Key Insights

- The Shapella upgrade will go live at epoch 194,048 around April 12

- ETH staking might be less risky after this upgrade, but bearish pressure may emerge

- Analysts says that strong pressure is unlikely, and ETH may not plunge

- If ETH does not break $2,000 soon, a $1,720 retest may occur

The Ethereum (ETH) network’s long-awaited Shapella update is scheduled to hit the mainnet around epoch 194,048 on April 12, 2023.

For the first time in more than three years, Staker deposits will finally be able to be withdrawn (“unstaked”) with the March 2020 introduction of the Ethereum (ETH) deposit contract.

The Shapella upgrade promises to provide a variety of advantages to the Ethereum network, including the capacity to unstake and withdraw funds from The Beacon Chain.

This will enable the network to release staked ETH valued at an astounding $30 billion, which will provide significant liquidity to the network at large.

What Is the Shapella Update, What to Expect?

The Shapella hard fork is one of the most significant developments in the world of blockchains and crypto in recent months.

So far, it is one of the most anticipated network upgrades for Ethereum (ETH) in 2023. However, in the long run, what should you expect from this upgrade, and how will this affect the Ethereum network and of course, the price of ETH?

- The Shapella update for Ethereum (ETH) is scheduled to go live on April 12, 2023, at about 10:27 PM (UTC)

- Changes to the Engine API, the consensus layer (called Capella), and the execution layer (Shanghai) are all on Shapella’s agenda;

- At the same time, there might be some drastic consequences of this upgrade. While ETH staking is made less risky by the unlocking of funds, it may also lead to ETH bearish pressure;

- The Shapella Upgrade is expected to reduce gas costs for developers, allowing them to build and deploy more Dapps and smart contracts.

The upcoming Shapella upgrade is expected to increase demand for the already thriving liquid staking market. Almost half of all ETH is now staked via liquid staking, and it is anticipated that this percentage will increase dramatically following the update.

By doing this, users will be able to earn staking rewards more quickly and easily while still being able to utilize their ETH for other things.

How ETH Price Will React

First of all, if this upgrade eventually goes live and the staked funds get released, massive selling is likely to occur. If this happens, it could lead to a decrease in market demand and a subsequent drop in the cryptocurrency’s price.

While this is scary enough on its own, CryptoQuant has revealed that things may not be as bad as they seem.

According to CryptoQuant’s profit and loss calculations on Ethereum, there should be little to no selling pressure on ETH as a result of staking withdrawals following the update.

This is because the majority of ETH staked (9.4 million ETH, or 52% of the total) is currently “out of the money” (or valued lower than they were bought). Most people who sell their unstaked Ether from the Shapella upgrade would actually be selling at losses.

The Shapella Update is scheduled to go live on Wednesday this week.

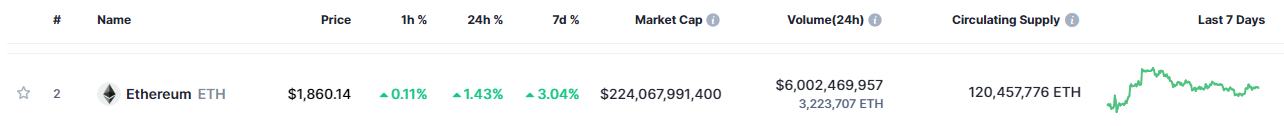

According to CoinMarketCap, Ethereum is on the bullish side at the moment, after having risen 3% over the last week, and by 1.5% over the last day.

This is a good sign for the cryptocurrency, as far as the upcoming upgrade goes. In the charts, For the past few months, the price of Ethereum has been rising and breaking through numerous important resistance levels.

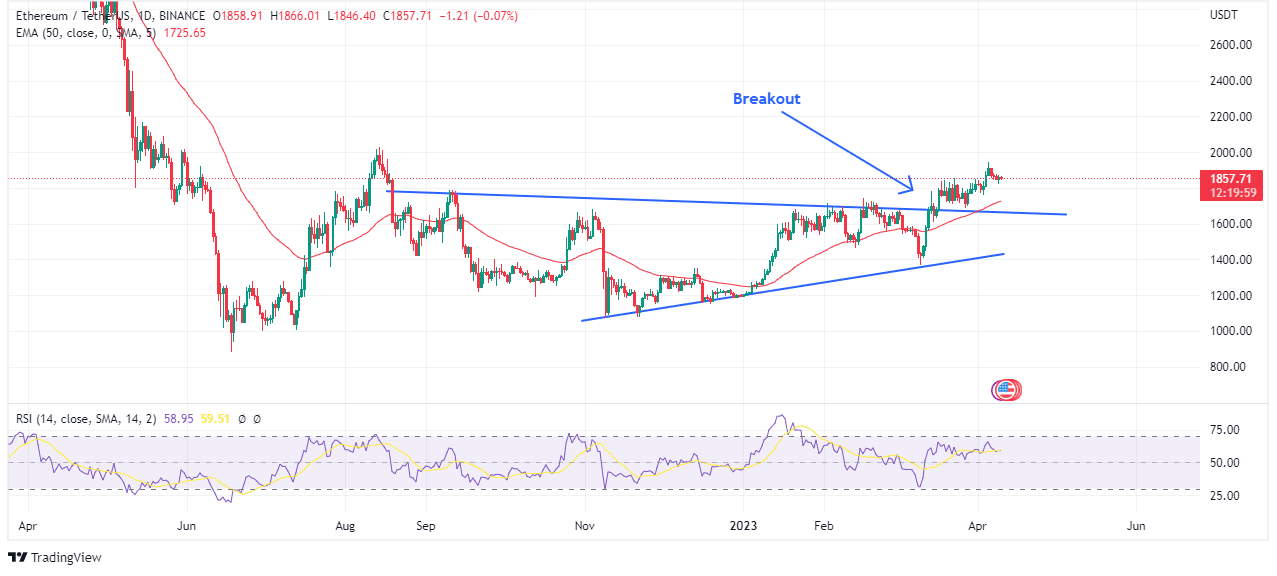

On the charts, we can see that Ethereum was in a minor descending wedge, and has just managed to break through the top resistance around $1,700 in mid-March.

The cryptocurrency now trades at $1,857 at the time of writing and appears strong enough for now.

However there are still some concerns that loom ETH and its price trajectory

- The cryptocurrency has shown an inability to go above $2,000 and the bullish momentum after the breakout from $1,700 appears to be fading.

- The RSI is currently above the 50 range and shows that the bears are currently in control.

This is good for the Bulls for now. However, the window of opportunity is closing, and the bulls will have to push the cryptocurrency into a breakout from $2,000 before 12 April.

If the bulls are unable to push the price of Ethereum above $2,000 before the Shapella Upgrade goes live, a “buy the rumour, sell the news” scenario may happen, driving ETH into a retest of its 50-day moving average (red line around $1,720) or lower.

Disclaimer: Voice Of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.