Key Insights

- Whales moved $1 billion worth of Bitcoin off Coinbase over the weekend, indicating bullish sentiment.

- The amount of Bitcoin in Coinbase’s order book is the lowest since 2015.

- Some believe the withdrawals are due to whales expecting a price increase, while others suggest it’s for internal restructuring.

- Bitcoin’s price is currently consolidating around $51,000. Analysts are watching to see if it breaks above $52,515 for further upward movement.

- A break below $51,700 could lead to a drop to $50,000 or lower.

The crypto market is at the helm of a serious bullish takeover, and the Bitcoin market, in particular, has been experiencing most of it.

According to recent reports, the whales just attacked Coinbase and pulled a whopping $1 billion off over the weekend.

Now, this only means one thing:

The whales pulling this amount off Coinbase in such a short time span indicates that their confidence in Bitcoin is at a high, and Bitcoin might be poised to continue further upwards from its current price level.

The Whales Pull Their Bitcoin Off Coinbase

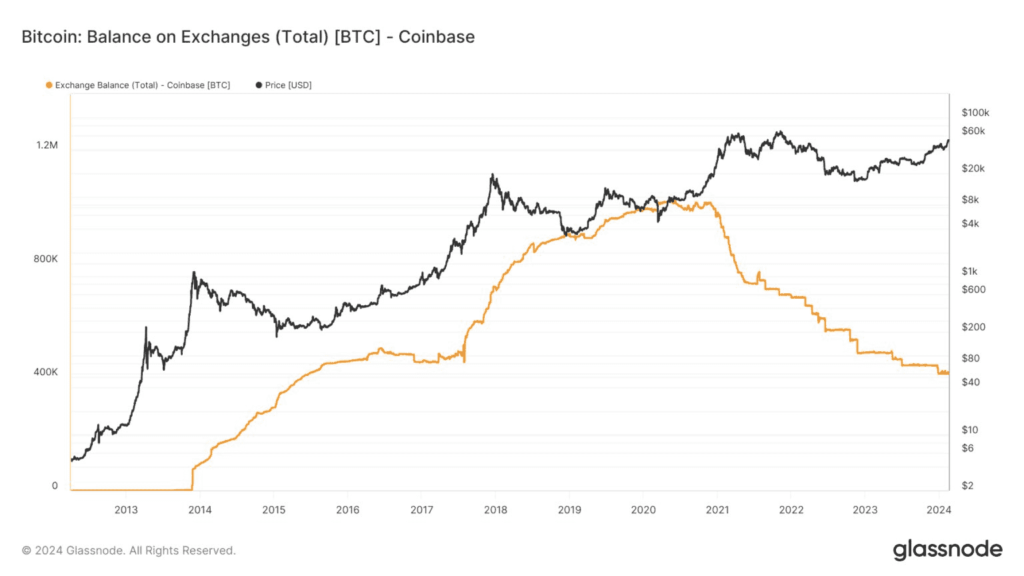

According to a recent report from CryptoQuant, Coinbase’s public order book now contains only 394,000 BTC, worth about $20.5 billion at current prices.

CryptoQuant notes that this is the lowest amount of Bitcoin this order book has contained since 2015 when the exchange held less than 300,000 BTC.

According to CryptoQuant, the whales moved about 18,000 BTC, worth about $1 billion off Coinbase in multiple transactions, ranging from around $45 million to $171 million per transaction.

Why Are Whales Moving Their BTC?

As we mentioned before, this withdrawal spree from the whales from Coinbase to self-custody wallets or other platforms is generally seen as a bullish sign.

It shows that the whales are expecting the price of the cryptocurrency to continue further upwards, and are attempting to secure their holdings before a rally starts.

These withdrawals could also be connected to the upcoming Bitcoin halving, which is believed by investors to mark the start of the next bull market.

However, other analysts have argued against the bullish nature of the Coinbase withdrawals.

Julio Moreno, for example, believes that the withdrawals may have had nothing to do with whales at all.

In a recent tweet, the analyst argued that the Bitcoins may be going into custody, with Coinbase creating new addresses to diversify its holdings.

The analyst also theorizes that the withdrawals may “just be an internal wallet reorganization”.

Moreover, the analyst pointed out that most of the coins transferred had not moved since December 2018.

The Implications Against Bitcoin’s Price

Bitcoin broke above the $50,000 zone on 14 February, even hitting the $52,816 zone on 15 February.

However, we are seeing consolidation around this price level, and the crypto community wonders: Will we continue further upwards from here, or crash lower?

According to a recent tweet from analyst, Ali, on the 10-minute chart, the TD Sequential indicator has a support trendline of around $51,700, and a resistance trendline of $52,515 as shown below.

According to Ali, Bitcoin might be poised to continue further upward if we see a break above the $52,515 zone again.

Moreover, if we see a sustained break below $51,700, Bitcoin may continue further downwards to the $50,000 support or even lower, depending on the strength of the bulls.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.