The crypto winter of 2020 has lasted almost a full year now. The general crypto market has gone from dip to dip since November 2021, but fresh gains are in sight as BTC gains 5% and ETH price is up 10% on a daily chart.

Unsurprisingly, the market sentiment around most of the crypto market (including the top 10 biggest by market cap) had turned negative over time. However, all the negativity appears to be fading for now, according to market sentiment and crypto analytics platform, Santiment.

Recent data from analytics firm Santiment presented that all the negative sentiment around Bitcoin (BTC), Binance Coin (BNB), Ripple Coin (XRP), and Cardano (ADA) is beginning to clear, while that of Ethereum is only slightly bearish.

The strength of the US dollar and the frequent increase in interest rates from the US Federal reserve is one of the catalysts that hold the price performance of most of the cryptocurrencies down.

However, most of these cryptocurrencies have been trading in ranges for months and are currently expecting explosive moves in either direction.

In all, short-term uncertainty in the market has failed to deter institutional investors so far. After a survey by BNY Mellon, it has been proven that about 91% of investors are keen on investing in tokenized assets over the next decade.

Bitcoin Responsible For Other Crypto?

Bitcoin is the flagship cryptocurrency and the largest on the market by capitalization. By virtue of this, it is only natural that all the other cryptocurrencies on the market react to changes in their price.

Coincidentally, whales and other institutional investors have been accumulating bitcoin on centralized exchanges and in private wallets alike. This may be a result of this increase in positive sentiment on crypto or something else.

Based on reports from Ki Young Ju, CEO of CryptoQuant, this accumulation craze started when bitcoin’s price broke below the $20,000 zone.

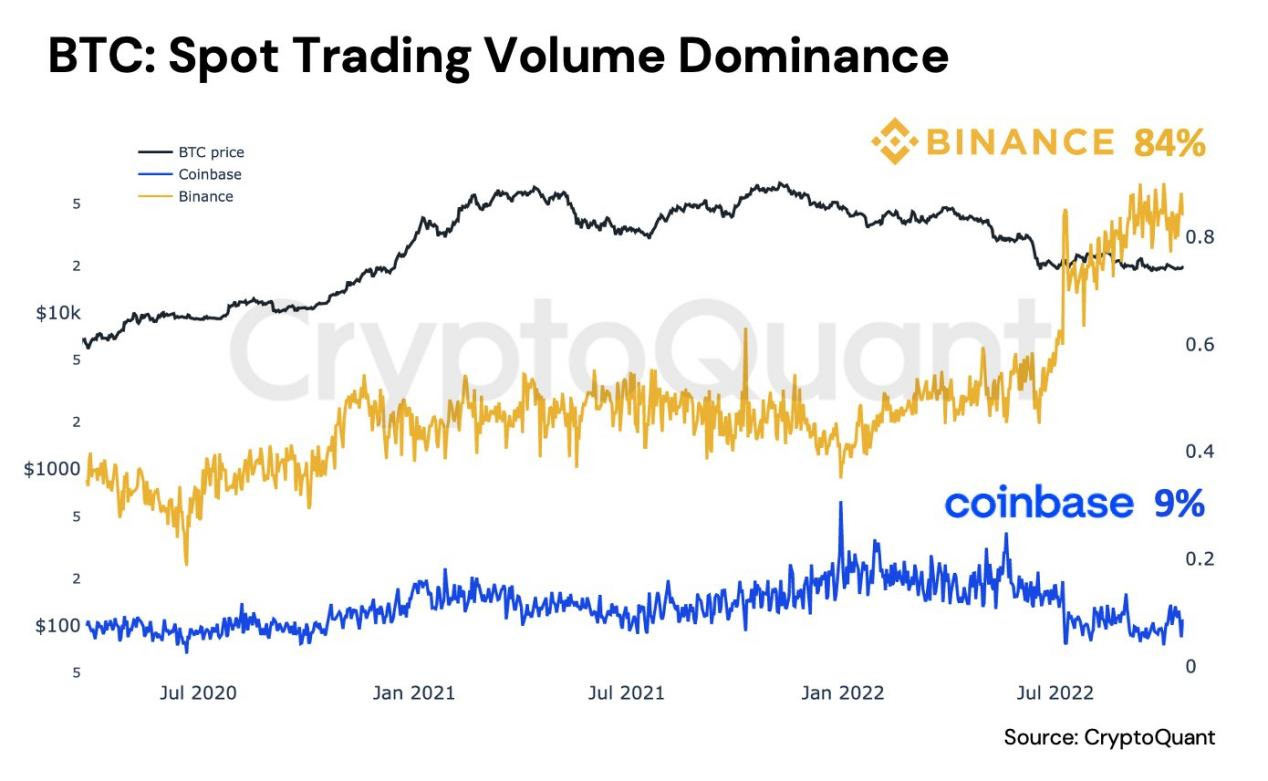

According to this report, bitcoin’s spot trading volume has skyrocketed as well, hitting 84% and painting a clear picture of bullishness on bitcoin.

Short-lived Positive Sentiment?

The Federal Reserve has mentioned in the past that following the interest rate hike in September that crashed the price of bitcoin to $24,000, it is possible that these rates get increased by another 75 basis points in November.

The next Federal Open Markets Committee (FOMC) meeting is expected to happen next month. According to the CME Group’s FEDWatch tool, the odds of a rate hike below 50 basis points happening is only 2.1%. This means that the rates may jump as much as the forecasted 75 basis points.

Considering the massive hit the crypto market took when the rates last increased in September, it isn’t hard to imagine what another rate hike may cause.

Analysts on the market are even starting to forecast a downside for bitcoin and the entire crypto market in general.

One such analyst is a Twitter user with the username Crypto Capo with an alarming theory involving a possible uptrend on bitcoin to the $21,000 zone before a drop that can only be described as “disturbing.â€

According to this theory, a macro-bottoming sequence seems to be hanging over the price of bitcoin.

Iterating what might happen to the crypto market if bitcoin follows this prediction seems needless because if bitcoin breaks below the $18,300 support and starts another downtrend, the resulting price dip may prove to be devastating, to say the very least.

Disclaimer: The author’s comments and recommendations are solely for educational and informative purposes. They do not represent any financial or investment advice. Always DYOR (do your own research)

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.info/en-ZA/register-person?ref=B4EPR6J0