Key Insights

- Privacy coin Monero is set to be delisted from Binance by February 20th, causing a 20%+ crash.

- This delisting was seen by industry observers as Binance bowing to government pressure against privacy coins.

- According to the charts, the price crashed but is showing signs of an incoming bullish correction, from the $100 strong support level.

- Monero could rally if breaks above $188, targeting $290-$520.

One of the biggest crypto exchanges in the world, Binance, has just announced that it will delist three cryptocurrencies, including Monero, one of the most popular privacy cryptos, by February 20, 2024.

As expected, the crash on Monero has been drastic over the last 24 hours.

The cryptocurrency saw a sharp sell-off in response to the move, and now trades at its lowest level by far, since Q3 of 2023.

According to industry observers, this will serve as a setback for not only Monero but Binance itself.

Monero Gets The Boot: Everything You Need To Know

As we mentioned earlier, Monero is one of the most popular privacy tokens.

For the unfamiliar, privacy tokens use advanced cryptography techniques to hide the identities of its users, as well as what they’re doing with their money.

In essence, transactions done in Monero are much, much harder to track than with Bitcoin or with Ether.

Recall that Binance is in the middle of one of the worst regulatory setbacks the crypto market has ever seen.

It turns out that Monero being a privacy token is also favoured by criminals who want to evade the law, and Binance has no need for that kind of attention.

Not now, at least.

According to Binance, the decision to remove Monero and the other tokens—Aragon, Multichain, and Vai is based on several reasons, like making sure that all their coin offerings “meet the highest level of standardâ€.

However, the crypto community seems to believe that Binance is making these moves under pressure from governments and authorities, who have been clamping down on privacy coins and other related crypto operations.

This comes on the heels of several regulatory beatings that Binance has been taking from several governments including the United States, the United Kingdom, Japan, Singapore, and Germany.

The Aftermath Of Monero’s Delisting

According to the announcement, Monero and the others will be booted off Binance on 20 February.

However, Monero’s delisting has been described by some industry commentators as a reflection of Binance’s problems and difficulties in the crypto space.

Binance so far, has been finding it hard to stay afloat in the face of growing competition, regulation, and scrutiny from both competitors and the authorities.

At the time of writing, Binance is still not out of the woods yet, when it comes to regulatory pressure in the US.

The exchange’s former CEO, Changpeng Zhao pleaded guilty to breaking anti-money laundering laws in August 2023 and is currently under house arrest in New York, while awaiting sentencing on 23 February 2024

Zhao also faces up to 18 months in prison, and the exchange itself has been banned from operating in places like Florida and Alaska, according to recent reports.

Overall, the delisting of Monero is likely to have a ripple effect on the crypto industry, as the regulatory landscape continues to target more and more cryptocurrencies and crypto-affiliated companies.

What Next For Monero?

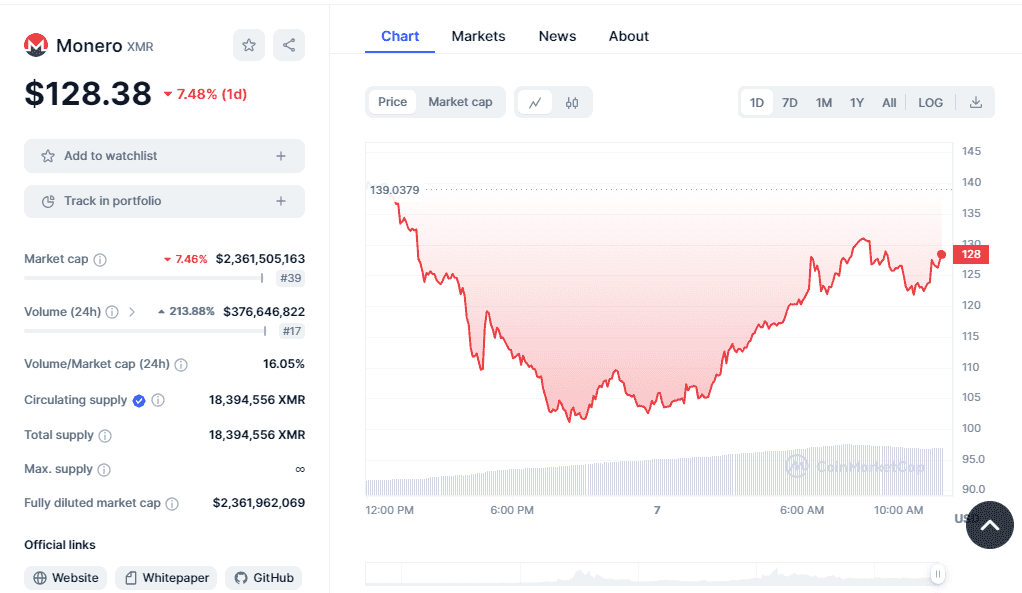

Monero crashed terribly over the last day and went down by more than 20%.

However, at the time of writing, the cryptocurrency appears to be in the middle of a bullish correction, and now trades at $128 and a 7.5% intra-day dip, after crashing to $100.

What is interesting about this though, is despite the crash in the cryptocurrency’s price over the last day, its trading volume has also increased by more than 200% over the last day.

This means that as much as $370 million has flowed through the cryptocurrency over the last day.

The chart above shows the Monero dip over the last day, to the $100 zone.

So what next for Monero?

One thing to keep in mind is that this $100 zone has been valid on Monero since September 2020.

This means that $100 is a very valid support, and a powerful Monero rally could happen anywhere from here.

We can already see a strong rejection from the bulls around $100, meaning that Monero only has to break above range high around $188 as shown below, to confirm bullish dominance.

If we see this breakout, Monero will be free to target anywhere between $290, $338 and $520.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.