Key Insights

- Bitcoin’s price spiked on Tuesday due to a false report that the SEC had approved BlackRock’s Bitcoin ETF proposal.

- The fake news led to $156.3 million in liquidations, with the bears losing $100 million and the bulls losing $56 million.

- Despite the fake news being debunked, Bitcoin’s trading volume has increased by 100%, suggesting that market participants are eagerly awaiting a BTC ETF.

- Edward Snowden has warned that a spot ETF approval could lead to more regulatory problems for crypto and threaten Bitcoin’s decentralization.

- Bitcoin’s price has declined since the fake news was debunked and could see a steep price decline if it breaks below $28,359.

The crypto market started the week on a very bullish streak on Monday, with BTC even registering a 1% price increase over a 24-hour timeframe.

However, Monday’s bullishness was nothing compared to Tuesday’s, when BTC and the rest of the market simply exploded to the upside.

According to the chart above, BTC, which had been struggling with breaking above $28,000 and retesting $30,000 simply did so overnight. Before declining so sharply again.

What exactly went on? Why did the crypto market’s prices suddenly explode?

The reasons for this might come as a surprise.

Bitcoin Driven Along By Fake ETF Reports

According to reports, it turns out that the volatility surge on Bitcoin on Monday and Tuesday that ultimately saw Bitcoin hit $30,000 was due to a false piece of news from a major outlet.

Cointelegraph, in a now-deleted post on Twitter, announced that the United States Securities and Exchanges Commission (SEC) had approved Blackrock’s proposal for a new Bitcoin Exchange Traded Fund (ETF).

By the time the news was debunked, the damage had already been done, with traders on both sides of the line losing more than $100 million to liquidations.

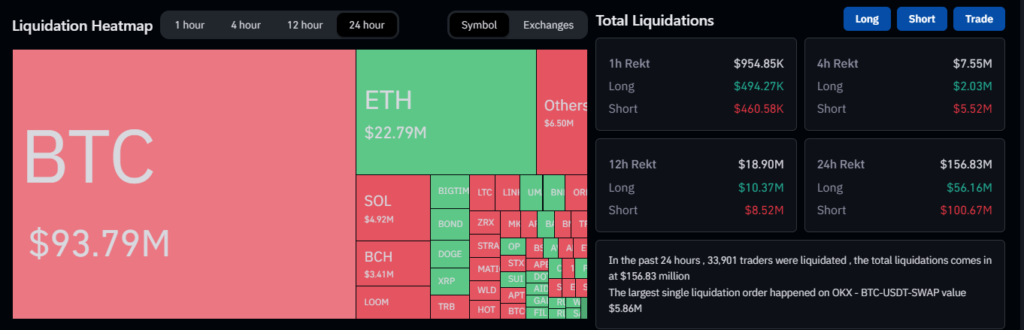

Coinglass data shows that a total of 33,862 traders were liquidated over the last 24 hours on both sides.

Coinglass shows that while the bulls lost a little more than $56 million, the bears suffered a massive $100 million in liquidations.

This brought the total amount taken from traders to about $156.3 million, with a single investor losing $5.8 million in a Bitcoin trade on OKX.

Additionally, BlackRock has so far, confirmed that its Bitcoin ETF application with the SEC has not been approved, and is still under review as of the time of writing.

This Is What To Expect If A Bitcoin ETF Becomes Approved

BTC, initially, was struggling to break and close above $27,000 and $28,000. However, when this news hit the internet, traders jumped on the bandwagon. Within seconds, Bitcoin was trading at fresh new highs with a dominance increase of about 1.4%.

This hasn’t stopped traders and investors though.

Despite the fake news being debunked, traders continued to hold Bitcoin up, crypto traders continued to ride the wave.

The cryptocurrency now has about a 100% increase in trading volume, with a current value of $26 million.

This shows that market participants eagerly await a Bitcoin ETF.

If an ETF becomes approved, what happened over the last 24 hours will only be the tip of the iceberg, because analysts have predicted that Bitcoin will rally to at least $150,000 by the end of 2024.

The US SEC is currently reviewing a dozen spot ETF applications.

And according to market experts like Kathie Wood, the founder of Ark Invest, the SEC may even approve all of them at once, to avoid giving any fund manager a head start over the others.

Edward Snowden’s Warning on Spot ETF Approval

Edward Snowden, a former hacker, security expert and computer intelligence consultant who is popularly known for breaking into and leaking classified documents from the United States NSA has weighed in on the conversation.

According to Snowden during the Bitcoin Amsterdam 2033 conference, a spot ETF approval might be good for Bitcoin’s price.

However, these ETFs will lead to more regulatory problems for crypto, on the path to economic freedom.

Snowden also expressed concern about the growing influence of institutional investors on the Bitcoin market.

“We don’t want to focus on things like ETFs. We need to focus on the fundamentals,” Snowden said.

Keep in mind that there have also been concerns about Bitcoin’s decentralization being threatened, with these trillion-dollar institutions now controlling a better part of the cryptocurrency’s supply via these ETFs

Are We About To See A Massive Correction?

According to the charts, yesterday’s Bitcoin candlestick was one of the longest and most bullish Bitcoin has experienced this year.

However, upon debunking Cointelegraph’s tweet, the bears swung into action and brought the price of Bitcoin into a swift decline.

BTC has now lost its standing at around $30,000 and has declined to where it now sits at $28,400.

If the bears sustain the momentum with which they pushed the price of Bitcoin down from $30,000 and the cryptocurrency breaks below $28,359, we are bound to see a steep price decline all the way down to the $24,860 support again.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.