Key Insights

- Over 138 memecoins launched in April 2024 alone, signalling a massive surge in memecoin popularity.

- Analyst, Crypto Koryo warns of a saturated market and memecoin bubble burst.

- The analyst says that this bubble exists because easier token creation tools are contributing to the memecoin boom.

- In all, Solana is becoming a preferred platform for memecoin development, surpassing Ethereum.

- Crypto Koryo notes that investors should always wait for memecoins to gain traction before investing.

Memecoin culture has always been a huge part of the crypto industry.

However, in recent times, the hype and popularity of memecoins have matched and even surpassed the Ethereum ICO craze of 2017, as highlighted in a recent piece by a crypto researcher.

This researcher notes that these cryptocurrencies which are typically inspired by memes and pop culture have become so huge in 2024, that we had more than 100 of them launched—in April of this year alone.

They Just Keep Comin’

According to insights in a recent tweet posted by crypto researcher, Crypto Koryo, April saw one of the craziest surges in memecoin activity this year.

Some thoughts on the memecoin narrative

In 20/21 bull, if you were into memes, your options were limited, DOGE, SHIB, FLOKI and maybe few others, most of which were on Ethereum. And most did extremely well.

Enormous inflow of retail/liquidity + few memecoin options =… pic.twitter.com/OKk6HySAkI— Crypto Koryo (@CryptoKoryo) May 5, 2024

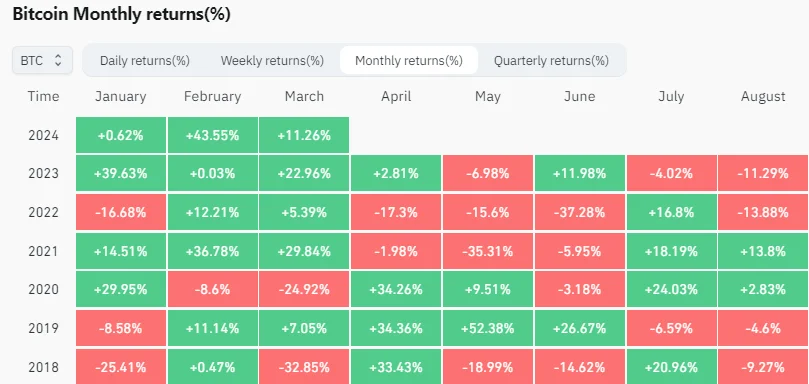

The analyst notes that a staggering 138 new meme coins were listed on CoinMarketCap within the fourth month alone, representing more than a 7 times increase from the same period in the previous year.

A staggering increase from last year

All of this, of course, indicates growing interest from the market’s participants. But doesn’t this number indicate looming trouble?

Further down the road, it is important to note that the actual figures are likely more than Crypto Koryo noted because, in actual sense, more tokens are deployed than listed.

Almost Anyone Can Create Memecoins Now

Crypto Koryo made reference to previous years when creating memecoins—or any other kind of cryptocurrency, really—required considerable technical know-how.

Developers had to do things like writing smart contracts, providing liquidity, marketing, releasing roadmaps and getting their tokens listed on price tracking platforms, before crypto exchanges.

Today, the crypto market has grown so rapidly, because token creation is now more “democratized”.

Almost anyone can create a token these days thanks to advanced blockchain tools and no-code solutions, that allow anyone to create a memecoin with a click or two.

While genuinely passionate creators have entered the market and created remarkable cryptocurrencies, scammers also recognize the opportunity and have done considerable damage so far.

Which Barriers Have Been Lowered?

This year, in particular, has seen several innovations in token standards.

For example, around 20 April, Bitcoin Ordinals creator, Casey Rodamor launched the Runes Protocol, allowing anyone to create fungible tokens right on top of the Bitcoin network.

The surge in Rune etching

Moreover, we also had the launch of the ERC404 token standard on Ethereum in February of this year, all of which have made it easier to launch new tokens.

These advancements in token creation have also played a direct role in shifting the memecoin focus from Ethereum to emerging competitors like Solana.

Crypto Koryo noted that Solana has now taken the baton from Ethereum, from a time when memecoins like PEPE, Floki Inu, and Shiba Inu were developed mostly on Ethereum.

Rising Oversaturation Concerns

Crypto Koryo notes that these memecoins have resulted in an oversaturated market, which as many know, might be the first sign of trouble.

The analyst warns that most of these tokens, by design, are likely to fail, leading to several burst bubbles and devastated investors.

The researcher also suggests that even if investors an on-chain approach and invest early, the success rate is still low.

However, the way to do things and be as safe as possible would be to wait for a token to gain traction for long enough, before jumping.

This makes sense, considering how most scam projects fail in the first few months after launch.

Overall, the growth in the memecoin market isn’t going anywhere anytime soon.

And as the bull market emerges further, it might be interesting to see which memecoins pass the test of time.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.