Key Insights:

- US government seeks to sell $2 billion worth of Bitcoins despite the current administration being a transitional one.

- This is completely opposite to what Donald Trump, the current president-elect, has for Bitcoin.

- The sell-off could trigger a brief consolidation in BTC’s price.

- Despite minor corrections, long-term goals should remain intact. Experts predict that $500k will be Bitcoin’s next target.

US Govt Moves $2 Billion in Bitcoins

The US Government has reportedly moved $2 billion worth of Bitcoins to Coinbase Prime, probably to sell them in the open markets. The current Biden administration has been cashing out on the Bitcoin reserves.

Earlier this year, the US sold $240 million worth of Bitcoins after Germany’s similar move.

ALERT: US GOVERNMENT MOVING $1.92B BTC TO NEW ADDRESS

Address: bc1q0av33ktzrkjps8exjex5gtv98vx225uqmzhspm pic.twitter.com/JSELsjFg5T

— Arkham (@arkham) December 2, 2024

The decision to sell Bitcoin might have come from the need to address the United States’ budget shortfall. Due to this budget shortfall, the US public debt has increased phenomenally, reaching $36 trillion, 33% higher than the national GDP.

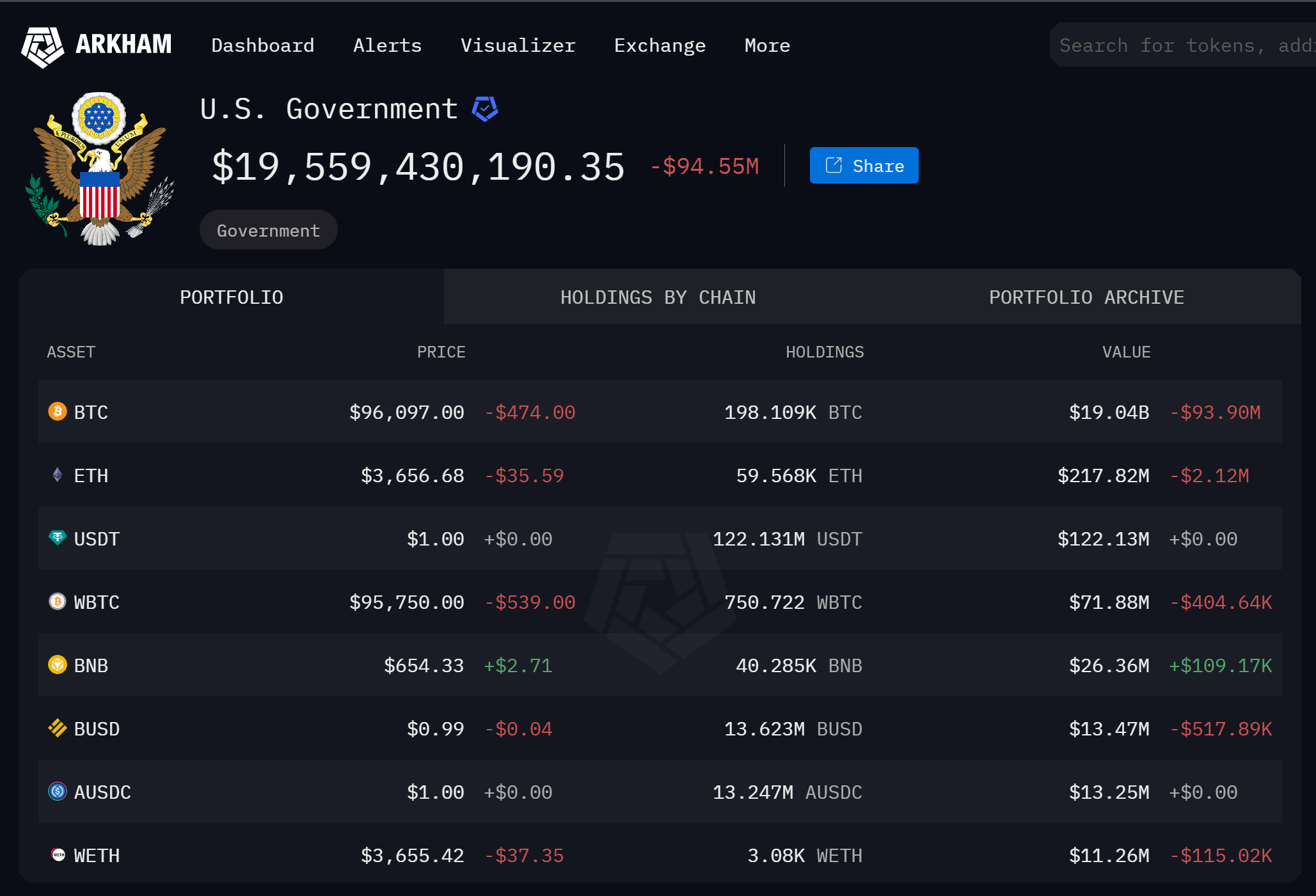

The US government is believed to hold the fifth largest Bitcoin reserves in the world. According to Arkham Intelligence, the total Bitcoin reserves with the US government currently are around $19 billion, 97.6% of its total crypto reserves.

US Government Crypto Reserves

Earlier last month, Donald Trump’s historic win helped surge the crypto markets, especially Bitcoin, which increased from $69k to $100k within November. At press time, Bitcoin was trading around $96k.

Trump has been vocal about backing the US Dollar with the Bitcoin reserves, a move that could not only diversify the assets with US treasury but also could make Bitcoin even more scarce and higher priced than it currently is.

How Far Could BTC’s Price Correct?

Bitcoin erased almost all of its gains this week and was trading 4% lower than its highest price ($99.6k), which it achieved last week.

The fall primarily comes from profit booking by short—and long-term investors alike. This is a normal phenomenon after a large rally. The markets could have fallen a bit more, perhaps to $75k, if it were not for the institutional purchases by MicroStrategy, some private funds, and a few other global funds like Japan’s Metaplanet.

BTC USD 1D Charts

At present, BTC’s 1D charts show that it has formed a support zone near $91.6k. If the price slides from these levels, it may find a strong buying zone at these price levels.

On the upside, BTC could only rally higher if it crosses $99.6k, its current all-time high.

Factors in Favor of Bitcoin

Most of Bitcoin’s current growth stems from institutional demand, which several wealth funds, pension funds, private investors, and corporate investors like MicroStrategy have created.

There is also a decent surge in demand from retail markets where investments primarily take place via ETFs and exchanges.

MicroStrategy’s BTC Accumulation

MicroStrategy has been accumulating Bitcoin like never before. In November 2024, it had accumulated $4.6 billion worth of Bitcoin.

Yesterday, it further increased its holdings by $1.5 billion and currently holds more than 440k BTC, which is over 2% of the total Bitcoin supply.

According to reports, the company now sits on a $15 billion profit from its Bitcoin purchases alone.

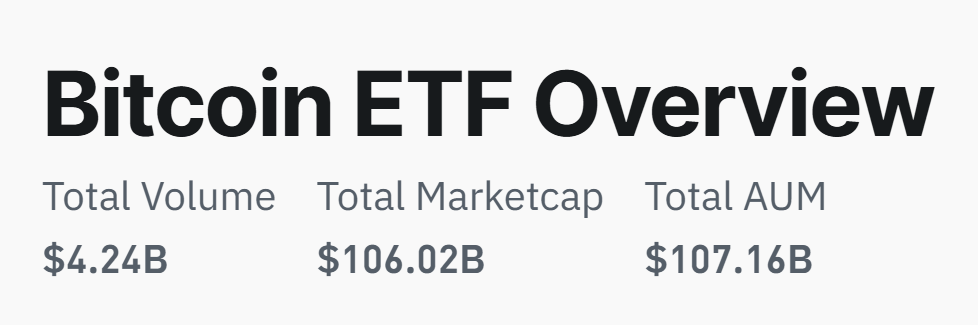

Bitcoin ETFs

Bitcoin ETFs are now one of the largest wealth managers in the crypto space. The market leader, BlackRock’s IBIT, has almost reached $48 billion in BTC, while the total ETF market currently manages $107 billion worth of Bitcoins.

Bitcoin ETF Market Summary

The most important reason for the success of ETFs is the relative ease with which users can invest in them.

Except on 25 and 26 Nov, ETFs have seen positive inflows for the month of November.

What Do Experts Say?

In a CNBC show, Michael Saylor said it was just a matter of time before Bitcoin crossed $100k.

"It's just a matter of time." – @fundstrat on #Bitcoin pic.twitter.com/0662fMs3VB

— Michael Saylor⚡️ (@saylor) December 2, 2024

#Bitcoin is going to $500,000 sooner than you think pic.twitter.com/gVSuwcQaK5

— Vivek⚡️ (@Vivek4real_) December 1, 2024

Another crypto analyst, Vivek, compares Bitcoin’s current rally to its past, saying that Bitcoin could soon cross above $500k.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.