Key Insights

- Investor sentiment is starting to flip bearish, and many investors are starting to view the altcoin market with a bit of skepticism.

- The altcoin market has been through a tough November, with many coins losing value.

- Two-thirds of the top 100 altcoins have declined over the last 24 hours and lost most of their gains in November.

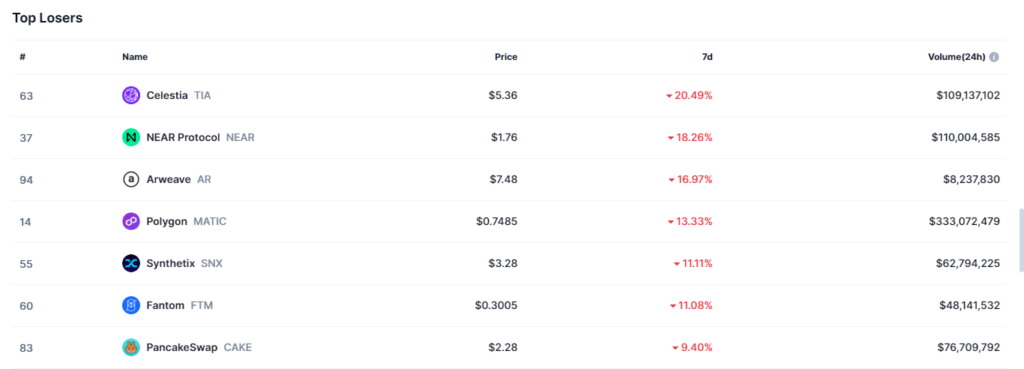

- The altcoin market has bled through November, with highly popular ones like Near, Polygon, Fantom, and Cake losing the most over the last 7 days.

- However, there are still some altcoins that are largely bullish, such as FTX Token, Celestia, Kaspa, Blur, and $RUNE.

The crypto market has been through ups and downs throughout November. The altcoin market, in particular, has been through some pretty rough weather, with Ethereum struggling around $2,000.

Investor sentiment is starting to flip bearish, and Santiment, the on-chain analytics platform has shared a few insights about what might be going on.

Here’s the altcoin market’s performance throughout November, and what we think might happen in December:

FUD Is Starting To Seep In, Santiment Says

According to a recent tweet from Santiment, the altcoin has been through some pretty rough weather as of late.

Santiment says that investors are starting to view the altcoin market with a bit of skepticism, especially how 2/3rds of the top 100 altcoins have declined over the last 24 hours and lost most of their gains in November.

This is bad enough. However, Santiment also says that if the market declines continue for long enough, some “buy the dip†opportunities might surface.

Let’s go over the altcoin market through November.

Sentiment: The Crypto Market Has Bled Through November

According to data from CoinMarketCap, most of the cryptocurrencies on the market have bled through the last month, with highly popular ones like Near, Polygon, Fantom and Cake losing the most over the last 7 days.

Solana, which was up by more than 200% throughout the month, has declined from its $68 high to about $55, after losing more than half of its monthly returns for November.

The same goes for Ethereum after its decline from above $2,100, and for XRP, after its decline from $0.72 to less than $0.6.

However, It’s Not All Bad

Through November, several cryptocurrencies are still largely bullish and have brought a lot for investors in terms of ROI.

A good example is FTX Token which has more than doubled through November and is now trading at around $3.66.

Others include Celestia with a 157% gain over the last 30 days, Kaspa (which has the best long-term bullish score) with a monthly price increase of about 147%, and others like Blur and $RUNE.

Time To Chuck Or HODL Your Altcoins?

The decline in the prices of altcoins across the market is evident in how Bitcoin’s dominance continues to rise.

This metric has been on a steady rally, ever since breaking past the 49% resistance in June.

This metric has been on the rise ever since and appears likely to continue its ascent. There is even a strong case for a Bitcoin dominance of about 57% very soon, as shown below.

However, Santiment, in its original tweet, mentioned that some good might come out of drastic declines in the altcoins as we have seen.

Because then, investors can jump into “buy the dip†opportunities and ride the wave as the next altcoin season approaches.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.