Key Insights:

- Major reason for NFT market crash is lack of implementation.

- High gas fee, lack of utility, and IP rights killed the will of NFT creators.

- Regulations might actually help NFT markets.

- Loss making NFTs should be either collateralized or sold.

The NFT markets have stayed down for a long time. The last peak in sales in the NFT markets were around 2021. Now, despite a revival in the crypto markets, NFT markets have failed to recover their lost volumes.

We have analyzed several data points to present you why NFT markets are down, what do they need and how they might see a revival in 2024 with some collections already witnessing good sales.

State of the NFT Markets in 2024

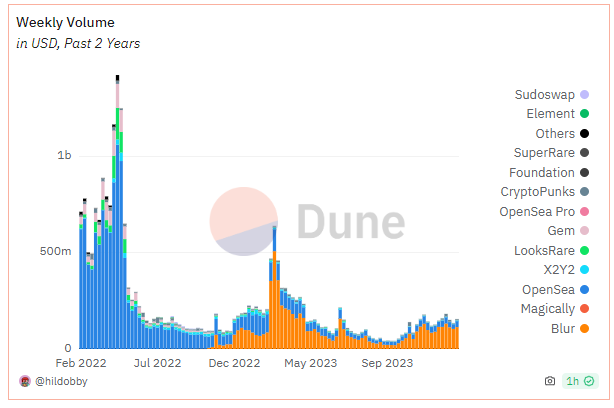

NFT sales volumes these days are not even at on-tenth of what they used to be in their heydays(early 2022). A look at the 2-year weekly NFT sales data from Dune Analytics, shows that by late April 2022 when the crypto winter had not even started, NFT weekly sales were at $1.4 billion with Opensea being the major seller in the market. However, by mid February 2024, these volumes plummeted to $155 million per week.

The fall in the sales were approximately 90%. Though there was a spike around mid February 2023, yet this wave failed to sustain and sales again plummeted to the bare bottom. The lowest sales were recorded in October 2023 when weekly sales fell down to barely $42 million.

Though the NFT sales have tripled since then, its still at a mere 11% of its past glory.

Why NFT Volumes have Not Fully Recovered?

There are several factors to blame for the fall in prices. We have two assumptions on why NFT sales failed to sustain.

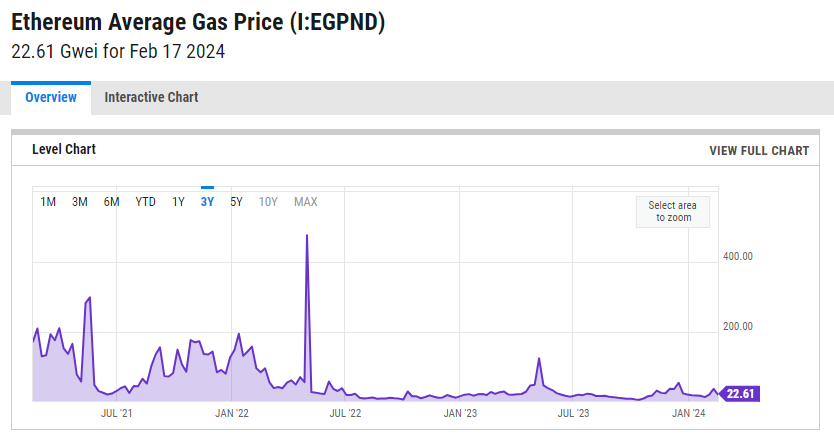

First, NFTs were over-dependent on Ethereum for minting, transfers and sales. A spike in Ethereum gas prices would definitely spook NFT buyers. On a surface level, gas fees seem to be easy to blame. However, data reveals something surprising.

A look at the past 3 year gas fee chart for Ethereum shows that during the peak NFT sales season, gas fee too peaked. This is contrary to the assumption that high gas fees scare NFT buyers.

Further, when NFT markets were in their full glory, the gas fees too were very high. Now, even when gas prices have reduced and are lower than their levels in 2021-2022, the NFT volumes have still not revived.

This brings us to our second assumption. Lack of utility.

The reasons for a race to buy NFTs were mostly fueled by two assumptions, one, NFTs would rise in prices, and the second, they are cool to own.

Being driven by just demand and no utility, an NFT once bought would just sit in the wallet of the buyer.

This lack of utility and its price driven just by scarcity, the prices of NFTs were to collapse soon. This price collapse was also driven by a lot of NFT creators who wanted to make quick money. Too many NFT collections led to a situation where prices ultimately collapsed due to over supply.

What was driving the prices earlier, has now led to its crash.

Why Utility NFTs have Failed to Thrive?

Utility NFTs had barely any utility. Those projects which had some utility died a cash-starved death in the crypto winter.

Let us take a look at one such utility NFT called Gods Unchained which is essentially an NFT-based game. Now, the problem why such projects failed was because these games were very rudimentary.

At a point in history where there were popular games like GTA, PUBG and Fortnite, these games were basically 2D card based games.

Further, they did not make much sense as these 2D games were more costlier than the most premium traditional games mentioned earlier.

What is Needed for Propping-up NFT Markets?

New Use Cases

There are several use cases where NFTs could be more utility oriented. A few examples are:

- Asset tokenization, where a physical asset such as house or car is tokenized for easy sales and instant authentication of ownership.

- Soulbound tokens. Here tokens are permanently attached to blockchain wallets so that their owners can be easily identified. These tokens are used primarily to get blockchain based degrees and certificates.

- Music, Literature and other IP rights.

- Memorabilia NFT where NFT owners get a chance to meet their favorite persons. Trump NFTs are one such example.

- NFT-based tickets for concerts.

- NFT collectibles as autographs

Though some of these use cases have been lying around for a while, yet there appears to be no mass adoption of these use cases by any major brand or business. Those who did, had an unfortunate bankruptcy due to lack of funding in the crypto winter.

NFT-backed DeFi Activity

Though the use of NFTs for defi had been for a while, yet only a few projects have implemented it. These projects just let you earn extra money from your NFTs.

Usually, users pledge their NFTs to get some ETH or Stablecoins. These stablecoins are then deposited into high yield protocols, liquidity pools or defi loans. However, one catch is that users need to find a protocol where the yield is higher than their loan interest rates. A project using these protocol is NFTfi.

Another implementation of NFT loans was seen in a concept of buying NFT in multiple payments like a car loan or a house loan. This feature called Buy Now, Pay Later widens the ability of retail buyers to buy even pricier NFTs. This is also beneficiary for those who are planning to invest but do not have the funds ready for an upfront payment.

Why NFTs Desperately Need Regulations?

NFT markets are in a desperate need for regulations because too many copyright violations can discourage the original creators.

All of us know how many monkey-based NFTs have been launched copying the original Bored Ape Yacht Club. Several of these copy cat NFTs are the main contributors to NFT scams.

In 2023, Hollywood art creators posed a serious question as to how AI challenged the entire market. AI generated images are more vivid and often more attractive than human generated images. However, there rises a question on who should be the legal Intellectual Property owner of such images or NFTs.

Also a single AI-based creator could easily create 1000 variations of a slightly modified popular NFT which would essentially kill the original collection’s value.

All of these reasons desperately demand for regulations.

Surprisingly even the most comprehensive regulations like MiCA in Europe clearly shows that they have no intention to regulate NFTs as of now.

Yes, NFT Markets will Revive

We are confident that NFT markets will ultimately revive. This is because we are witnessing several steps towards solving all the issues.

- Ethereum has been implementing its Dencun upgrade to curb gas fees.

- L2 Solutions like Shibarium and Polygon have their own NFT collections. They also support cross-chain transfers of Ethereum NFTs.

- Regulations and IP protection laws are stepping in, albeit in a slow fashion.

- NFT volumes have picked pace in the last 3-4 months. Weekly sales volumes have nearly tripled since October 2023.

- New utility NFTs are getting launched such as Soulbound Tokens, NFT-based degrees, etc.

Finally, a proof of slow but strong revival, we would like you to take a look at Donald Trump NFT sales.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.