BTC has surged to above $73,000 this week, and may even be poised to continue further up.Key Insights

- According to Kaiko, Bitcoin’s price is rising quickly, but there are fewer new large investors (whales) compared to previous bull runs.

- Kaiko suggests that whales might be “waiting” to invest more, taking profits, or both.

- Bitcoin ETFs may be hiding the data on some whales, making their behaviour hard to monitor.

- Some analysts are bullish on Bitcoin and predict a price target of $83,000.

BTC has surged to above $73,000 this week, and may even be poised to continue further up.

Investors, so far, have been in a mix of excitement and caution, considering how fast Bitcoin is moving up, and the other metrics that are currently bursting through the roof.

However, there might be a few strange things about this BTC rally when it comes to the whales, according to data from Kaiko.

Let’s go over what’s been up so far.

The Slow Return of Bitcoin Whales

According to on-chain data monitored and reported by Kaiko in a new study this week, despite Bitcoin’s impressive performance over the last few weeks, the return of the BTC whales has been suspiciously slow.

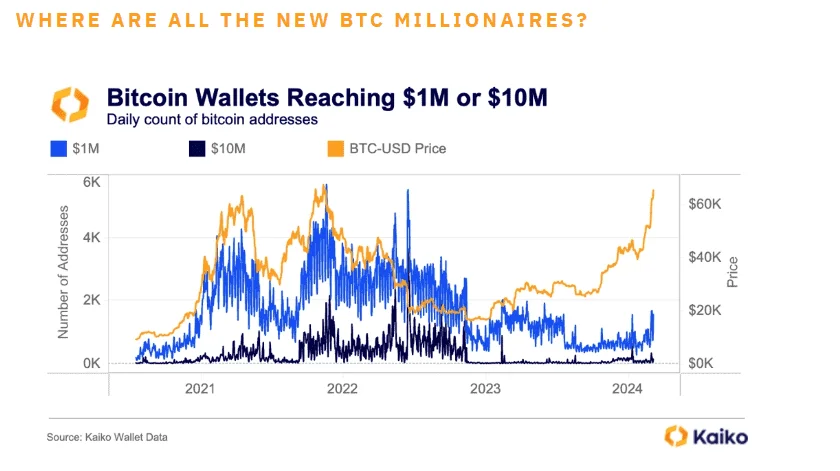

In detail, Kaiko reports that the number of “millionaire” BTC wallets being created daily has been all but gradual.

Where are all the new Bitcoin millionaires

This metric on its own is impressive because Kaiko shows that it has risen to 1,570, which is a significant increase from the 2024 low of 273 on January 24.

However, when compared to the last bull run, this rise to 1,570 millionaire wallets is nowhere near impressive.

Available data shows that during the peak of the previous bull run in November 2021, the number of BTC millionaire wallets being printed daily had risen to around 4,000 wallets, when BTC last sat at $69,000.

This shows that while the number of Bitcoin whales is increasing, the growth is nowhere near that of the previous bull runs, meaning that the whales are a lot more cautious this time around.

Comparing Bull Runs

More on comparing this bull run with the previous ones.

The current explosion in the number of millionaire addresses is also overshadowed by 2021, in that on 17 November, this metric hit a staggering 5,727 new millionaire wallets.

The current figures are similar to those of July 2022, when BTC first dropped below the $20,000 mark in the heat of the bear market.

Kaiko reports that some possible reasons for these figures may be that large investors are taking profits on BTC more frequently, rather than deploying new capital.

Moreover, the whales may be adopting a “wait and see” strategy before jumping into the market with fresh liquidity.

The ETFs also play a part.

According to Kaiko, the ETFs since their launch in January, have accumulated over $28 billion in Bitcoin, managed by custodians like Coinbase and BitGo.

This means that some of the BTC millionaires who have their holdings in the ETFs are not reflected in Whale wallet data.

Overall, while the current whale sentiment on Bitcoin shows caution, the fact of the matter is that BTC has rallied by around 71% in 2024 alone, and it’s only March.

This shows strong investor sentiment in Bitcoin and a possible continuation of the current uptrend.

Can Bitcoin Hit $83,000?

Analysts seem to think so.

Bitcoin set to hit $83

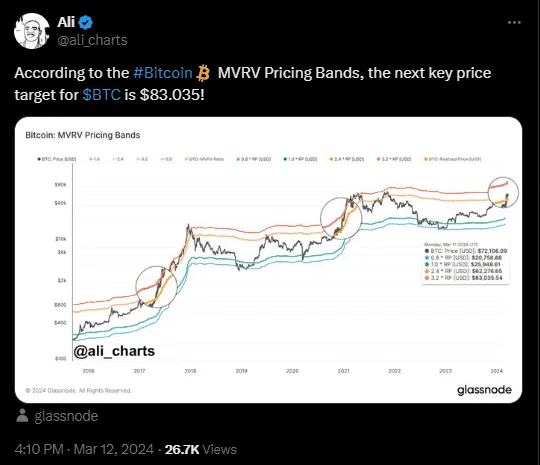

In a recent tweet from a leading analyst on Twitter, the BTC MVRV pricing bands show that the next price target for Bitcoin sits at around $83,035.

According to chart data from TradingView, Ali’s outlook above might be happening already.

Bitcoin breaking above its local high

Bitcoin is already showing signs of an incoming break above its previous $73,300 local high, and we only need to see a break and close above this level to confirm the next impulse move to the $83,000 target.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.