Key Insights:

- P2P Markets Surviving Amid All Threats

- Ban by the Indian Central Bank – RBI

- 30% Flat Tax on Income via Crypto or NFTs

- 1% TDS

- Barred From Using UPI Transactions

- Indian P2P Markets Survived Because of Simplicity

- Quick Resolution of Charges Against Offshore Exchanges Helped

- Newer Ways of Buying Crypto in India

- The Indian P2P markets have survived despite several external threats.

- Reasons for the popularity of P2P in India include its simplicity of use.

- Centralized Exchanges in the country are still hesitant to allow crypto deposits and transfers.

- Low level of customer support on CEXs.

Amid several attempts to curtail crypto trading, the Peer-to-Peer (P2P) market has not only survived but thrived. P2P markets in India benefit from several advantages that are not available to their global counterparts.

We have done a little investigation into the reasons why Indian P2P markets have thrived despite numerous external and internal threats. Most of such popular markets exist on offshore exchanges like Binance.

By the end of the article, we will also show you some new ways of buying crypto in the country and how they are indirectly supporting P2P.

P2P Markets Surviving Amid All Threats

The Indian P2P markets have grown as a result of high taxation in the Indian crypto markets. Further, the lack of proper services by several Indian exchanges aids in their prosperity.

Ban by the Indian Central Bank – RBI

The P2P markets were not well known in the country during the previous bull markets of 2017 or 2020. The reason why they got popular was because of the ban on Indian crypto exchanges by the Reserve Bank of India in 2018.

It wasn’t until 2020 that the Indian Supreme Court intervened to quash the RBI Circular.

30% Flat Tax on Income via Crypto or NFTs

The next threat came in April 2022 from the Indian Finance Ministry which imposed a flat 30% tax on income generated via cryptocurrencies. What was scarier was that to calculate the taxes for this income, the taxpayer could not write off their losses against profits.

This means the taxes have to be paid on total profits irrespective of whatever losses the taxpayer makes.

1% TDS

The third and the most severe blow to crypto markets came in July 2022 when a 1% TDS was imposed on all crypto transactions that involved the Indian Rupee (₹).

This means that when you buy cryptocurrency or an NFT, you must pay an additional 1% tax as TDS and similarly when you sell a crypto or NFT, you must deduct a 1% TDS. All exchanges were mandated to deduct taxes both ways to ensure compliance.

Barred From Using UPI Transactions

There was also a ban on Indian exchanges from using UPI, the most popular payment method in India. However, it was suspended after a brief ban in 2022.

Bharat Web3 Association, an advocacy group of Indian crypto companies, was supposedly instrumental in lifting the ban.

However, this was never a challenge for P2P markets as most of the buyers and sellers transacted with UPI between themselves.

Indian P2P Markets Survived Because of Simplicity

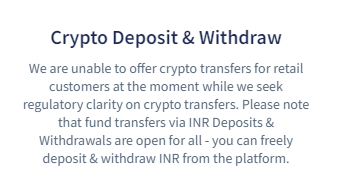

The reason is more external than internal. The secret to the survival of Indian P2P markets lies in the fact that due to the earlier ban on Indian Centralized Exchanges, they resorted to over-compliance. Even when the law allows them to offer a service, they are scared of getting banned again.

Understand this with an example. Most crypto exchanges in India are free to accept crypto deposits and withdrawals. Yet, several of them do not allow the deposit of crypto or withdrawal citing the lack of regulatory clarity.

Further, a large number of professionals who are involved in the global crypto economy are Indian. Most of the time, they are paid in stablecoins like the USDT or USDC. With several crypto exchanges now allowing crypto deposits and withdrawals, these professionals resort to P2P to get cash.

Another reason why Indian P2P markets are thriving is the problem of over-compliance. No doubt onboarding and KYC are faster in the case of Indian centralized exchanges, yet, often time customer support is virtually non-existent. Customers often have to wait for hours and days to get their issues sorted.

P2P markets are simple and charge lesser fees for buying and selling. Further, they are simple to use and with the addition of escrow mechanisms, have become safer than before.

This is the reason why many Indian exchanges also have a P2P desk.

Quick Resolution of Charges Against Offshore Exchanges Helped

Binance has been in trouble in several countries lately, the latest of which is Nigeria.

In India, Binance was asked to comply with money laundering rules and placed under a temporary ban due to the alleged lack of compliance. Its URL, along with several others, was made inaccessible to Indians. By then, the company had one of the strongest P2P markets in India.

Binance immediately jumped into action and a few days later its URL was accessible. Lately, other exchange URLs have also been accessible, such as KuCoin and OKX.

If these URLs were still blocked, a large number of P2P users would have been forced to choose centralized exchanges.

Newer Ways of Buying Crypto in India

The emergence of a few new crypto-buying methods helped in controlling the prices of crypto in the Indian P2P markets. Without these, a lack of cryptocurrencies would have resulted in sky-high crypto prices like what Russia faced after global sanctions.

Transak

Transak is a global crypto-asset provider that allows users directly to buy from their MetaMask wallets. Armed with both UPI and IMPS, which are the two most popular modes of payment in India, it delivers crypto directly to the wallet of users, saving them time and transaction costs.

OnRamp.money

OnRamp.money is a crypto on-ramp service that lets users buy and sell crypto with a fast KYC verification method. Despite using the same methods of compliance like CEXs, OnRamp.money’s KYC is a lot faster and from personal experience, it was a lot smoother than CEX KYCs.

The service provides users with the option to buy crypto with both IMPS and UPI.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.