Key Insights

- A hacker exploited a vulnerability to crash 69% of Dogecoin’s nodes.

- The official Cardano X account was compromised, leading to a scam promoting a fake token and a price crash below $1 for ADA.

- El Salvador now has unrealized profits of more than $300 million after Bitcoin’s price crossed $100,000.

- Advances in quantum computing, like Google’s “Willow” chip, could potentially threaten Satoshi Nakamoto’s 1 million BTC stash in the future.

- Microsoft’s board finally voted “no” on a shareholder proposal to add Bitcoin to its balance sheet

A colossal tragedy could have hit the Dogecoin network last week, considering how a hacker found a critical flaw—

- Key Insights

- A Hacker Found a Dogecoin Network Flaw and Crashed 69% of Its Nodes

- Microstrategy Now Has Gains of >$300 Million on Its Bitcoin Purchases

- Cardano Official Account Hacked, Used to Post Scam

- Google’s New Quantum Computer Could Possibly Break Satoshi’s 1 Million Bitcoin Stash.

- Microsoft’s Board Voted “No” To Having a Bitcoin Reserve

—and then used it to crash 69% of its nodes.

A few days later, the Cardano Foundation’s official X account was hacked and used to promote a scam, leading to a massive price crash for the cryptocurrency.

Meanwhile, El Salvador is smiling to the bank, with Bitcoin’s recent cross above the $100,000 mark having brought its profits above $300 million.

Remember Satoshi Nakamoto’s 1 million Bitcoin stash? It turns out that this Bitcoin pile could quickly become the “mother of all” bug bounties, considering how powerful quantum computers are becoming.

Finally, during the week, MicroStrategy’s board voted a “no” to establishing a Bitcoin reserve.

Here are all of the biggest stories from Crypto over the last week.

A Hacker Found a Dogecoin Network Flaw and Crashed 69% of Its Nodes

Dogecoin would have been rendered entirely unresponsive last week if hackers had found the right chink in its armor.

Andreas Kohl, co-founder of the Bitcoin sidechain Sequentia, stated in a tweet on 12 December that he had successfully brought down 69% of the Dogecoin network.

Oops I just did a thing and I think I might have just crashed more than half of all doge nodes… pic.twitter.com/04NcRtj5k1

— Andreas Kohl (@aejkohl) December 11, 2024

He claimed to have exploited this issue in El Salvador using an outdated laptop.

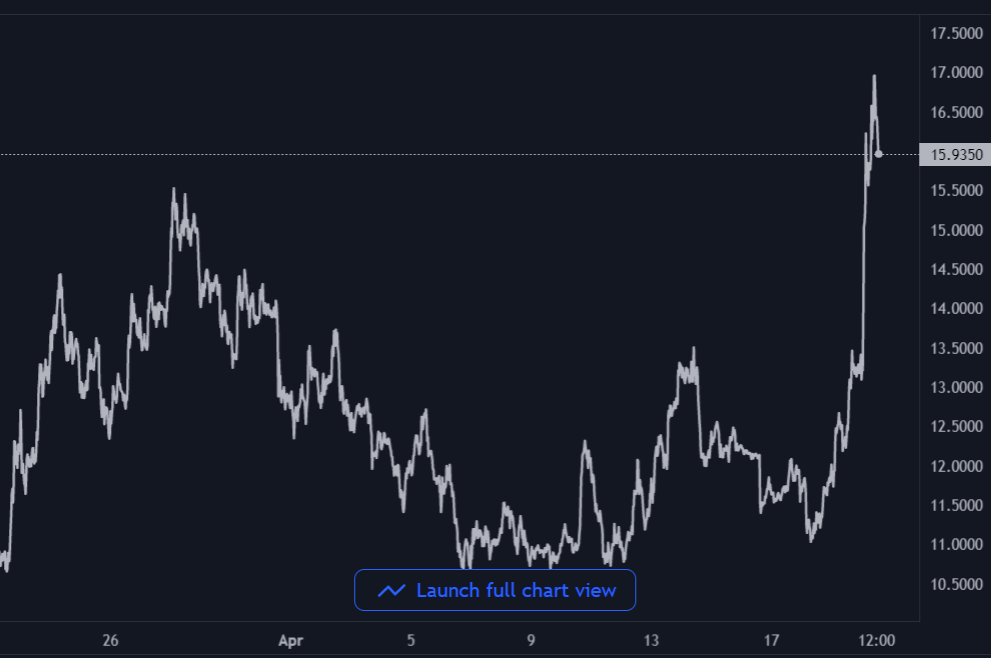

Interestingly, data from BlockChair corroborated his story, showing that the network had 647 active nodes before being exploited.

Soon after, the network had a mere 315.

According to Kohl, he crashed these nodes using a vulnerability initially discovered by researcher Tobias Ruck.

Ruck’s analysis of the exploit showed that it could allow anyone who found it to crash ANY Dogecoin node remotely.

Public Disclosure of "DogeReaper", a critical vulnerability in Dogecoin

DogeReaper is a critical vulnerability on Dogecoin, allowing anyone to crash any Dogecoin node remotely.

See the video below for a demonstration.It works similarly to the Japanese manga series "Death… pic.twitter.com/vsBL5kdJFc

— Department Of DOGE Efficiency (@EfficiencyDOGE) December 4, 2024

Imagine the damage that would have resulted if the wrong person had exploited this issue.

Microstrategy Now Has Gains of >$300 Million on Its Bitcoin Purchases

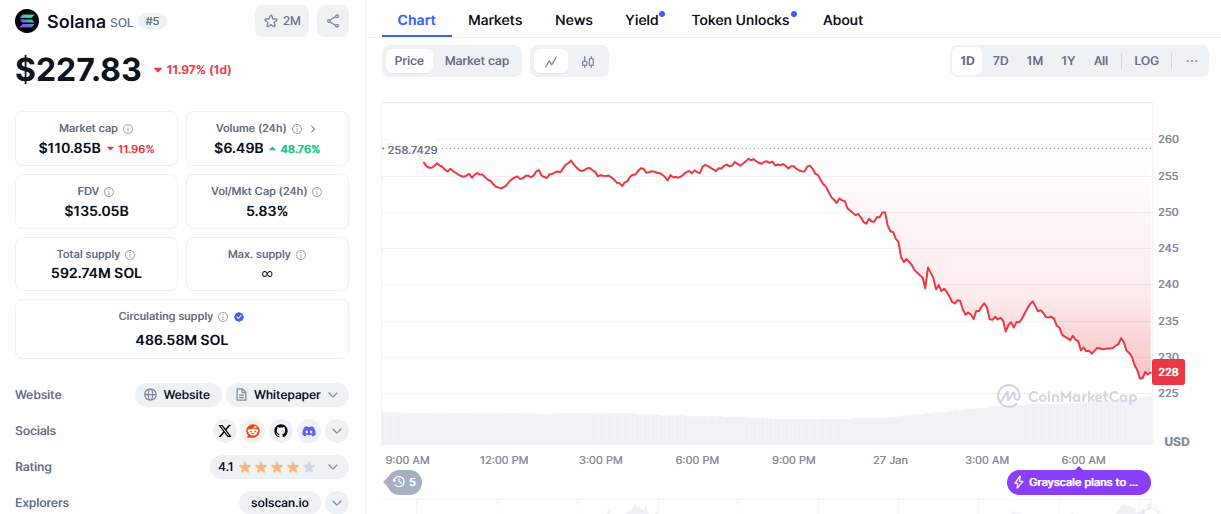

Bitcoin crossed the $100,000 mark last week, crashed below, and is back up again.

During the rollercoaster ride, El Salvadorian president Nayib Bukele pointed out the country’s unrealized Crypto gains.

Crypto influencer account Autism Capital posted a tweet asking Bukele to share El Salvador’s Bitcoin portfolio and “dunk on the haters,” to which Bukele responded by sharing a screenshot showing a $603 million balance.

Portfolio gains from El Salvador

The portfolio screenshot shows that the country has invested nearly $270 million in Bitcoin since adopting the cryptocurrency as legal tender in September 2021.

The portfolio shows no Bitcoin has been sold, and the country has unrealized gains of over $333 million.

Cardano Official Account Hacked, Used to Post Scam

On the other end of the table, the Cardano Foundation fell victim to the long trend of scams overtaking 2024.

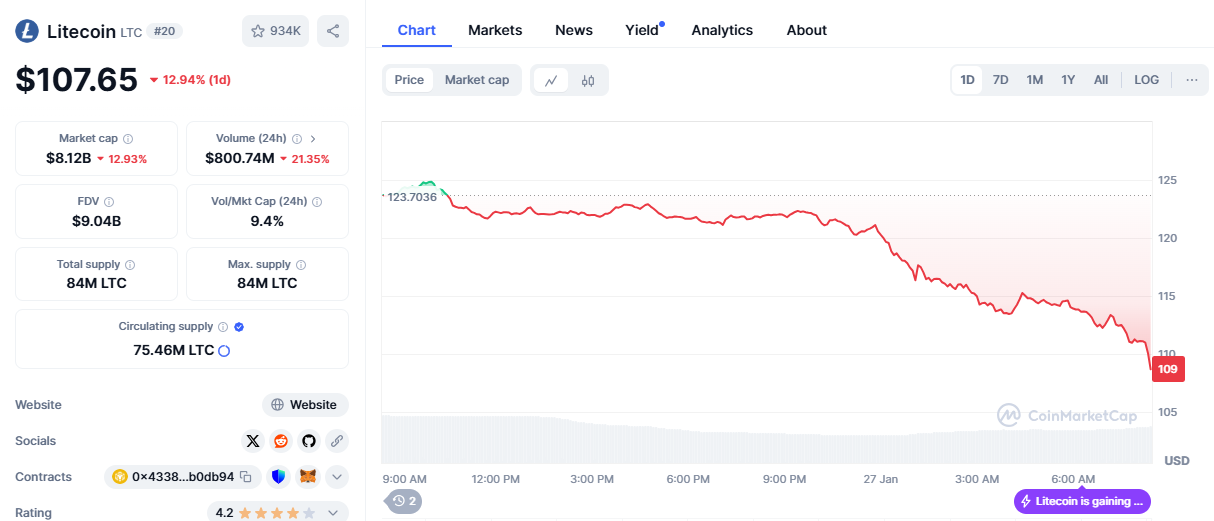

The incident unfolded on 8 December, when a malicious actor gained control of the foundation’s official X account.

According to independent investigator ZachXBT, the bad actor posted tweets via the compromised account stating that the Cardano Foundation will stop supporting ADA, the network’s original cryptocurrency, and instead switch to a new “ADAsol” coin.

Scam alert from ZachXBT

Soon after this fake announcement, ADAsol crashed by a staggering 99% after garnering over $500,000 in trading activity.

The official $ADA cryptocurrency crashed below the $1 mark alongside the rest of the crypto market before recovering to around $1.1, where it now sits at the time of writing.

The Cardano Foundation incident is the latest in a series of similar ones, including those from Symbiotic, EigenLayer, and TruthTerminal.

Google’s New Quantum Computer Could Possibly Break Satoshi’s 1 Million Bitcoin Stash.

Quantum computers are becoming more and more powerful over the years.

This year in particular, Google developed a new Quantum computing chip called “Willow,” which is allegedly capable of solving problems that would take one of the best supercomputers about ten septillion years to solve—in less than five minutes.

Kevin Rose, a former senior product manager for Google, noted that Willow’s capabilities are impressive. However, compromising Bitcoin’s encryption would take much more than this.

Cracking Bitcoin’s encryption

Satoshi’s BTC stash currently uses a transaction format that is no longer being used because it could potentially expose the owner’s public key.

This transaction type is called P2PK and is still relatively safe from quantum threats.

However, this could become a problem in the future as advancements in quantum computing make it a more viable option for hackers.

Satoshi’s holdings might not be safe.

As Min Gün Sirer, the founder and CEO of Ava Labs, puts it, Satoshi’s haul could be the “mother of all cryptography bounties.”

Microsoft’s Board Voted “No” To Having a Bitcoin Reserve

Last week, at Microsoft’s annual meeting on 10 December, shareholders voted against adding Bitcoin to the company’s balance sheets.

The no vote on Bitcoin

The initial resolution was first proposed by the National Center for Public Policy Research (NCPPR).

It framed this proposal as an excellent way for the company to diversify profits and offer value to shareholders.

“Microsoft can’t afford to miss the next technology wave, and Bitcoin is that wave,” the NCPPR said, showing the possible benefits of owning Bitcoin.

It stated that adding Bitcoin to Microsoft’s balance sheet could “strip away risk” from shareholders and generate billions in value.

The association also proposed using between 1% and 5% of the firm’s profits to purchase Bitcoin, similar to Michael Saylor’s proposal that Microsoft could add almost $5 trillion to its market cap if it went all-in on Bitcoin.

However, Microsoft’s board remained unmoved. In an SEC filing, it noted that “this requested public assessment is unwarranted. “

Microsoft has “robust and suitable” procedures in place to manage its corporate treasury for the long term, the company said.

This means that the crypto market has missed out on hundreds of billions that would have flowed in if the board had voted yes.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.