Key Insights

- Binance launched a new marketplace dedicated to Ordinals inscriptions and BRC-20 tokens.

- This shows the expansion of Ordinals due to the massive controversy around them.

- ORDI, in the meantime, is predicted to rebound and reach $115 soon.

- Technical analysis suggests a potential breakout for ORDI, with price targets of $59.6, $72.1, $87.7, and $112.85.

This isn’t a matter of preference anymore.

Ordinals, whether spam or not, have been expanding heavily since inception, and have become the next best thing in the crypto industry.

Quite recently, this expansion came further into view, when Binance, currently the largest centralized crypto exchange in the world, launched a new marketplace.

According to this official announcement, Binance’s new marketplace will be dedicated entirely to inscriptions and the ordinals protocol, providing users with an easy and efficient way to trade, mine, and even store their BRC-20 tokens.

Meanwhile, ORDI, the most popular Ordinals token is set to make a spectacular comeback.

Binance’s New Marketplace

According to Binance, the new Ordinals marketplace is powered by the exchange’s web3 wallet, which users can access through the official Binance app.

Users will reportedly be able to connect their Binance accounts to the new marketplace buy and sell BRC-20 tokens, mine tokens and earn rewards using Binance’s computing power, as well as transferring and storing these tokens on the the web3 wallet without fees, and with several layers of protection.

The Ordinals Expansion, And The Endless Debates

Ordinals have been expanding rapidly since they were created in January 2023, and there may be no end in sight to their growth.

However, this expansion is not without its challenges. For example, in December of last year, the U.S. National Vulnerability Database (NVD) added Ordinals inscriptions to its list of cybersecurity threats.

According to the NVD, Ordinals pose the risk of spamming and clogging decentralized networks like Bitcoin, by disguising non-transactional data as regular transactions.

Ordinals can also be used for other malicious purposes like creating counterfeit and impersonation.

This comes while Bitcoin core developers continue to bash Ordinals on Twitter, under allegations that it violates the core principles and purpose of the Bitcoin network.

For example, in September, Luke Dashjr, one of the biggest anti-Ordinals critics submitted a proposal, to make the Bitcoin protocol more “effectiveâ€.

On the flip side, this effectiveness would also make it extremely hard and expensive to create and push ordinals onto the network.

The proposal caused another war between the Bitcoin developers. At the end of the day, after months of debates, the proposal was finally closed and rejected by Ava Chow, one of the Bitcoin core maintainers.

Check Out The Incoming Rally To $115 On ORDI

Meanwhile, ORDI, one of the most popular BRC-20 tokens, is set to explode upwards soon.

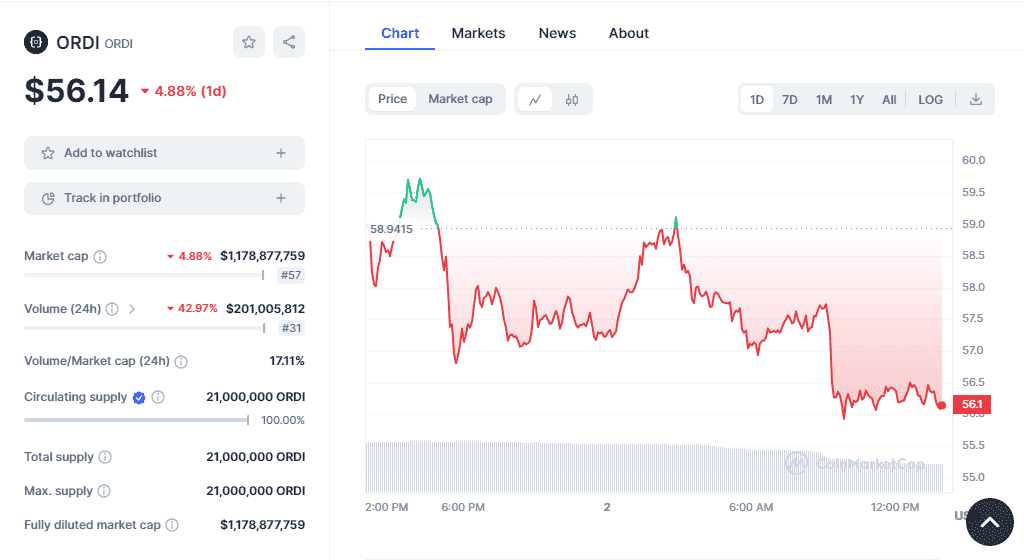

The cryptocurrency appears to be heavy under the influence of its bears over the last day, as shown by the snapshot below

ORDI currently trades at around $56.14 and is down by around 5% over the last day. In summary, every metric from market cap to tradingview is down on this cryptocurrency.

However, what if this was a sign that a bigger rally was incoming?

Above, we have the 4-hour chart on ORDI, showing an ascending trendline.

This chart shows that despite the massive rejection from $92 on 2 January, the cryptocurrency has declined, but has not broken below the medium-term ascending trendline above.

Moreover, on the daily chart, we can see signs of an impending cross between the MACD line and the RSI signal line, indicating that if a bearish crossover does not occur at this point, ORDI is set to rebound off this ascending trendline.

How high up can ORDI go if a rebound occurs?

The Fibonacci retracement levels on the daily chart show that if a rebound from the ascending trendline we mentioned earlier occurs, we are bound to see ORDI attempt to break above its previous $92 high from 2 January.

From here, if we see another breakout above this zone, the next price level to keep an eye out for is anywhere between $112 and $115.

Overall, the price targets for ORDI include $59.6, $72.1, $87.7 and $112.85.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.