Key Insights

- VanEck, a global asset manager, believes that Solana has the potential to compete with Ethereum and become a leading blockchain platform.

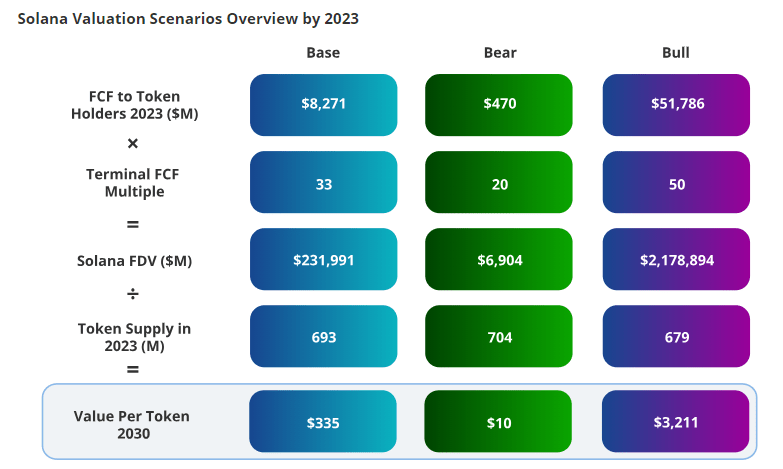

- VanEck has four price scenarios for SOL by 2030, ranging from pessimistic ($9.81) to breakthrough ($3,211).

- In the breakthrough scenario, Solana becomes the first blockchain platform to host applications with more than 100 million users and achieves mass adoption.

- VanEck threw a few jabs at Ethereum, saying that it has “evolved” from selling cheap block space to “peddling expensive block space”

- Solana on the other hand, believes in the “inexpensive” blockspace.

Solana has been branded and marketed as an “Ethereum killer†from the onset.

Solana runs a Proof of History mechanism (compared to Ethereum’s Proof of Stake) and is one of the fastest, scalable, and low-cost solutions, despite its several issues with security and FTX selloffs.

SOL is capable of processing over 50,000 transactions per second in theory, with its native cryptocurrency, $SOL, displaying strong price performance.

According to a recent report from VanEck, a global asset manager, these features and more, make Solana poised to compete with Ethereum.

More details below:

How High Can Solana Price Go?

According to VanEck’s report, there are four price scenarios for SOL.

These scenarios range from pessimistic predictions to base, to optimistic, and then to breakthrough.

VanEck bases its predictions on assumptions about Solana’s market share, user base, transaction volume, and revenue model. The scenarios are:

Pessimistic View:

According to VanEck’s more pessimistic scenario, SOL may fail to gain significant traction and continue to be a mid-tier blockchain/crypto.

If this happens, Solana’s dominance may stay at 0.5% (compared to Bitcoin’s 53% and Ethereum’s 17%).

Solana’s user base may stay at about 1 million, with its transaction volume sitting at 1 billion per year and its revenue model is based on transaction fees only.

In this scenario, VanEck projects a SOL price of $9.81 by 2030.

Base

Here’s a better scenario:

VanEck says that for the base prediction, SOL may achieve moderate success and actually compete with other blockchain platforms.

In this scenario, Solana’s market share may rise to 5%, its user base to 10 million, its transaction volume to 10 billion per year, and the blockchain may add staking rewards to transaction fees as revenue.

In this scenario, VanEck predicts a $SOL price of $98.12 by 2030.

Optimistic

This one is good.

In this scenario, Solana becomes a leading blockchain platform and challenges Ethereum’s dominance.

VanEck says that Solana’s market dominance may rise to 25%, its user base to 50 million, its transaction volume to 50 billion per year, and Solana makes its revenue from transaction fees, staking rewards, and platform fees.

In this scenario, VanEck projects a $SOL price of $490.59 by 2030.

Breakthrough

This scenario may sound crazy, but VanEck sees SOL breaking $3,000.

In this scenario, SOL becomes the first blockchain platform to host applications with more than 100 million users. Even better, it also achieves mass adoption.

Solana’s market share will rise to 50%, its user base to 100 million, its transaction volume to 100 billion per year, and its revenue model will become based on transaction fees, staking rewards, platform fees, and value capture.

In this scenario, VanEck projects a SOL price of $3,211.28 by 2030.

For comparison, VanEck also provides valuation scenarios for Ethereum based on similar assumptions. The report projects an ETH price ranging from $590 to $11,800 by 2030.

VanEck Comes After Etherereum

According to VanEck, Solana’s potential is based on its founding team successfully “blending radical experimentation with applied scienceâ€.

VanEck says that, unlike other blockchains, SOL is one of the most focused on scalability.

However, VanEck also threw a few jabs at Ethereum.

Van Eck says that while Ethereum has “evolved†from selling cheap blockspace, it now “peddles expensive blockspace that secures consumer-facing blockchainsâ€.

VanEck says that Solana believes in the “inexpensive” blockspace, and building a network that assumes consumer-grade computing power grows with Moore’s Law. Because of this, SOL was made to take advantage of hardware advancements more directly than competitors.”

In all, VanEck sees a future in which SOL one day flips or overtakes Ethereum.

Which is interesting, because Ethereum also has several predictions from top industry experts about one day overtaking Bitcoin.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.