Key Insights

- A massive network crash hit the Solana network for 5 hours due to high transaction volume and divergent nodes this week.

- Validators identified the issue, patched software, and used snapshots to restore the Solana network.

- $SOL dropped 4% but bounced back to $95.5 with the network online.

- The 50-day EMA and $100 mark are acting as strong supports, helping the bulls keep SOL afloat.

- Solana has the potential for further consolidation before a rally, and a break below the $79 January low would signify bearish control.

Solana got hit with one of the most massive setbacks on Tuesday this week when the entire network crashed for as long as five hours.

As expected, the price of SOL dipped following the incident.

However, $SOL appears to have bounced back along with the network, and we are going to be covering what really happened.

The Solana Network Crash

The Solana Foundation recently tweeted that the pending transactions on the SOLnetwork spiked, overloading the network and causing a crash when the network hit a TPS of 400,000 transactions.

Because of this overload and the network’s capacity being hit, some of the nodes in the network started to fork themselves, producing divergent blocks in the chain and disrupting operations.

This contrasts with the network’s Proof of History consensus mechanism, which requires that every node agrees on the same ledger state, causing the massive crash on Tuesday.

The Fix And The Aftermath

The network’s validators, along with the SOL team, quickly found the source of the issue and started to work on a fix.

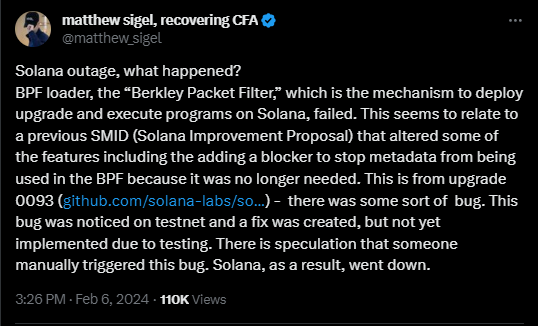

The head of Digital Assets Research at VanEck Matthew Sigel suggested on X that the issues might have been coming from problems with the Berkley Packet Filter mechanism.

To address the problem and stop it from happening again, the SOL core engineers published a patch, along with a new version of the validator software.

The validators also had to create snapshots of their local ledger state—the most current and accurate data available before the outage—and use those snapshots to restart the network.

Around 15:00 UTC on Tuesday, the validators had already updated their software and synced their snapshots, bringing the network back to life once again.

The Solana Foundation apologized for any problems the outage may have caused and appreciated the community and validators for their assistance and cooperation. Additionally, the foundation also guaranteed that the security and integrity of the network remained unaffected and that no money was in danger.

Solana Crashes, And Then Bounces Back

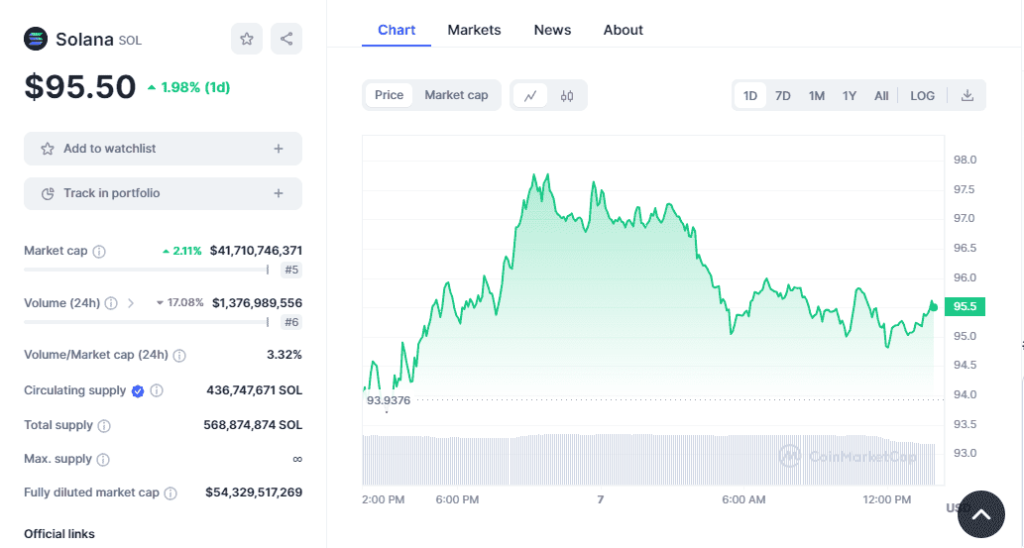

According to data from CoinMarketCap and TradingView, SOL declined by as much as 4% on Tuesday this week, straying further from the $100 mark.

However, with the network back to normal, Solana’s price has turned bullish once again and now trades at around $95.5 as shown above.

In the charts, we can see that SOL is being held up by its 50-day EMA, and is consolidating under the $100 mark.

This presents a pretty solid line of resistance for the bulls, against the bears.

Solana’s 50-day moving average sits at around $91.5, and if this moving average is ever going to be tested without breaking the ascending trendline shown above, SOL will likely consolidate for a few more days.

This consolidation will give the bulls enough time to gather their strength, and for the 50-day EMA to hit the ascending trendlne shown above.

Solana remains bullish at the end of the day, and will only confirm bearish control if we see a break below the 23 January low of $79.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.