Key Insights:

- IBIT sees a record $1.1 billion inflows, reaching half a million BTC under management.

- IBIT crosses Grayscale Bitcoin ETF in size and becomes the largest Bitcoin ETF.

- BTC ETF market reaches $80 billion in market cap and $60 billion in AUM.

- Factors supporting growth are ease of investment and ease of custody.

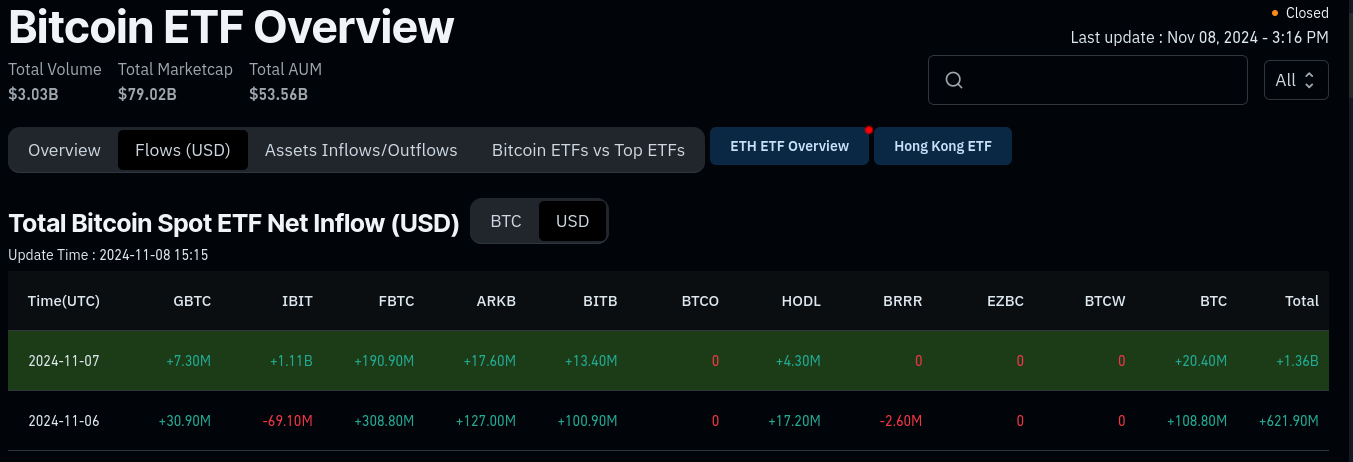

Bitcoin ETFs saw one of their largest inflows yesterday, at $1.36 billion, with Trump’s win. BlackRock saw the highest inflow, at $1.1 billion, followed by Fidelity at around 191 million. The rest of the ETFs saw little inflows.

At present BlackRock’s IBIT holds 432,674 Bitcoins valued at $17.2 billion. It has recently surpassed Grayscale ($16 billion) and is currently the largest Bitcoin ETF in the market.

Bitcoin ETF Inflows on 07 November 2024

These inflows proved crucial in taking Bitcoin to a new all-time high and helped it retain the $76k levels despite profit bookings. At press time, Bitcoin is trading around $76k.

The last time BTC attempted to cross $73.7k (its previous ATH), its price fell to $69k within 2 days due to profit booking. This kind of behavior was not seen yesterday.

This was because of several factors.

- First, Bitcoin investors are more confident that BTC will maintain its current level and not fall.

- Second, Bitcoin could soon get regulatory support from the Trump administration as soon as the government forms.

- Third, as the Bitcoin market matures, most investors have held the crypto for over one year, showing long-term patience.

Trump’s win followed the high ETF inflows in the US elections. At the Bitcoin 2024 Conference in Nashville, Trump promised fairer regulations in the crypto markets, backing the US dollar with a Bitcoin reserve and firing Gary Gensler.

Bitcoin ETFs Grow to $80 Billion

Within one year of their launch, Bitcoin ETFs have swelled to over $79 billion in valuation and over $60 billion in assets under management. This rapid rise took place in this sector despite a negative outlook towards them under the Biden administration.

ETFs now hold the largest chunk of Bitcoins; among them, BlackRock owns almost half a million BTC. This is followed by Grayscale (220k BTC) and Fidelity (189k BTC). Other Bitcoin ETFs have low trading activity as well as lower holdings. Below is a complete list of other spot ETFs.

Bitcoin ETFs That Hold At Least 150 BTC

Factors Influencing Bitcoin ETF Growth

The top reason Bitcoin ETFs have been seeing high growth is the ease at which an ordinary investor can buy them. With a checking or trading account, ETFs can be bought within seconds. Further, it takes just a few clicks to redeem them as well.

Large investors like wealth funds, pension funds, and family offices can also easily buy Bitcoin ETFs. They do not have to secure or safeguard these assets. Crypto custodians like Coinbase Custody, who are much better at this job, do all the custodial work.

Investing in Bitcoin via ETFs also lowers your tax worries. At the end of a fiscal year, the ETF itself sends you an email containing the report of your funds, their performance, your balance, and your tax liability.

Further, there have been several incidents where small-time users were locked out of their wallets due to lost passwords.

There Are Some Downsides Too

Despite all these benefits, investing via the ETF route has several downsides.

For starters, ETFs can easily freeze your funds, citing compliance issues at times when you might need them. Most investors have already faced this at some point in their lives.

Further, ETFs contribute to the centralization of Bitcoin into a few companies, which completely goes against the ethos of decentralization. We recently saw a spat between Vitalik Buterin and Michael Saylor on this matter.

However, it is ultimately at the hands of the retail investors making these investments. A bad player, FTX, forced several of them to either go for self-custody or use any other custodian. In the future, if any ETF capitulates with locked-in customer funds, the trend of investing via ETFs may come to an end, too.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.