Bitcoin Halving History

Bitcoin Halving has occurred three times in the past

- Bitcoin Halving History

- What We Know About the 2024 Bitcoin Halving?

- What Can Traders Do Around Bitcoin Halving Event?

- What Are the Factors Pushing Bitcoin Prices Up?

- 1.Bitcoin ETF

- 2. 2024 US Elections: Investor Expectations of a Rate Cut

- Traders Wary As Bitcoin Halving Approaches

- Bitcoin Halving Countdown Clock 2024

- Miners Power Up Rigs to Record Levels Before The Bitcoin Halving

- Something Unique has Happened This 2024 Bitcoin Halving

- Crypto Analyst Warns of $5 Billion Bitcoin Sell-off Post Halving

- Will the Sell-off Worsen?

- Additional Factors Trying to Pressurize Bitcoin Prices

- Final Words

- Bitcoin’s Fall Wipes out $5.2 Billion, Market Could Get Worse After Halving

- $5.2 billion worth of Leveraged Positions Liquidated

- Fear of a Crash Due to Miner Sell-off

- ETF Inflow Decreases

- Price Analysis

- Bitcoin Halving Takes Place at a Block Height of 840k on April 19, 2024 UTC

- On 28 November 2012, the rewards were reduced from 50 BTC to 25 BTC.

- On 09 July 09 2016, the rewards were reduced from 25 BTC to 12.5 BTC.

- Lastly, on 11 May 2020, the rewards were halved from 12.5 BTC to 6.25 BTC.

A peculiar phenomenon that has been observed after each Bitcoin halving, is that the price of Bitcoin always rallies parabolically within a year after the halving date. The rally in prices after the previous three halving dates are:

- 8069%

- 284%

- 538%

What We Know About the 2024 Bitcoin Halving?

The Bitcoin Halving is a phenomenon where the rewards associated with each newly mined block is reduced by half after every 210k blocks or roughly 4 years. The aim of designing such a phenomenon was to decrease the supply of Bitcoin which in turn could help lift its price.

The Bitcoin Halving that is about to take place on 18 April 2024, seems to follow its predecessors. The price of Bitcoin has always behaved in a peculiar way in every halving be it in 2012, 2016 or 2020.

Rekt Capital has identified this pattern and has defined six phases through which the price of Bitcoin passes. These phases revolve around a price zone called the Macro Diagonal and hence this theory is dubbed as the Macro Diagonal Theory.

The six phases are:

- Pre Halving Rally

- Pre Halving Retrace

- Macro Diagonal Rejection

- Post Halving Re-accumulation

- Macro Diagonal Retest

- Post Halving Parabolic Upside

NOTE: Macro diagonal refers to a price zone where Bitcoin initially encounters resistance and then uses this later as a support zone for its parabolic price rally.

What Can Traders Do Around Bitcoin Halving Event?

Traders need to be wary of the period surrounding Bitcoin Halving as the price volatility might increase.

For the aggressive traders, there does exist an opportunity to trade if they follow the Macro Diagonal theory. It has been observed that Bitcoin always gives phenomenal returns within the first year post halving.

What Are the Factors Pushing Bitcoin Prices Up?

Lately, several factors have been pushing the Bitcoin prices upwards. The most important ones among them are listed below.

1.Bitcoin ETF

The approval of Bitcoin ETFs was a game changer for Bitcoin as there appears a new channel of demand, that could drive Bitcoin prices higher. Though Bitcoin ETFs existed earlier, the approval of Spot Bitcoin ETFs made all the difference.

Bitcoin Futures ETF could only make a difference in the derivatives market and, since the derivatives market is much more limited in terms of people using it, it hardly made any impact.

Spot Bitcoin ETFs existed outside the USA. However, they were so small in size that they could only purchase a handful of Bitcoins.

2. 2024 US Elections: Investor Expectations of a Rate Cut

The presence of several pro-crypto candidates like Ron De Santis, Donald Trump, ex-candidate Vivek Ramaswamy, and democrat Robert F. Kennedy Jr.

Robert F. Kennedy has gone to the extent of calling Bitcoin as the “Currency of Freedom”.

Investors in the US, which is perhaps the largest crypto market, expect the US Federal Reserve to cut interest rates.

The US Fed has maintained interest rates since June 2023 and is anticipated to lower rates before the US elections in November 2024

Rate cuts increase the monetary supply in the economy and it helps lift the price of Bitcoin as more people have higher levels of cash to spend.

Traders Wary As Bitcoin Halving Approaches

Worsening macroeconomic data and tightening regulations had kept traders on an edge lately. Bitcoin which was on its way to cross $70k was caught in a trap after US CPI data came a bit worse than expected. The expected month on month increase in inflation was expected around 0.3%. However, it came to be 0.4%. CPI increased 3.5% year on year against expectations of 3.4%.

On top of this, the US Fed has shown a clear stance that it would not consider cutting interest rates anytime soon. The Fed Watch tool by CME now shows September as the month that a rate cut would likely arrive. September might also be the month of elections in the USA.

Arthur Hayes, crypto analyst, now expects the halving event to be a “buy the rumor and sell the news” drawing a parallel with the 2016 halving.

Bitcoin Halving Countdown Clock 2024

Miners Power Up Rigs to Record Levels Before The Bitcoin Halving

As the halving approaches, miners have powered up their rigs on full throttle, mining every Bitcoin block before the halving reduces block rewards from 6.25 BTC to 3.125 BTC.

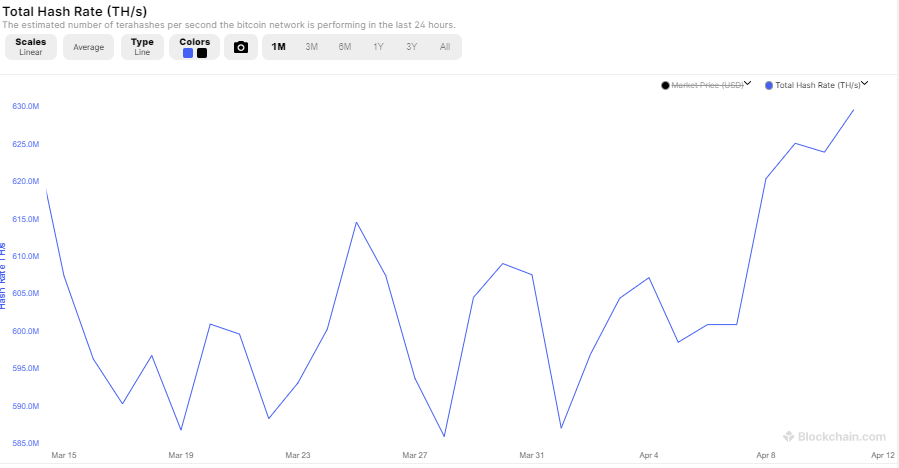

Data from Blockchain.com shows that the total hash rate has reached $629 million Tera Hashes per second (TH/s). A week ago this figure was near 598 TH/s. The 5% rise within a week points towards the aim of miners to mine every possible block that can give them 6.25 BTC per block.

Hash Rate Explorer

The Bitcoin Halving Event counter at Voice of Crypto shows that there is approximately 9 days remaining for the halving event. The block height during press time was 838,881 blocks with the event scheduled at a block height of 840,000 blocks. The halving takes place every 210,000 blocks.

At the halving event, the block difficulty will increase to the extent that the miners would only be able to generate a block if they dedicate twice the amount of computational power they dedicate now. This is the reason why Bitcoin miners are trying to extract as much Bitcoin as possible.

Something Unique has Happened This 2024 Bitcoin Halving

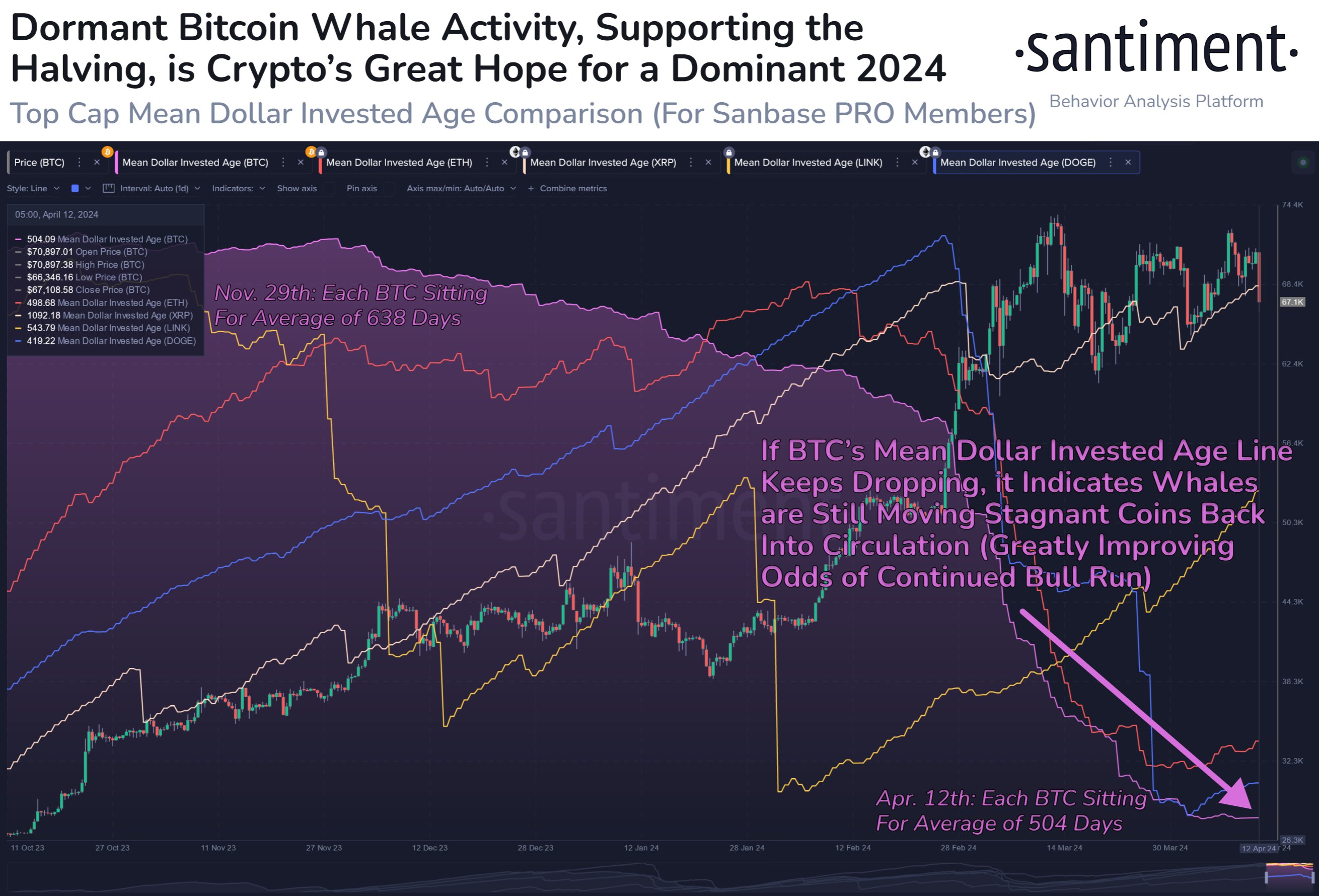

During the previous halvings, Santiment has observed that in the previous halvings, the market activity usually rises around the event. However, in the 2024 Bitcoin Halving, the market activity has neither increased nor decreased. It has remained consistent in the last few weeks.

Santiment uses an indicator called the Mean Dollar Invested Age(MDIA) to decode the market activity of Bitcoin traders and investors at any given point in time. The indicator tracks the average amount of time an investment (into Bitcoin) has been made. The data considers individual wallets as units for the measurements.

A falling line in the MDIA graph against time shows that there is an increased market activity as invested age shrinks due to frequent trades. Similarly, an increasing MDIA graph shows that Bitcoins are spending more time in the user’s wallets.

For other cryptocurrencies, the MDIA has been increasing which means recently, there has been less trading and investing in those markets.

How much time does Bitcoin spend inside wallets?

Something peculiar has been observed in the past few days. The MDIA line in the last few days() has stagnated, which means market participants have neither increased nor decreased their activity. This shows that as Bitcoin approaches the halving, traders and investors have been making very calculated moves.

Such activity was also observed in late 2023 (Oct-Dec) when despite several rumors of delay and rejection of Bitcoin ETFs arose, the markets stayed firm.

Crypto Analyst Warns of $5 Billion Bitcoin Sell-off Post Halving

Top Bitcoin Analyst Markus Thielen and 10x Research have brought out a report on Bitcoin miners, that shows that, once the Bitcoin Halving is over, miners are ready to sell $5 billion worth of Bitcoins. According to the analyst, this selloff could keep Bitcoin under pressure for the next six months.

In a previous article, we showed how Bitcoin miners were trying to extract every Bitcoin before the fourth halving event on 19th April. The event will reduce new miner rewards and hence the Bitcoin supply by half.

Will the Sell-off Worsen?

The fourth Bitcoin halving which is expected to occur on the 19th of April, 2024 will reduce the Bitcoin mining rewards from 6.25 BTC per block to 3.125 BTC per block. The event would reduce the supply of new bitcoins from 900 per day to 450 per day. This means the miners will have to make the same effort to mine half the number of coins.

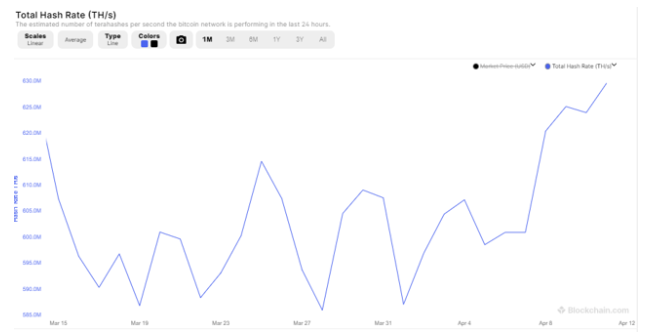

Lately, miners have been trying to push their mining rigs to their limits in an attempt to mine every Bitcoin before the halving event strikes.

Bitcoin Hash Rate

Also, after the halving event, these miners would have to sell their Bitcoin holdings to cover their expenses since it would take some time for the miners to adjust to the new mining rate.

The report by 10x Research shows that miners have approximately $5 billion worth of unsold Bitcoins in their inventory. If these Bitcoins are sold in the open market, they may keep the price of Bitcoin under pressure for several months.

Additional Factors Trying to Pressurize Bitcoin Prices

The situation is further aggravated by the fact that the US Federal Reserve has been reluctant to cut interest rates in mid-2024. This news alone caused Bitcoin to fall about 10% in a single day.

Further, the US Government has been trying to sell $2 billion worth of Bitcoins that was recovered from various seizures done by various US Authorities. All of these factors seem to worsen the situation.

Final Words

Though Bitcoin seems to be under pressure, not everything has turned sour in the market.

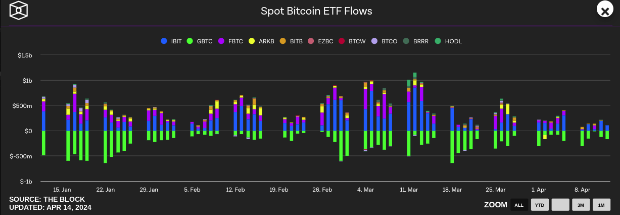

There is also a factor working in the positive direction. Spot Bitcoin ETFs continue to buy Bitcoins. This buying has been the core of the rally in Bitcoin in the last six months.

Spot Bitcoin ETF Inflows

As of today, 14th April, at press time, Bitcoin has found support at $61k and is stable at $65k.

Bitcoin’s Fall Wipes out $5.2 Billion, Market Could Get Worse After Halving

Bitcoin’s drop to $61,000 has left the market in tatters. This move has liquidated leveraged positions with a nominal value of $5.2 billion. The deepest of all liquidations took place in futures markets.

This sudden downturn adds to fears of a miner-led sell-off that had been predicted just moments earlier. Bitcoin is about to undergo its halving event in a few hours. A market-wide selloff is expected as Bitcoin miners prepare to sell their stash to cover costs.

The pain of the halving event will strongly be felt this time as the ETF inflows have also turned negative.

$5.2 billion worth of Leveraged Positions Liquidated

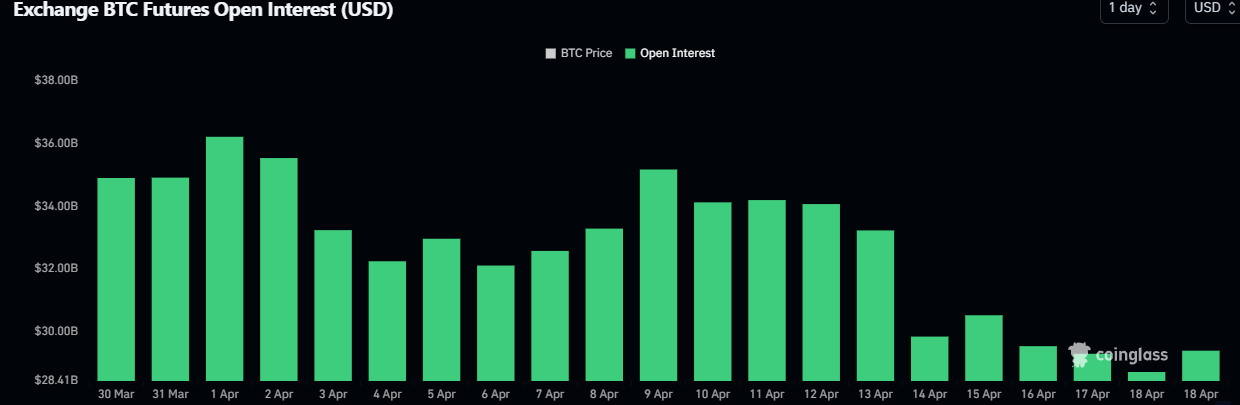

Change in Bitcoin’s Open Interest

In April 2024, the Bitcoin leveraged positions have been liquidated to the tune of $5 billion and more. The unexpected falls in the spot price have been causing huge impacts in the derivatives markets.

A drop in the value of total futures contract value from $35 billion on April 1 to $29.4 billion on April 18 was also noted. The largest fall in marketwide positions came on 13th April when the market cap fell from $33.23 billion to $29.8 billion within a single day. Bitcoin’s price fell from $67.1k to $63k within the same period.

The funding rate has also dropped from being super bullish with 0.1% on April 1st to a neutral value of -0.0053% on April 18th.

The funding rate is the difference between the futures contract price and the spot Bitcoin price. A positive funding rate means Bitcoin buyers are super bullish and expect higher prices. Similarly, a negative funding rate denotes a bearish expectation of price.

Fear of a Crash Due to Miner Sell-off

There have been additional fears of a Bitcoin crash due to miner-led selloffs. As the halving event passes, miners would struggle to meet their mining costs and might be forced to sell Bitcoins from their stash.

The amount of Bitcoins with miners is estimated to be around $5 billion. Though this volume seems less as compared to Bitcoin’s daily trading volume, it is considerably high considering the sentiment in the market. The miner-led selloff does not seem to be huge but it can surely trigger a selloff in the markets.

Added to other woes, this would ultimately put pressure on current markets which already seem fragile.

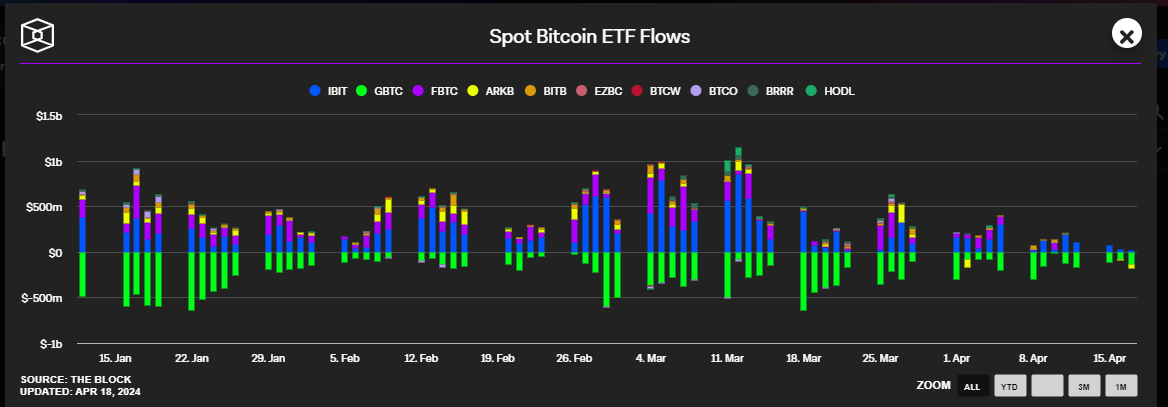

ETF Inflow Decreases

For a few days, Bitcoin ETFs have also been witnessing a negative inflow which shows that the people are pulling out their money from the spot ETFs.

Bitcoin ETF Flows Since Approval

Data from The Block shows a gradual decrease in the ETF inflows and an increase in outflows shown in the light-green color.

Negative inflow forces the ETF crypto custodians to sell their Bitcoins which could also trigger a selloff along with the miners.

Price Analysis

Bitcoin daily charts also show that a sell-off in Bitcoin might be inevitable after the halving event.

Bitcoin Daily Charts as on 18 April 2024

RSI has already plummeted to a lower range of 40 which shows that there is a weakness in the price momentum.

Further, Bitcoin is about to break strong support in the zone of $61k-$60k. If this support is broken, daily price charts indicate that a price of $50k might be inevitable.

All of these, put together, paint a grim picture of Bitcoin’s price in the coming week.

Bitcoin Halving Takes Place at a Block Height of 840k on April 19, 2024 UTC

The Bitcoin Halving is finally over at a block height of 840,000 and at 12:09 am UTC on April 20th, 2024. The moment saw a huge number of people try to get their transactions included on the 840,000th block to mark the moment. Block rewards are now at 3.125 Bitcoins. However, there is also an increase in the price of Bitcoin, meaning, though block rewards are getting lower, the amount in dollar terms has increased from $53,860 (6.25 BTC) to $200,229 (3.125 BTC).

The next and the fifth Bitcoin halving is estimated to be scheduled between February 4th, 2028 to April 17th 2028 at a block height of 1,050,000. This halving would serve to reduce the block reward from 3.125 Bitcoins to 1.5625 Bitcoins. However, with an expected increase in Bitcoin’s price, we expect that each block reward would be worth over a million dollars by them.