Key Insights

- After consecutive wins, Solana has emerged as one of the best-performing cryptocurrencies since October.

- Listings on major exchanges like Coinbase (Jito) and Binance (Bonk) have increased liquidity and fueled Solana’s price movement.

- Impressive growth in both DeFi and NFT applications on Solana has contributed to the SOL rally.

- A possible breakout above $75 could lead Solana to reclaim the $80-$95 zone and possibly retest $130.

- Increased transactions, strong DeFi metrics, and a rebound off $68 suggest another leg up for Solana.

Solana has turned out to be one of the best-performing cryptocurrencies since October, after making win after win.

Over the last day, Solana has reattempted a break above $75, and at some point, we need to take a deeper dive into SOL.

What makes this cryptocurrency tick, how bullish has it been so far, and how high up can it go?

Let’s take a look at some data:

Coinbase And Binance May Have Helped Solana

Solana-based tokens have taken off as of late. These tokens are the backbones of Solana’s Dapps, creating a sort of symbiosis between them and the network.

The higher they rise, the more Solana-based DEXes, Lending platforms and NFT marketplaces are used.

These Solana-based memecoins have been so successful as of late, that two of the largest exchanges in the world, Coinbase and Binance, recently announced support and listings for them.

Coinbase, for example, listed Jito, the native token of a Solana-based staking protocol sometime this week.

Soon after its listing, Jito rallied powerfully in terms of price and trading volumes.

Binance, on the other hand, also listed Bonk, a Solana-based memecoin this week, with Coinbase also announcing that it was going to list the memecoin soon.

The listing of these Solana-based cryptocurrencies has added much to their liquidity, which in turn has fueled Solana’s price movement

DeFi and NFTs Thrive on Solana

Quite recently, Solana has thrived in terms of NFT applications and Defi.

Another factor that contributes to the SOL price rally is the impressive growth of DeFi and NFT applications on Solana.

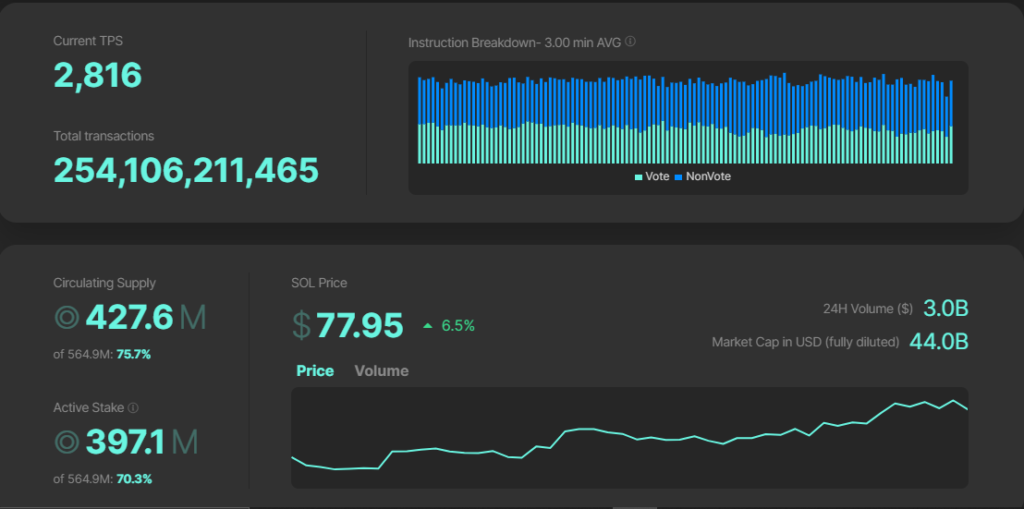

According to Solana Beach, the number of transactions on Solana increased by 12% in the past week, reaching over 250 billion as shown above.

In contrast, Ethereum saw a 1% decline in transactions, while BNB Chain recorded a 4% increase.

According to data from DefiLlama, Solana’s Defi transaction volume has also spiked by about 81%, compared to a 15% rise in Ethereum and a 40% jump in BNB.

The TVL in Solana’s DeFi protocols has also just breached the $1 billion zone, marking nearly double its value from November

Can Solana Hit $95 Soon?

Solana, at the start of the day, had just rebounded off $68 and was retesting $75. At the time of writing, however, Solana appears to be on the verge of a breakout, as shown below:

Solana, as it turns out, is now at its highest point since May 2022.

Solana’s previous decline from $75 was necessary because the cryptocurrency is only just bordering on overbought conditions and may have enough fuel to break and close above $75 and cement this zone as support.

According to the charts, if we see a break and close above this $75 zone, Solana will finally be poised to retake the zone between $80 and $95.

If the bulls deliver as before, and Solana successfully clears the aforementioned zone, we might see the cryptocurrency retake another 70% rally to the upside and retest $130 for the first time since April 2022, as predicted by analyst Ali.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.