Key Insights

- Celsius Network is selling 56.8 million MATIC tokens (worth $44.5 million) on Coinbase, potentially impacting MATIC’s price.

- Bankrupt firms FTX and Alameda Research are also offloading crypto assets, including MATIC, further pressuring the market.

- Despite the selling, MATIC’s chart shows potential for a rebound from $0.72, with a possible rally to $1.58 if this key level holds.

- Technically, MATIC looks promising, but fundamentally, the Celsius and FTX selloffs could create uncertainty.

- Investors should closely monitor the $0.72 price level for MATIC, as a breakdown could lead to further declines

Celsius, the bankrupt crypto lending company, has been in the news a lot lately, for selling massive tranches of crypto to pay off its disgruntled investors, creditors and customers

This time around, it seems that Celsius has brought this selling spree right to Pollygon/MATIC’s doorstep, according to recent insights from SpotOnChain.

Celsius has now transferred tens of millions worth of MATIC to Coinbase, in an obvious attempt to sell.

In this article, we will be going over MATIC—should you bet on MATIC this week, or should you bolt the door, wash your hands and keep away completely?

Let’s find out.

.

Celsius Network Unloads $45 Million of MATIC Tokens

Celsius Network, according to various sources, has been dumping its crypto holdings quite rapidly, at a set pace.

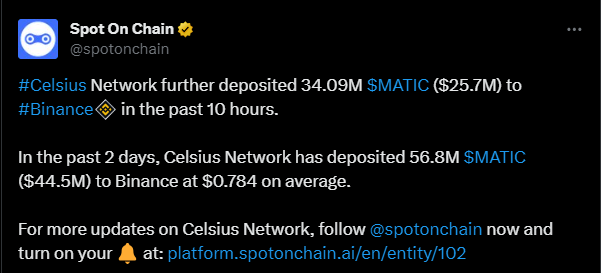

SpotOnChain was the latest to draw attention to this selling spree in a recent tweet, in which the blockchain analytics firm noted that Celsius Network had moved a staggering 56.8 million MATIC tokens (which are worth $44.5 million by the way), to different crypto exchanges in the last three days.

On Saturday alone, SpotOnChain noted that Celsius network transferred 34.09 million MATIC (valued at $25.7 million at the time of the tweet), to Binance.

Furthermore, SpotOnChain also mentions that these MATIC sales have come in at an average price of around $0.784 per token.

However, it gets worse, because Celsius Network hasn’t been the only bankrupt firm dumping.

FTX and Alameda Research Offload $15 Million of Crypto Assets

FTX and Alameda Research two of the most infamous bankrupt companies have also been in deep trouble since 2022.

Both of these companies also owe a lot of money to their creditors and have been liquidating their assets at a set pace since 2023 after receiving permission from a court.

In the past week, the firms have moved tens of millions of dollars in crypto, including Wrapped Bitcoin, Bitcoin and Ethereum, to Binance, Cinbase, FalconX and Wintemute, a crypto exchange based in Nigeria.

The last known major transfers from FTX as highlighted by SpotOnChain were two separate tranches of $11.72 million to Binance and Coinbase.

In total, FTX and Celsius are some of the biggest threats to any kind of rally in the crypto market from what we have seen.

Celsius still has about $1.28 billion in Ether and other assets left to stake, and this week, this sell-off has come for MATIC.

Let’s see what the charts say:

We Might See A Rally On MATIC Afterall

Fundamentally, the outlook on MATIC may be of “doom and gloomâ€.

Celsius selling such a large amount of the cryptocurrency is bound to create some uncertainty for the cryptocurrency’s price on a normal day.

However, the outlook on MATIC’s chart shows that it has a strong standing overall, as far as technical outlooks go.

For example, MATIC suffered a heavy decline from $1.09 in late December last year, when the bulls failed to start and sustain a full break and close above $1.

However, the decline brought MATIC into a retest of $0.72, a price level it has tested severally over the last few weeks, without bearish incident.

At the time of writing, MATIC is trading only a hair length above $0.72, around $0.8.

This signals a possible rebound from this price level and a possibly bullish rebound from here.

In essence, the verdict for MATIC is that investors should watch the $0.72 zone very closely, and see what happens around here.

If we do not see a breakdown of this price level, MATIC is poised for a powerful rally straight up to $1.58, despite the strong selling from Celsius and FTX.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.