Key Insights

- Analysts were initially optimistic about Ethereum ETF approval in May, but are now less confident.

- Lack of communication from the SEC regarding approval is one of the key factors fueling scepticism.

- Meanwhile, Ethereum’s price seems strong, even with the ETF FUD.

- Technical indicators suggest a possible Ethereum price increase to $5,000 very soon.

The Bitcoin ETFs were a massive success on launch in the US.

The IBIT alone has seen inflows of nearly $10 billion, with analysts predicting that the Bitcoin ETFs might beat the Gold ETFs in terms of AUM in the next two years.

Bitcoin has nearly doubled since the ETF approvals on 11 January 2024, and from here, the world has set its sights towards Ethereum ETFs.

“When will we see this kind of growth on ETH?” The world asks.

As it turns out, we might have to wait for slightly longer, as recent analyses suggest that confidence in a possible approval is waning.

Analysts’ Take on SEC Approval

In January, analysts and investors were optimistic about an Ethereum ETF approval, considering SEC had to decide by May.

However, we are now closer than ever to an ETF approval, and this initial optimism appears to be going down the drain as the days go by.

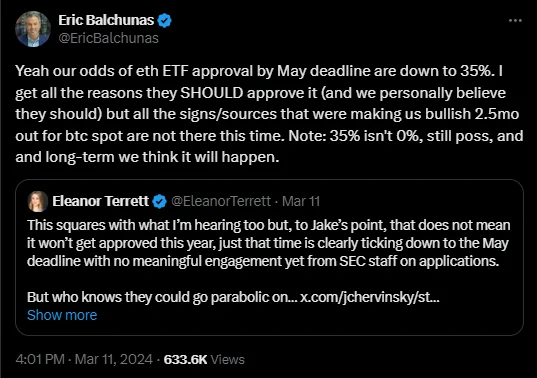

Very recently in a tweet, Bloomberg ETF analyst Eric Balchunas reduced his estimate of an ETH ETF approval from around 70% to a disappointing 35%.

Balchunas acknowledges that there are several reasons for the SEC to approve an ETH ETF, but that “all the signs/sources that were making us (him) bullish months ago, are not there this time”.

However, he also mentions that “35% isn’t 0%”, and that an approval could still happen in the long term.

Scepticism Among Ethereum Experts

James Seyffart, another Bloomberg ETF analyst has also weighed in on the conversation with a different tweet, stating his own pessimistic views of the matter.

According to Seyffart, there has been radio silence from the SEC as the deadline looms, meaning that there might be lower chances of approval.

Moreover, Jake Chervinsky, Chief Legal Officer at Variant Fund, stated something similar in yet another tweet.

Chervinsky says that the SEC is showing an obvious lack of effort towards approval and is seemingly ready to face whatever lawsuits investors and key players might be planning to level.

Market Reaction and Future Signals

Despite the scepticism, ETH has seen a 6% increase in value over the last week and is now trading comfortably above $4,000 for the first time since late 2021.

Ethereum’s market reaction

According to the charts, Ethereum is trading nicely above the $3,722 support and is now trading above the $4,000 zone and attempting to break above $4,093.

So far, the sluggishness with the ETFs had no bearing on the price of Ethereum, and we could be seeing some of the warning signs of an Ethereum rally to as high as $5,000.

Overall, as the deadline approaches, all eyes will be on the SEC for any indication of approval, which could have significant implications for the future of Ethereum and crypto ETFs in general.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.