Key Insights

- The performance of stablecoins is a potent metric for determining the health of the crypto market.

- USDT’s dominance hitting a double-top at 8.5% could be a sign of a crypto market recovery.

- The stablecoin market cap has been declining for 18 months, which is another indication of an imminent crypto market recovery.

- Stablecoin trading volumes have also declined, which could mean that Bitcoin may see a price rally before September ends.

- Binance’s decision to discontinue its stablecoin, BUSD, due to regulatory pressures is a sign of trouble in the stablecoin market.

One of the most potent metrics in determining the health of the crypto market is the performance of stablecoins.

It’s quite simple.

When investors pull their money out of crypto, the prices drop. The reverse occurs when they put their money back in.

However, where do these investors put their money after taking it out of crypto (and crashing prices in the process)?

The answer is… Stablecoins.

By measuring the performance of stablecoins from here, we can gauge how healthy the crypto market is, and vice versa. As it happens, there may now be glaring signs that the crypto market is on the verge of recovery.

USDT Dominance Hits Double Top

USDT is by far the largest stablecoin, with an $83 billion market cap (more than thrice that of USDC).

According to TradingView, USDT’s dominance has now hit a double-top at the 8.5% level.

The last rejection from the 8.5% zone on USDT’s dominance chart coincides with Bitcoin’s bounce off the $24,742 support, and its break above the $27,000 zone once again.

This is one of the first signs of a crypto market recovery and may signal Bitcoin’s recovery back above $30,000.

Stablecoin MarketCap Has Been Declining For 18 Months

According to the FCA-authorized benchmark administrator and a world leader in digital asset statistics, CCData, USDT isn’t the only stablecoin that has been suffering.

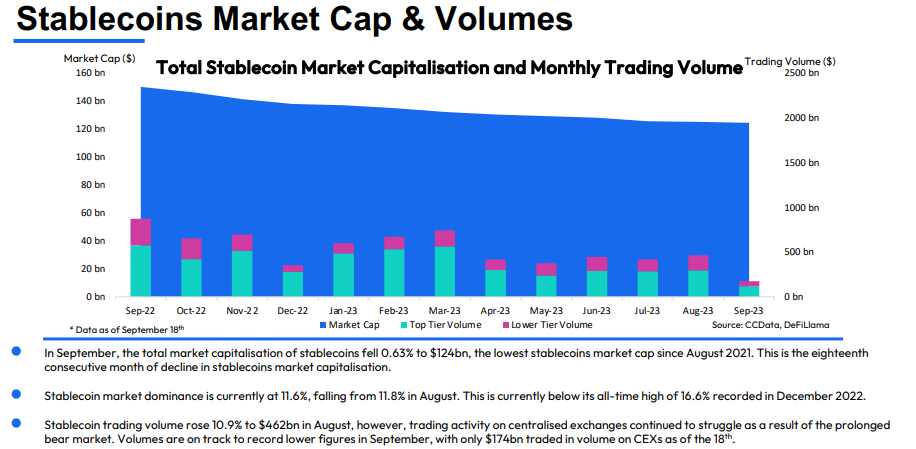

According to CCData’s September 2023 edition of its “Stablecoins & CBDCs Report”, for 18 months and counting, the entire stablecoin market has been in decline.

According to CCData, the overall market cap of stablecoins as of September 18, 2023, was $124 billion, which is the lowest level it has been at since August 2021.

CCData also says that although stablecoin trading volume increased by 10.9% in August to $462 billion, activity on controlled exchanges (CEXs) has lagged, with just $174 billion transacted as of September 18, 2023.

This decline in stablecoin dominance points towards an imminent crypto market recovery, leading to another reason why Bitcoin may be revisiting $30,000 soon.

Stablecoin Trading Volumes Also Decline

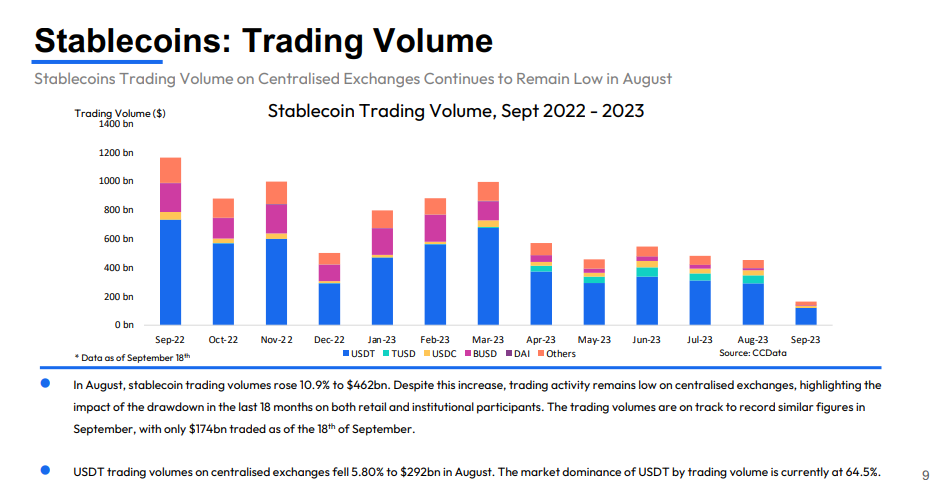

According to CCData, the general stablecoin trading volume has also declined after increasing by 10.9% to $462 billion in August.

In particular, CCData reports that while stablecoin trading volumes climbed by 10.9% to $462 billion in August, just $174 billion had been exchanged as of September 18, 2023.

This indicates a potential decline for September and could mean that Bitcoin may see a price rally before September ends.

Binance Plans To Discontinue Its Own Stablecoin

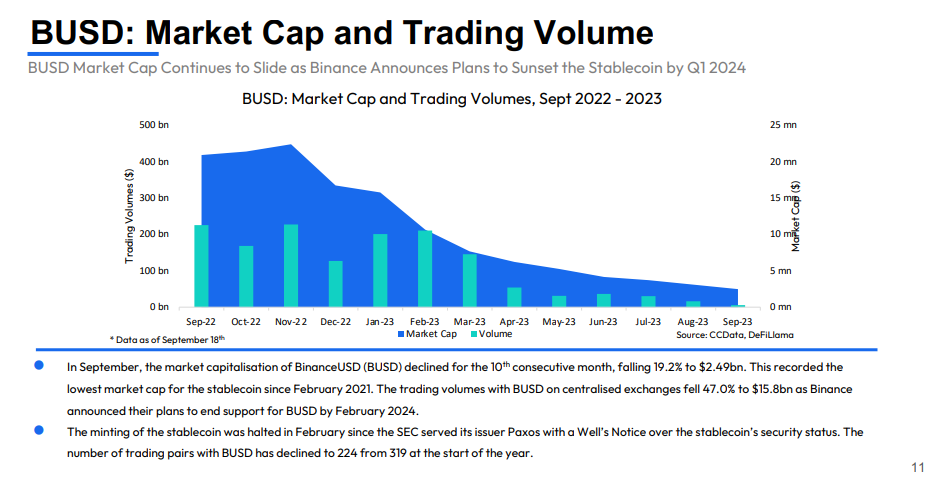

According to a recent blog post, Binance has announced plans to discontinue several BUSD-related spot trading pairs.

As per the announcement, Binance now urges its customers to convert their BUSD holdings to other stablecoins by February 2024 due to regulatory pressures on BUSD’s issuer, Paxos.

Prior to this, however, BUSD’s market cap had been declining for ten months in a row, falling 19.1% to $2.49 billion in September.

And since the start of the year, Binance’s BUSD trading pairs have decreased as well, from 319 to 224.

In Summary

The market health of stablecoins and that of the rest of the crypto market have always had a negative correlation.

The protracted decline in the stablecoin market brings some degree of promise to Bitcoin’s price action and indicates that we may indeed be seeing a price rally on Bitcoin soon, as the cryptocurrency tries to get back above $27,000.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.