Key Insights

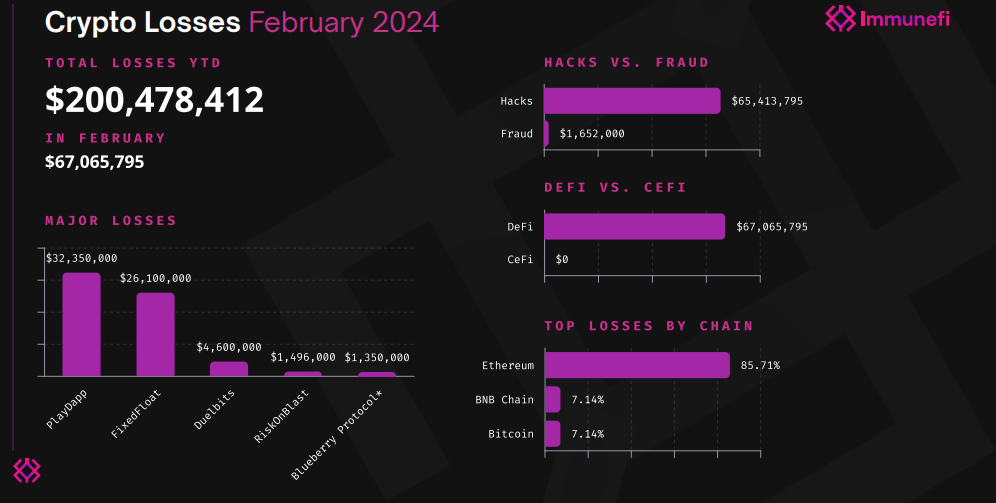

- Over $200 million in crypto stolen in 2024 so far: This is a 15.4% increase compared to the same period in 2023.

- Ethereum is the most targeted blockchain by hackers, accounting for 85% of the total value stolen.

- DeFi was the most targeted sector, in which hackers stole over $64 million from DeFi protocols.

- Bitcoin and BNB also saw attacks: Bitcoin lost $7.8 million, and BNB lost $2.5 million.

One of the biggest tradeoffs of having the market come back to life is that the number of hacks all over the industry is bound to skyrocket.

2024 is only two months in, and according to reports, the crypto market has witnessed a sharp rise in hacks.

Over $200 million worth of crypto and other digital assets have reportedly been stolen or lost across 32 incidents, according to a new report by Immunefi.

The Crypto Hackers Are On A Roll With $200 Million Stolen

According to this new report from Immunefi on 29 February, the value of crypto that has either been hacked, stolen or lost in 2024, increased by around 15.4% compared to the same period in 2023.

Comparatively, January and February 2023 saw thefts of around $173 million.

What is interesting though, is how this figure dropped from around $133 million in January to $67 million in February (despite the crypto market being hotter now, than it was back then).

This indicates that hacker activity in the crypto space either declined, or protocols are gearing up for the incoming bull run with proper audits and improved security measures.

Ethereum Remains the Top Target for Crypto Hackers

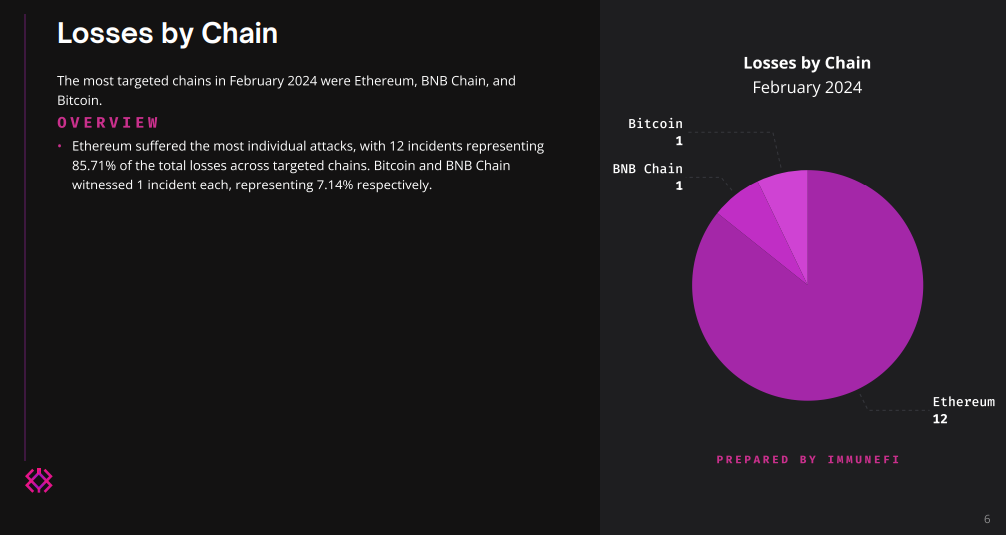

The report also stated that Ethereum is by far the most targeted blockchain by these hackers in 2024.

Ethereum according to Immunefi, accounted for as much as 85% of the total value stolen or lost so far.

In particular, this network suffered 12 staggering individual attacks in February, that wiped $57 million out of the total $63 million.

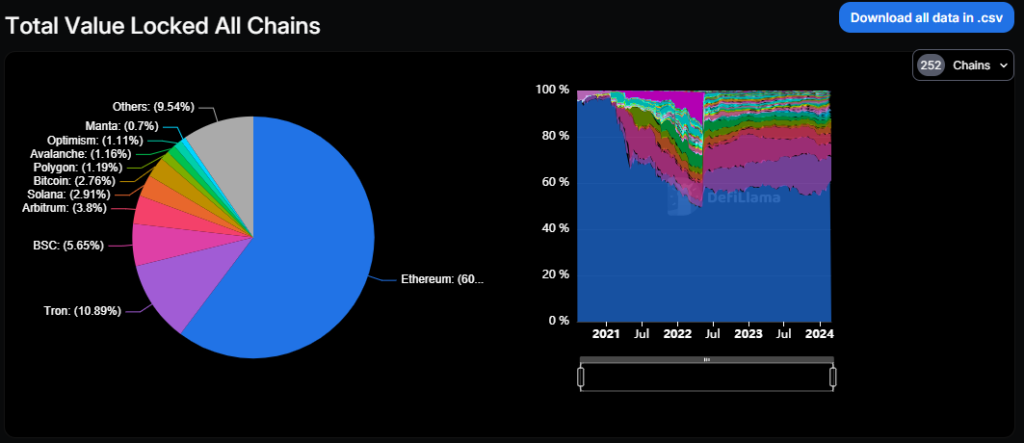

The report also states that Ethereum may have been so frequently attacked because it is by far the most popular, complex defi network.

Moreover, the majority of the dapps and smart contracts deployed onto blockchain networks are deployed on Ethereum.

This likely cast a pretty wide net for the hackers, making Ethereum a very obvious choice.

Ethereum also holds more than half of all the TVL deployed on decentralized networks, as shown by the DefiLlama snapshot above.

Moreover, two of the most brutal hacks on Ethereum happened in February, including the $32.3 million cyberattack on PlayDapp, and the $26.1 million theft from FixedFloat.

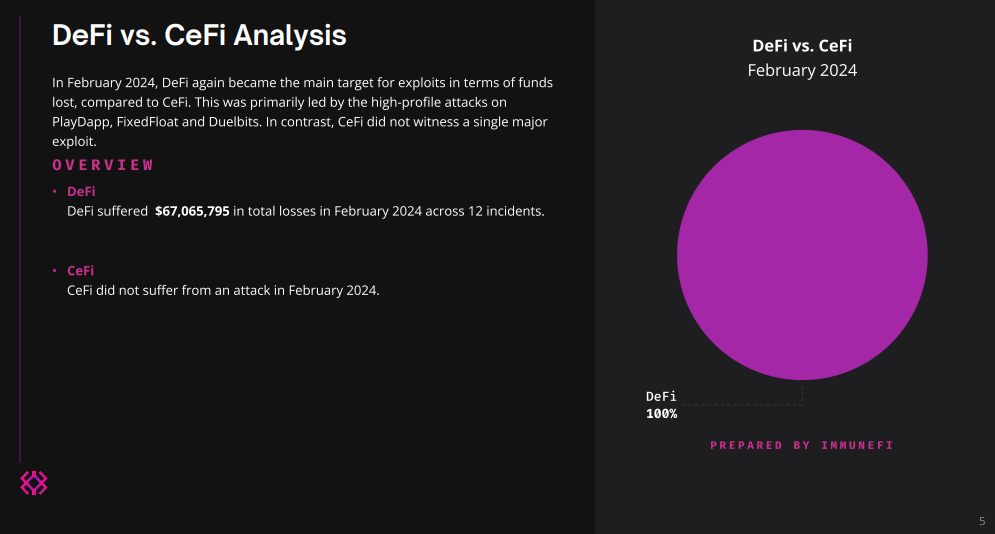

According to the reports, the hackers barely had any interest in Centralized finance protocols.

Immunefi notes that the defi sector was the most targeted by hackers in February, seeing over $64 million worth of crypto drained overall.

Cefi on the other hand, remained largely untouched.

Bitcoin, BNB Suffered Too

Although Ethereum was the target of the most hacker attacks in February, hacker threats also affected other blockchain networks.

The report cited one instance each, of attacks on the Bitcoin network on BNB.

The Bitcoin network suffered a massive $7.8 million hack in a cyberattack that targeted the Bitcoin Savings and Trust when a hacker managed to break into the protocol’s wallet and transfer the funds to an unknown address.

The BNB Chain also got hit with a massive $2.5 million hack in a PancakeSwap phishing scam.

Why The Market Needs To Stay Vigilant

Overall, the Immunefi report urges investors to be careful with crypto platforms, especially ones that are unaudited, new, or offer unrealistic gains.

Moreover, crypto platforms were also urged to conduct regular audits and implement best practices.

As the crypto market continues to rally as the months go by, the hackers will likely intensify their efforts, leading to harsher hacks across several crypto protocols, and affecting several users.

It is important to remember, going forward, to conduct proper research, and never let the greed of FOMO win.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.