Key Insights

- Uniswap just announced plans to distribute fees to active users, and the price of UNI has reacted positively.

- The new proposal aims to address centralization concerns and is an improvement to a proposal that was rejected in mid-2023

- In the near term, UNIÂ has surged to 70%, reaching its highest point since February 2022.

- The RSI on the weekly chart suggests that UNI is overbought and that the $13 resistance might hold.

- UNI might consolidate around the $7.5 – $13 range, before any kind of breakout.

$UNI, the native cryptocurrency of Uniswap, has been on a tear as of late.

This cryptocurrency has soared by nearly 100% and is one of the best-performing cryptocurrencies on CoinMarketCap by far.

In particular, the cryptocurrency now trades at a two-year high, following a recent update on a governance proposal for its users.

Will we be seeing a Uniswap decline from here, or is this the start of a larger rally?

The Proposal That Sparked The Rally

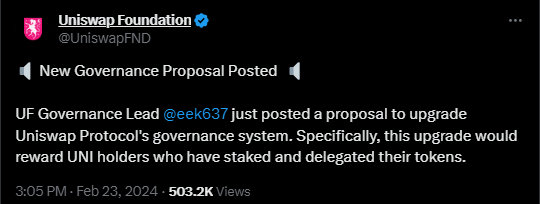

Uniswap’s stellar performance on all timeframes came right after a proposal was submitted by the Uniswap Foundation.

According to the details of this proposal, the Uniswap Foundation will start to distribute protocol fees to holders of UNI who have actively participated in the activities of the network, by staking and delegating their UNI.

At present, Uniswap collects around 0.15% in transaction fees from every trade or swap on the platform.

These fees were usually sent into the Uniswap treasury which could only be accessed by governance votes.

However, the proposal is set to change this, by allowing the users of Uniswap themselves to claim a share of this money.

In essence, users now have a reason to continue using Uniswap and gain rewards for doing so, according to how much they stake and delegate.

All of this activity is set to increase the price of $UNI, which in turn increases engagement on the platform, and so on.

So Why Is This Important?

According to the Uniswap foundation, this new proposal was put in place to improve the governance structure of Uniswap, which to be fair, has been criticized repeatedly, for being centralized.

This new proposal is set to ease the tension among some UNI holders who have expressed dissatisfaction with earlier attempts to reward them with fees collected from the DEX.

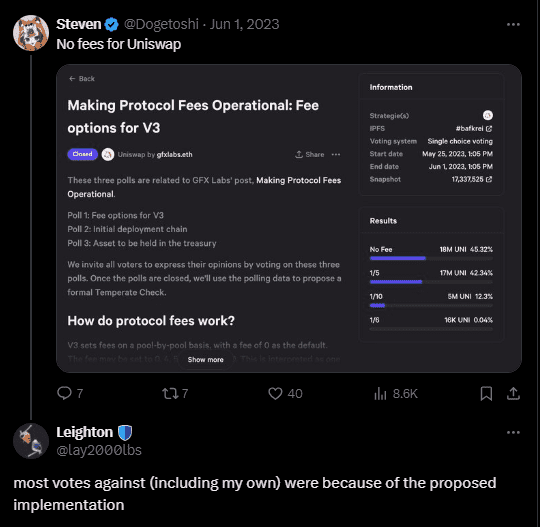

Sometime last June, a similar proposal was sent out, to activate fees across several liquidity pools and reward holders of UNI with some of this money.

However, this proposal was eventually rejected for being too “complicatedâ€, and for being “unfairâ€

This new proposal, however, is set to simplify this fee reward mechanism for UNI and Uniswap, making the cryptocurrency/exchange more attractive to investors and users to stake, swap and delegate their tokens.

Uniswap Token Reacts

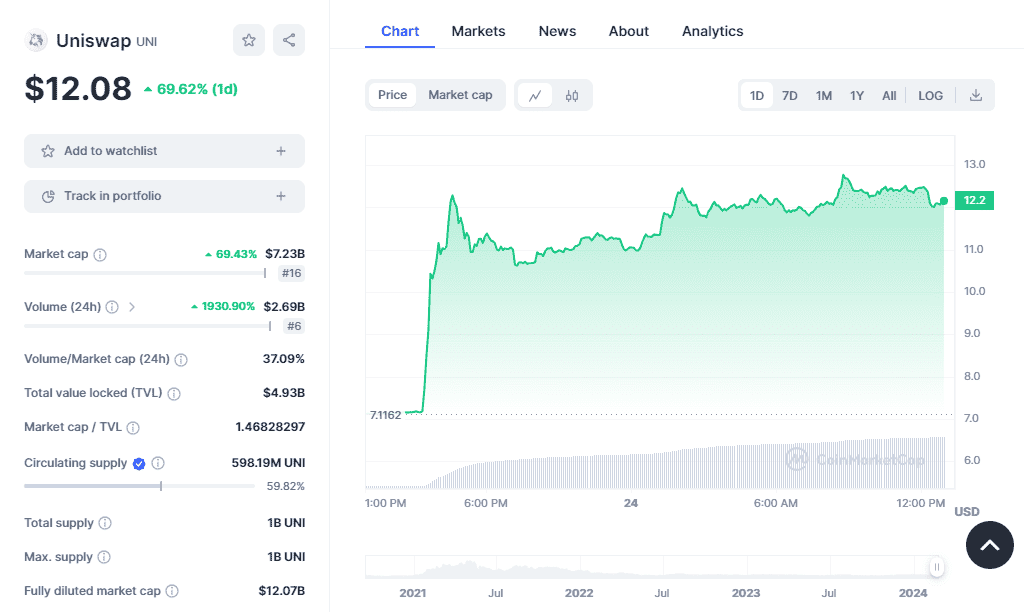

According to data from CoinMarketCap, Uniswap is up by nearly 70% in the last 24 hours alone.

The cryptocurrency’s trading volumes have also skyrocketed by nearly 2000%, to around $2.7 billion worth of $UNI transactions processed in the last 24 hours alone.

According to the weekly charts, Uniswap was trading within a descending wedge underneath the major $13.28 resistance as shown:

The cryptocurrency broke out of this formation in November 2023, during the general market rally at the end of the year.

After a consolidation move, Uniswap’s current price action appears to be a rebound move and has been successful so far.

However, there might be a problem.

The $13 zone has been valid for most of Uniswap’s run in the charts and has remained unbroken since the cryptocurrency broke below in January 2022.

Uniswap doesn’t appear to have many good chances at a break above this price level, considering how the RSI on the weekly chart shows that it is overbought.

We are likely to see a consolidation between the $13 zone and $7.5 zone, as the bulls gather the strength to finally break above $13 for the first time in two years.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.