Key Insights:

- The Dencun upgrade at best seems as only a stop-gap solution.

- Ethereum users rely on Layer-2 Solutions for cheap transactions.

- Solana seems to be a potent competitor and successor.

The Ethereum blockchain has been witnessing many problems for a long time. It has a very high cost of transactions, a very slow network speed and upgrades are only once in a while. Its last major upgrade was in 2022 which helped its transition from Proof of Work to Proof of Stake.

The delays in upgrades not only compromise security, as more people rely on L2 blockchains, but also paves the road for others to take its market position where Solana seems the most potent successor.

Nothing Much Happens on Ethereum

In 2023, very few things happened on Ethereum except for a few minor updates on its whitepaper. The blockchain had last implemented its transition from Proof of Work to Proof of Stake, called the Merge, in September 2022.

Even the new Dencun upgrade which seeks to lower gas fees were finally tested for the very first time in 2024. This too was meant to happen in 2023.

The price of Ethereum also could not rise as much as Bitcoin due to several factors.

- First, Ethereum still waits for its ETF approval which seems difficult in 2024.

- Bitcoin Ordinals brought NFT-like capability in its blockchain.

- The first blockchain based SNES game too was launched on Bitcoin.

Problems Caused by Delay in Action

Further as compared on other blockchains, Ethereum has a very high gas fees thanks to its transaction speed of 10-15 TPS. The slow speed causes people to compete for gas fees which drives the transaction costs higher.

To combat high transaction fees, the developers and the Ethereum Foundation developed the planned upgrade called Surge. However, its execution is taking forever.

Even the rushed up things which seem as a temporary solution are taking a long time to implement.

As a stop gap solution, developers are trying to implement “Proto-Dank Sharding” which will add additional temporary space to the blocks. The blocks will only record transaction summary like ZK Rollups and the blobs will store the individual transactions for a period of three months.

The final solution is supposed to be chain Sharding which aims to divide the total amount of validators in about 64 groups. Each group will be able to independently add transactions to the blockchains. However, that is way far for now.

Counter Intuitive Decisions by Vitalik Buterin

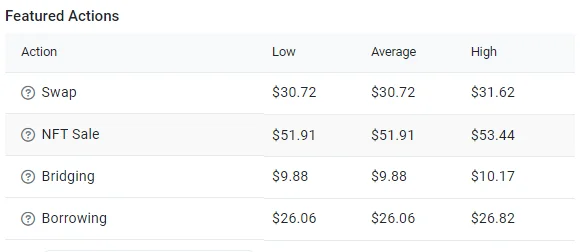

Vitalik Buterin proposed to increase the gas limit in Ethereum by a further 33% on Jan 11, 2024. This might prove to be disastrous as the fees are already very high. You can take a look at the following average gas fees for different action on the blockchain.

Who Benefits? Solana and L2 Solutions

Currently, due to the slow speed, the main beneficiaries are layer-2 scaling solutions. However, these scaling solutions are not safe and have been exploited several times.

On June 8, 2022, a L2 scaling solution Optimism lost tokens worth $20 million. The scaling solution is one of the top layer-2 solutions for Ethereum.

If these lacunas in its blockchain continue, the greatest beneficiary would be Solana which has been doing several upgrades to boost its ecosystem’s presence lately.

Solana has several things in its favour as of now. Its Saga Phone was a huge success. The blockchain has a few times overtaken Ethereum in terms of NFT sales and stablecoin volumes. Further, Solana has a real-transaction speed of nearly 4000 per second, way greater than Ethereum’s 15 per second.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.