Key Insights:

- Canary Capital filed an amended S1 application for a Litecoin ETF with the US SEC yesterday.

- A change in US administration and SEC’s Chairman lifts the chances of approval by a great factor.

- Litecoin sees an imminent growth to $200 and a long-term target of $412.

- Strong fundamentals like network growth and ETF approval could push LTC above $400 by the next Bitcoin halving cycle.

Canary Capital’s Litecoin ETF Coming Soon

Canary Capital is reportedly very close to securing a Litecoin ETF approval, which, when approved, could be the first altcoin ETF after Ethereum. However, there have been no 19b-4 filings yet.

In the SEC’s procedure for ETF approval, 19b-4 filings are a declaration of rule that allows the ETF to self-regulate (typically via an exchange). S1 filings, on the other hand, are the main application for ETF approval.

NEW: @CanaryFunds just filed an amended S-1 for their Litecoin ETF filing. No guarantees — but this might be indicative of SEC engagement on the filing. Still no 19b-4 filing yet though

(A 19b-4 would actually start the potential approval/denial clock) h/t @isabelletanlee pic.twitter.com/wFtNOmbmYx

— James Seyffart (@JSeyff) January 15, 2025

Canary Capital made the first application for a Litecoin ETF on 15 October 2025.

Lately, speculation around altcoin ETFs has risen because of Trump’s choice of SEC chief. Former SEC Chief during George Bush Junior, Paul Atkins, will take charge as the new SEC chairman on 20 January 2024, i.e., the same day Trump becomes president and Gary Gensler leaves office.

Other ETFs waiting for approval are XRP and Solana. However, none of them has made it to the amended S-1 filing stage yet. Last year, the SEC required an amendment in S-1 applications, both for Bitcoin ETFs (Jan 2024) and Ethereum ETFs (May 2024).

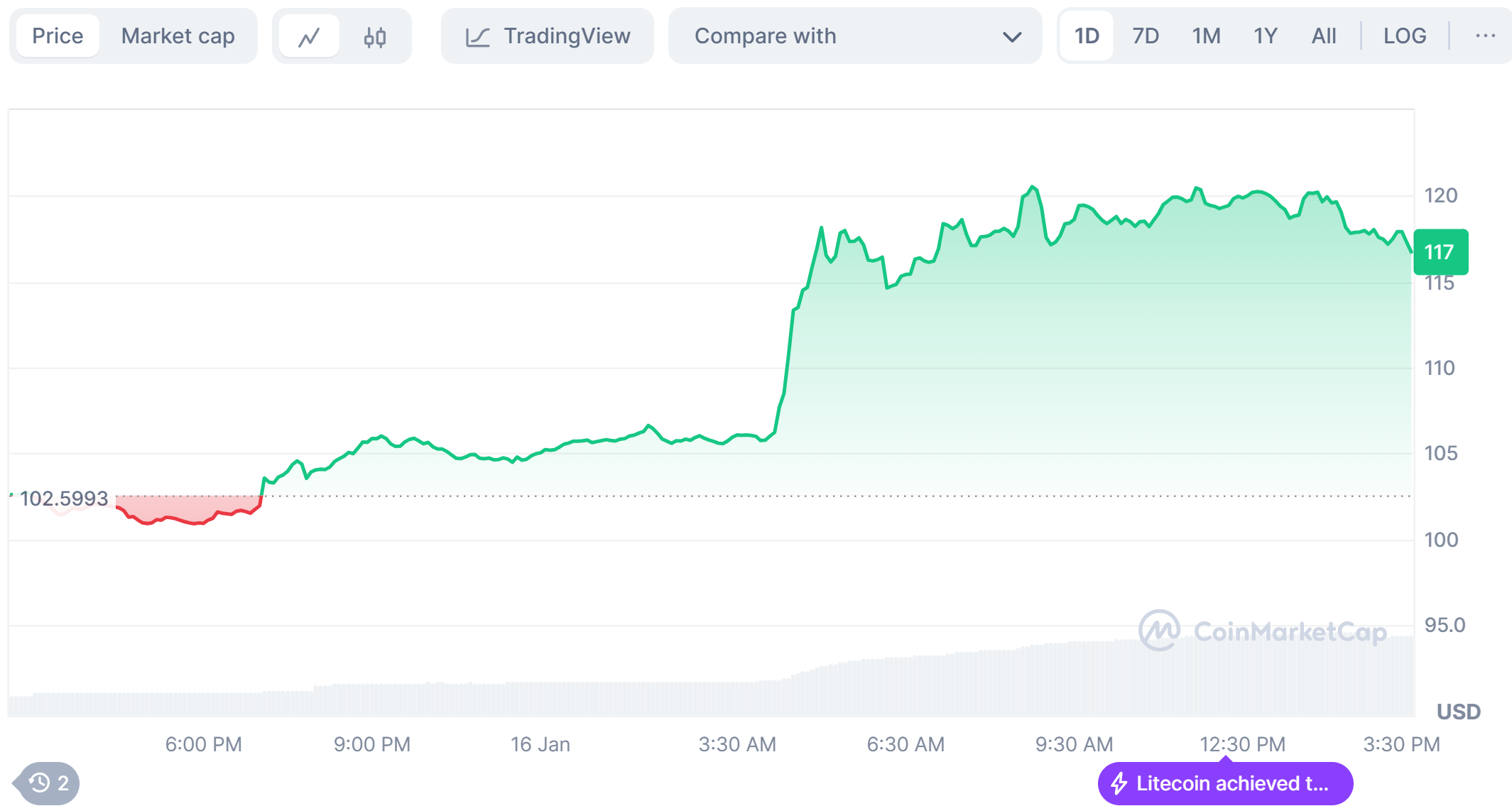

LTC Price Jumps 15% in the Last 24 Hours

As a result of the application, Litecoin saw a 15% intraday jump in its price and was trading at $116 at press time. The last 24-hour training volume was $1.66 billion, 226% higher than the previous day.

A strong whale accumulation reportedly took Litecoin above the $114 resistance level.

Litecoin Price Jumps 15%

Strong Fundamental Could Push Litecoin Higher

Litecoin recently crossed Bitcoin and Ethereum and became the highest-traded crypto on Bitpay. The exchange processed 608,000 Litecoin transactions in 2024.

The network also grew its hash rate to 1.8 PH/s last month.

Last year, Litecoin saw its transaction count rise to 1 million daily transactions on 14 November 2024.

Strong Network Growth

Litecoin recently saw itself crossing Bitcoin and Ethereum and becoming the highest-traded crypto on Bitpay. The exchange processed 608,000 Litecoin transactions in 2024.

The network also saw its network hash rate grow to 1.8 PH/s last month.

Litecoin’s Hashrate just hit a new ATH

Hitting ⚡️⚡️1.80 PH/s ⚡️⚡️at block 2,806,273$LTC is more secure than ever! #Litecoin pic.twitter.com/eQ5PmWP84s— Litecoin Foundation ⚡️ (@LTCFoundation) December 9, 2024

Last year, Litecoin saw its transaction count rise to 1 million transactions per day on 14 November 2024.

#Litecoin registered 1 million $LTC transactions on November 14 alone, marking a new all-time high. pic.twitter.com/vrVuLbMYKD

— Ali (@ali_charts) November 16, 2023

What is Litepay?

Despite multiple payment processors in the markets, whether independent or supported by third-party exchanges, almost zero payment processors were focused on privacy. All of them required a certain amount of KYC, which invaded and traded your personal data.

Litepay is a payment processor that allows businesses to receive payments without their customers performing KYC. All it requires is an address on the Litecoin network to which you wish to send the payment.

High-Security Blockchain

Litecoin is a proof-of-work blockchain based on Bitcoin, which allows it to have a much higher grade of security than most Layer-2 platforms.

What makes Litecoin even more secure is its partnership with Dogecoin, where nodes from both networks can pool their resources together to secure both chains.

Where is Litecoin Headed in 2025?

Litecoin saw a breakout after a multi-year consolidation between $57 and $114. it had earlier broken out of these levels, but the current market corrections kept its price below $100 for over a month.

#Litecoin gives a breakout after a multi-year consolidation near $57 to $114.

Near-term estimates show growth to $279 is possible in H12025, and by the end of the #Altseason2025, prices may close to $390.

Start #HODL ing $LTC while you still can. pic.twitter.com/r0olZftPIg

— Dhirendra Das (@dhirendracd) December 3, 2024

However, given its price breakout above these levels today, we assume LTC will cross $200 in the near future.

An ETF approval could further push Litecoin above $412 ATH, which it last achieved on 10 May 2021.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.