Key Insights

- Despite a decline in the frequency of crypto security incidents in 2023, Ethereum remained the top target, suffering $500 million in hacks.

- DeFi hacks dominated with 31% of losses and 60% of incidents, followed by centralized exchanges at 20% of losses and 15% of incidents.

- As popularity resurged, NFTs faced 12% of incidents and 5% of losses, with minting fraud, fake auctions, and IP infringement being common.

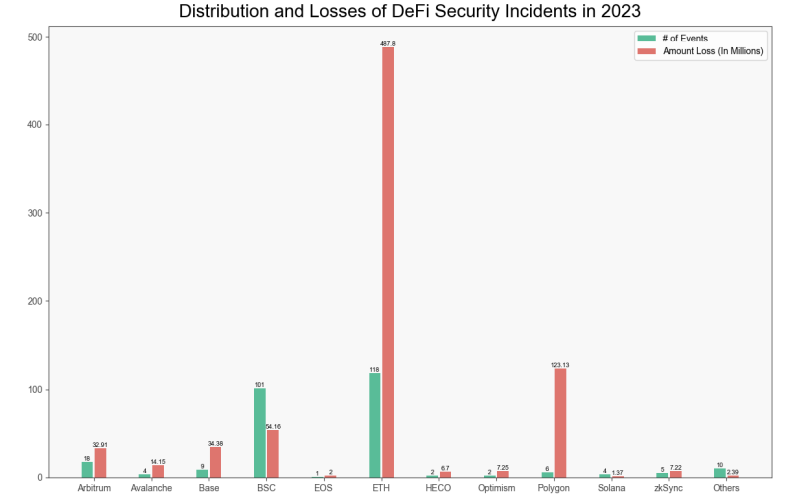

- Ethereum bore the brunt, experiencing $487 million in losses, closely followed by Polygon, which suffered $123 million in losses.

According to a report by the blockchain security company SlowMist, the frequency and seriousness of security incidents in the crypto industry decreased in 2023. However, Ethereum, the cryptocurrency with the second-highest market cap, remained the most highly targetted chain, losing about half a billion dollars to several hacks, scams and exploits throughout the year.

SlowMist’s Report Highlights

SlowMist released its 2023 report on the state of the crypto industry’s security quite recently.

In this report, SlowMist found that in 2023, 464 security events involving various project kinds, platforms, and policies were affected.

The total losses from these incidents amounted to $2.48 billion, representing a 34.2% decrease compared to 2022 when the losses reached $3.77 billion from 302 incidents.

SlowMist says that this reduction in the amount of stolen funds may have been due to the crypto community’s enhanced security, along with the efforts of law enforcement and bug bounty hunters to locate and retrieve the stolen funds.

Funds Were Stolen According to Project Type

SlowMist also classified the hacks by project type, with the most targeted industry being DeFi.

SlowMist reports that DeFi hacks accounted for 31.2% of the overall damages ($773 million) and 60.7% of all incidents (282 instances).

The report also pointed out that smart contract vulnerabilities, front-running assaults, flash loan exploits, and governance concerns were just a few of the difficulties that DeFi initiatives had to deal with.

Centralized exchanges, on the other hand, accounted for about 14.9% of all occurrences (69 instances) and 19.6% of all damages ($487 million), making it the second most targeted industry.

SlowMist made it clear that insider theft, phishing, hacking, and regulatory pressure were among the issues that CEXs had to deal with.

The third most targeted sector was the NFT sector, which attracted both users and attackers in 2023 as its popularity came back.

SlowMist says that NFTs experienced 11.6% of the total incidents (54 cases) and 4.9% of the total losses ($122 million), with the most popular NFT attacks being minting fraud, fake auctions, and intellectual property infringement.

Ethereum and Polygon Suffered the Most

SlowMist was also classified based on the losses they sustained from hacks in 2023.

Ethereum was reportedly hit with $487 million in losses, ranking it as the biggest loser on the list.

Polygon closely followed Ethereum at  $123 million. SlowMist also mentioned that Ethereum and Polygon were the most widely used chains for these Defi and NFT applications, increasing their vulnerability to these attacks.

Exit scams were also found to have been the most frequent source of thefts in 2023, accounting for 23.7% of all occurrences (110 instances) and 3.3% of all losses ($83 million).

Account compromise (via phishing or social engineering) also accounted for 18.5% of all events (86 instances) and 19.6% of all losses ($487 million), making it the second most frequent source of crypto exploits.

In conclusion, smart contract bugs accounted for 14.9% of all occurrences (69 instances) and 31.2% of all losses ($773 million), making them the third most frequent source of loss.

In summary, the report shows that SlowMist expects the crypto industry to continue growing and innovating, but to also face more complex security challenges over the years.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.