Key Insights

- Cathie Wood, the CEO of Ark Invest, believes Bitcoin is transitioning from “digital gold” to outright replacing gold as a store of value.

- Bitcoin’s performance compared to gold and its resilience during market downturns support this shift.

- Data shows a strengthening correlation between Bitcoin and gold, showing that Wood may be on to something.

- Meanwhile, analyst PlanB predicts Bitcoin will surpass gold’s market cap after the next halving, implying a 1000%+ price increase.

Investors have flocked towards the spot BTC ETFs since they were approved by the SEC in early January this year.

However, the flock of investors may be coming from an unexpected source, according to Ark Invest’s CEO, Cathie Wood.

Remember the “Bitcoin as digital gold†arguments from the last decade?

Cathie Wood now believes that Bitcoin is starting to become a lot more than some digital version of Gold, and is starting to become an outright substitute for this precious metal.

Wood says that BTC is now performing better than Gold, and in this article, we will be going over what she means.

The Bitcoin Versus Gold Argument

“Bitcoin has been increasing in relation to gold.â€, Wood said in a conversation with chief futurist Brett, Winton on 4 February, on a recent video uploaded to Ark Invest’s YouTube channel. Wood stated, “There is currently a substitution into BTC and we think that is going to continue now that there is a less friction-filled way to access Bitcoin.”

According to Wood, Bitcoin has shown to be a strong and resilient “risk off asset” in times of difficulty for the banking industry. She gave the example of the “regional bank crisis” that hit the US in March 2023, which led to the collapse of the Regional Bank index. In comparison, the price of BTC increased by 40% in the same month.

“The Regional Bank index was collapsing, and it’s acting strangely once more. Here, the notion that it’s a flight toward safety or quality is making a comeback,†Wood said.

Bitcoin And Gold Correlation Reaches a Record High

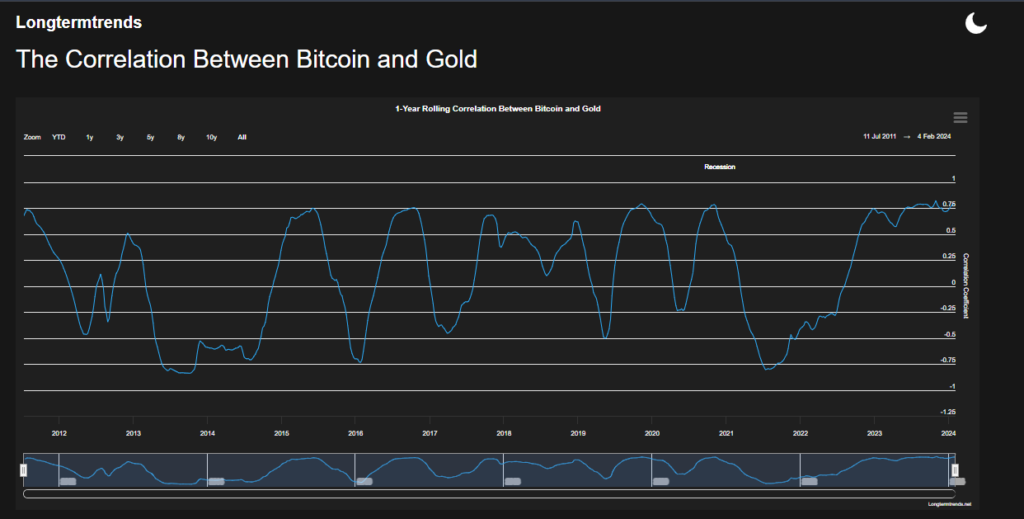

Wood’s comments are supported by a recent report from Investing News Network, which demonstrates that in 2023, Bitcoin’s correlation with gold strengthened and broke from its earlier negative correlation with interest rates.

Gold and BTC have increased in lockstep despite the increase in global interest rates, and this, according to Wood, indicates their mutual attraction as alternative assets.

Wood also discussed her thoughts on the recent launch of the BTC ETFs and the way they ultimately crashed in a clear “sell the news” event.

Ultimately, she mentioned the Bitcoin currently in circulation, and how about 15 million Bitcoins out of the 19.5 million circulating supply hadn’t moved in more than 6 months, indicating that the long-term holders are stronger than the short ones.

Overall, according to data from LongTermTrends, Bitcoin’s correlation to gold continues to soar, as shown by the snapshot above.

This correlation currently sits at around $0.8 (with a value of 1 indicating perfect correlation).

An Analyst Also Predicted Something Similar Last Week

The creator of the Stock-2-Flow (S2F) model, PlanB, has once again expressed his strong support for Bitcoin.

In a recent tweet, the analyst maintained that after the April halving event BTC will become more scarce than both gold and real estate, leading to something quite interesting.

According to PlanB, he would be surprised if the market cap of BTC (which is currently around $850 million according to Coingecko) didn’t beat that of Gold.

Now, keep in mind that Gold has a market cap of more than $10 billion at the time of writing according to Companies Market Cap.

A little math here and there, and we can see that PlanB expects BTC to rally by more than 1000% after the next halving, to around $500,000 per token.

Keep in mind that overall, while Gold is the asset (or company) with the largest market cap globally, BTC comes in at 13th, right beneath Berkshire Hathaway, Meta, Silver, Amazon, Google and a host of others.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.