Key Insights:

- Indian Crypto Exchanges seem to fail in capturing lost customers.

- Indian authorities blacklisted off-shore exchanges in Jan 2024.

- Poor customer service, lack of CRM, failure to attract corporate customers among few reasons.

When the Government of India decided to ban the URLs and apps of off-shore crypto exchanges, which was a golden opportunity for the Indian crypto exchanges. Despite, it seems that the Indian exchanges are barely capable of capturing this traffic.

In this article, I will show you why Indian crypto exchanges are failed to capture lost customers (due to 1% TDS and 30% VDA tax) even after getting golden opportunity.

FIU Decides to Ban Apps and URLs of Off-Shore Exchanges

The Financial Investigation Unit setup by the Indian Ministry of Finance, issued notices to several off-shore crypto exchanges to share information and regularize compliances.

Not receiving an appropriate response, these exchanges were then blacklisted on Google Play Store, Apple Store and their URLs too were blacklisted.

Background

Since July 1, 2022 India imposed 1% tax deductible at source for all fiat-crypto transactions. Three months ago the same was done for Indian Crypto traders placing them under 30% tax for income via virtual digital assets (VDA), which included crypto-trading, ICO and NFT-related income.

This caused a scare-run which ended up wiping almost 95% traffic from these exchanges. For the next one and a three-quarter of a year, the offshore exchanges like Binance, KuCoin and Coinbase were the prime destination of these users.

But this temporary arrangement had to end sometime.

In December 2023, foreign off-shore crypto exchanges were issued a show-cause notice on why India-specific compliances were not taking place. Unsatisfied with the responses, the FIU had requested the government to block the URLs of these exchanges.

With this ban, it was a golden opportunities for the Indian Crypto Exchanges to get back the traffic they lost two years earlier, yet these exchanges were grossly unprepared.

Problems with Indian Crypto Exchanges

Indian crypto exchanges are purely capable of handling the traffic that is intending to come back to them. A lot of them failed to capture KYC properly several of them have obsolete on boarding techniques and few of them we believe do not even want to do proper business.

Zero to No Support for Enterprise Registration

India has a very vibrant blockchain development ecosystem due to the presence of more than 170k tech-focused startups in India. Big startups can manage to use on-ramp and off-ramp services.

However, for the smaller ones, crypto exchanges were the only mode to transact cryptocurrencies as on and off-ramp services usually have a threshold below which transactions are not allowed. As per our investigation, the limit was near $10,000.

Yet, Indian crypto exchanges had little to no interest in grabbing these customers which could have gotten them more fees than regular traders.

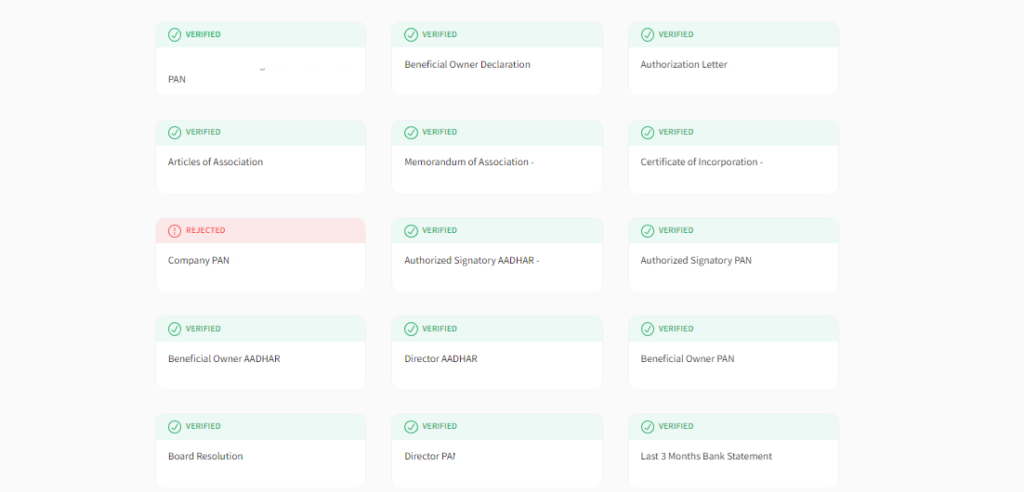

Below is a screenshot of documents submitted for company account on an Indian exchange.

In a certain crypto exchange, which is among the top most in India, despite registering as a company user, it was comical that the page wanted company’s AADHAR. For the uninitiated, AADHAR is a government issued ID card for Indian citizens only, not for companies. There is another AADHAR kind of card for companies which is called UDYAM.

Failure to Manage Customer KYC

Another exchange went a little too far, despite deleting an earlier account, they somehow held on to the KYC documents. Now, they are not letting the user login to their old account, neither are they letting them create a new one.

Non-Updated KYC Procedures

In another exchange, we found that their corporate KYC procedure dated back to 2020 and reflected no changes after that. A lot of events have occurred after 2020 some of which are:

- 1% TDS

- 30% VDA Tax

- Ban on off-shore exchanges

Zero Intent to Capture Leads

Now, for the same company, they require these details to be e-mailed. We believe at least a lead capture form should have been added. All of these make the UX lot worse.

Let us ask you this question, why would you not assist a customer when they want to buy your services? This exactly shows a lot about their work ethics.

Poor Customer Support

Most of these exchanges rarely have any direct contact or helpline number. The only methods for communications are chat or email.

In my own experience, they seldom reply to these emails most probably because of an outdated Client Resource Management system.

In the case of chatbot, the waiting time seems pretty high, yet no commitment to make the process smoother and less tiresome. For example, they could have installed a callback feature where a customer support executive could have called or mailed back the customer a few minutes or hours later.