Key Insights

- The GBTC recently allowed shareholder redemptions for Bitcoin after a 6-month lockup.

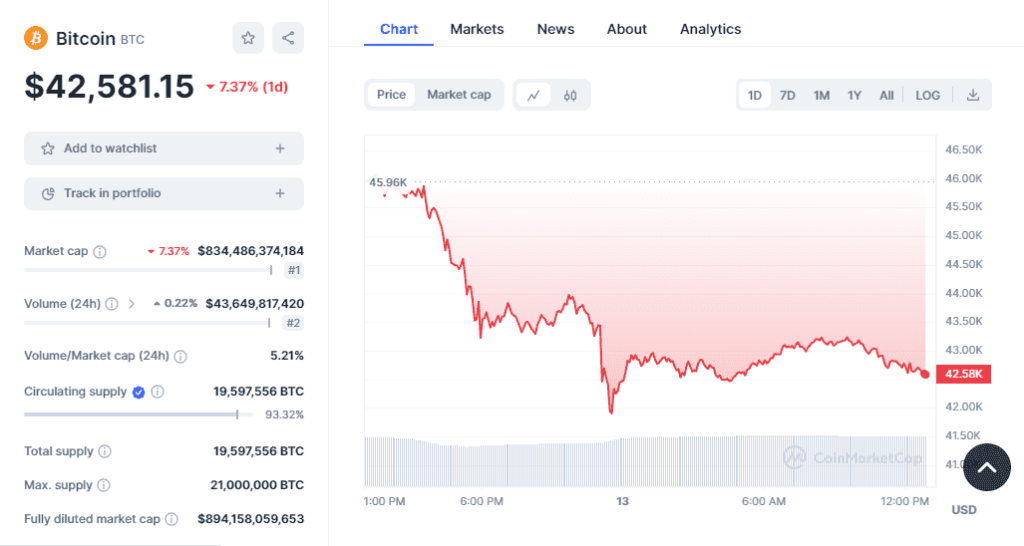

- The sell-off that resulted, sent Bitcoin’s price crashing by more than 7% to $42,500

- GBTC also sent $41 million worth of Bitcoin to Coinbase and other exchanges on the same day as the price dip, further fueling speculation.

- While the outflows represented a small portion of GBTC’s total holdings (0.59%), $160 million entering the market could have impacted the price.

- Analysts and market figures like Ran Neuner believe the redemptions and profit-taking caused the Bitcoin crash.

Bitcoin, for some reason, dipped significantly from around $47,000 to as low as $43,000 on Jan. 12, 2024.

While market dips happen all the time in the crypto market, this one is especially interesting, given that it also happened on the same day that the Grayscale Bitcoin Trust (GBTC) allowed its shareholders to redeem their shares for Bitcoin.

As usual, analysts on Twitter have speculated that the price dip on Bitcoin was triggered by investors trying to cash in profits from these GBTC redemptions.

Moreso, GBTC also sent out a whopping $41 million worth of Bitcoin to Coinbase and other exchanges.

Let’s go over the whole issue with GBTC, and what might have caused this Bitcoin dip.

What happened On Jan. 12, 2024?

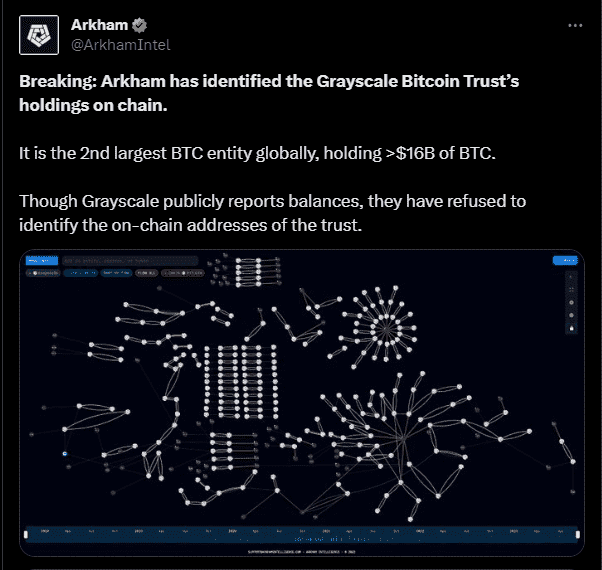

As of January 12, 2024, GBTC was one of the world’s largest single holders of Bitcoin, with more than $16 billion (or approximately $27 billion) worth of the cryptocurrency in its coffers, according to Arkham Intelligence.

GBTC declared on January 11, 2024, that company investors could now redeem shares for Bitcoin, following a six-month break.

This meant that these investors who had created shares in July 2023, when the price of Bitcoin was about $30,000, could sell their holdings, now that Bitcoin was close to $50,000.

And sell they did.

The day after the announcement, on January 12, 2024, Arkham Intelligence noticed four transactions coming out of GBTC’s wallets totalling 3,501 Bitcoin (or around $160 million at the time of the transfers).

What is interesting though, is how out of these, 894 Bitcoin, or $41 million, were transferred to a Coinbase Prime deposit wallet.

The remaining 2,607 Bitcoin, or $119 million, were sent to wallets that have never been used before, which would mean they are new or unidentified receivers.

Recall that we mentioned that the GBTC held about $27 billion worth of Bitcoin.

This means that the $160M outflows represented a meagre amount (about 0.59%) of GBTC’s total holdings.

Meager or not though, $160 Million suddenly entering the market is no joking matter, and analysts have speculated that this might have been the cause of Bitcoin’s 7% crash.

Bitcoin’s Flash Crash: Evidence And Speculation

It is hard to prove that these GBTC redemptions were the complete cause of Bitcoin’s crash.

However, one has to admit that the timing of these withdrawals and the crash were too good to be coincidental, because both events happened on the same day, within hours of each other

Given that investors had a chance to sell for profit for the first time in 6 months, the withdrawals may mean that investors took the opportunity and raked in gains from the market.

Ran Neuner, the host of CNBC’s Crypto Trader for example, also believes that the profit-taking was responsible for Bitcoin’s dip as mentioned in a recent tweet.

“$25 Billion is a serious number,†Neuner says. He also went further to mention that “we could see some selling pressure for a whileâ€

Overall, the events surrounding the GBTC redemptions present a strong case for Bitcoin’s dip.

However, it is possible that Bitcoin either dipped for a completely different reason or that the GBTC redemptions played a partial role in the Bitcoin price dip.

At the time of writing, Bitcoin’s dip continues to accelerate further, as Neuner predicted, and currently trades at around $42,500 with more than a 7% intra-day dip over the last 24 hours.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.