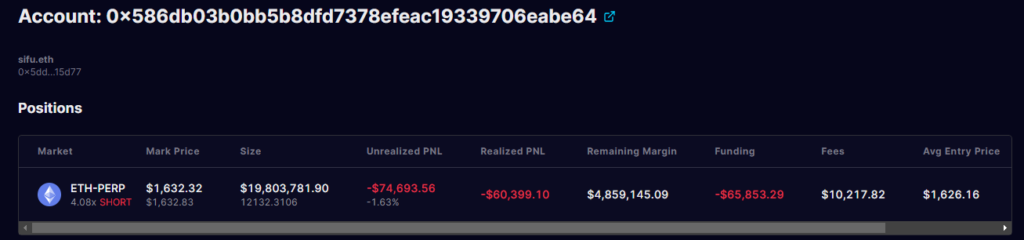

According to a recent tweet from Colin Wu, a renowned crypto reporter, Frog Nation’s former CFO, sifu.eth (with address “0x586d…abe64â€) now has a massive short position on ETH derivatives on Kwenta, a derivatives trading platform.

According to data from Synthetix watcher, sifu.eth has been selling ETH derivatives with more than 4X leverage, precisely at an average price of $1,627 (the resistance level ETH is desperately trying to break above).

This individual now has an open transaction worth $19,805,251, and a liquidation price of $1,991 as illustrated above.

This means that sifu.eth is betting $20 million on Ethereum’s inability to rally to above $1,990 again.

If ETH ever rallied up to $2,000 for example, it would result in an incurred loss of more than $19 million on sifu.eth’s part.

Ethereum Remains Red Despite Active Addresses and Deposits Spike

As illustrated below, the number of Active addresses on the Ethereum network remains high over the 30 and 7-day perspectives.

Additionally, over the last three days, the number of daily active addresses increased by 11%, going from about 357,200 to 396,150 wallets.

However, these metrics have not been enough to save the price of Ethereum.

CoinMarketCap data shows that Ethereum has been quite sluggish in price over the last day, and is up by 1.12%.

On the weekly timeframe, Ethereum is also nursing a not-so-impressive 3.46% loss over the last seven days.

Can Ethereum Maintain Its Footing Above $1,630? (Price Analysis)

After rebounding off the $1,540 zone, Ethereum appeared to be showing the final signs of a recovery, as illustrated below.

However, Ethereum has now hit resistance at $1,630 (sifu.eth‘s entry point) and is showing signs of a reluctance to break above.

The RSI is neutral but is leaning more towards the bearish side, indicating that the bears are more in control of the market than the bulls.

In all, Ethereum’s actions make predicting its behaviour quite easy.

If we are going to see a price rally on Ethereum, we first need to see a break above the $1,630 resistance, before another rally above $1,700.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.