Key Insights

- Bitcoin’s price dropped by +10% in a week, wiping billions off the board.

- Telegram-affiliated TON just launched palm-scanning tech to compete with Worldcoin and Humanity Protocol’s digital identity solutions.

- An Aave fork on Blast Network accidentally liquidated user positions, causing a $26 million wipeout.

- A recent report suggests that American Gen Z and Millennials are more likely to invest in crypto than stocks, compared to Gen X and Boomers.

- The US government is the world’s largest Bitcoin holder, according to a recent report from Arkham

The usual happened over the last week, with the crypto market.

- Key Insights

- Bitcoin Has Declined By Around 17% So Far, Wiping Out Billions Off The Board

- TON Is Entering The Human Identity Arena With New Palm-Scanning Tech, Set To Compete With Worldcoin

- An Aave Fork On Blast Network Accidentally Liquidated User Positions Worth Over $26 Million

- Gen Z And Millennials Are Choosing Crypto Over Stocks, Report From Policygenius Shows

- US Is One Of The Top Bitcoin Holders In The World, Followed By Germany And The UK

Aside from the market-wide devastation with Bitcoin’s ~20% dip so far, we had the usual stories of hacks, liquidity wipeouts and major trend shifts happen over the last week.

And in this article, we will be going over some of the biggest stories across the market from the last seven days, to keep you entertained and on track with the latest happenings in the crypto market.

Let’s jump right in.

Bitcoin Has Declined By Around 17% So Far, Wiping Out Billions Off The Board

It has been a serious bloodbath in the crypto market over the last week, considering how close we are to the Bitcoin halving (which will happen between next Friday and Saturday).

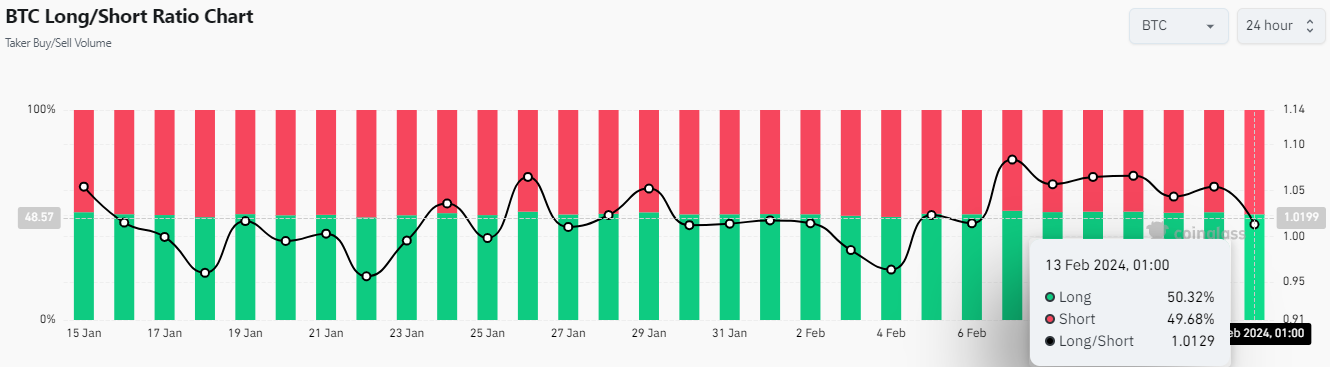

Over the last week, billions of dollars have been wiped off the board, during Bitcoin’s drop from around $72,000 to $60,660 according to data from CoinGlass.

Coinglass liquidation data

On 12 and 13 April, we had $784 million and $771 million wiped off the entire board respectively, with $126 million and $261 million coming from Bitcoin respectively, on these two days.

Interestingly, the latest happenings are directly in line with a prediction made by former BitMEX CEO, Arthur Hayes early last week, in a blog post he titled “heatwave”.

Hayes argued that investors should close all of their “risky positions” in light of the Federal Reserve’s Quantitative Tightening, and re-enter the market in May.

TON Is Entering The Human Identity Arena With New Palm-Scanning Tech, Set To Compete With Worldcoin

Worldcoin used to be the only player in the human digital identity arena.

However, earlier in the year, the Humanity Protocol and Polygon partnered to introduce a less invasive alternative to Worldcoin’s iris scanning, with Palm scanning technology.

As it happens, only last week, another major player has entered the fray.

The launch of TON’s new project

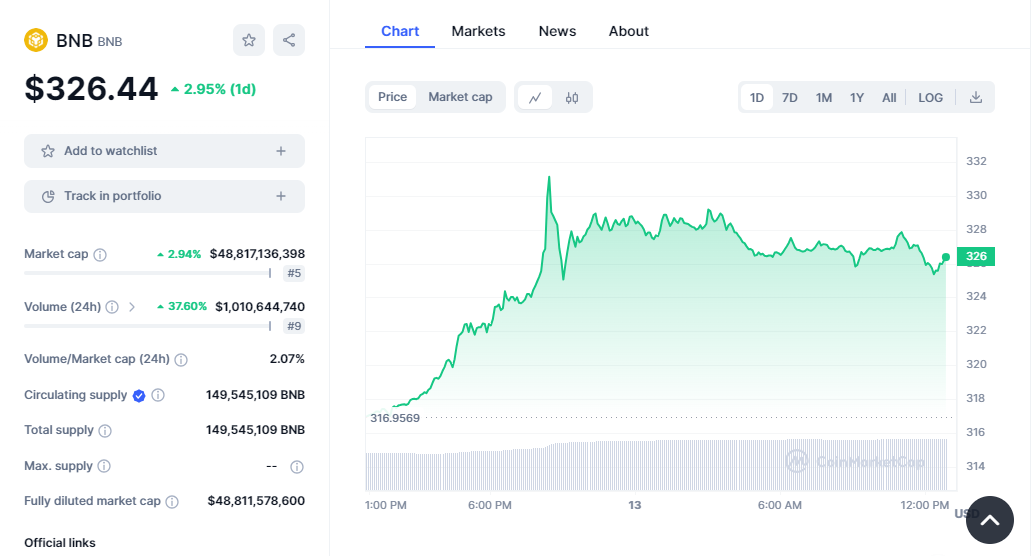

On 8 April 2024, at the Hong Kong Web3 Festival, Telegram’s TON, in collaboration with HumanCode announced a $5 million program to launch a palm recognition technology, similar to Worldcoin’s and the Humanity Protocol’s.

This and several other factors caused a massive price increase on TON, causing the cryptocurrency to rally to $7.7, before declining along with the rest of the market.

An Aave Fork On Blast Network Accidentally Liquidated User Positions Worth Over $26 Million

The Defi ecosystem was hit by a massive shock during the week when $26 million went down the drain within an AAVE fork on the Blast network.

On 11 April, Pac Finance, a version of Aave on Coinbase’s Blast, tried to modify its loan-to-value (LTV) parameters.

However, instead of doing this successfully the Aave fork accidentally lowered its liquidation threshold.

Liquidation spree on Aave

This costly mistake immediately wiped upwards of $24 million off the slate, with one user losing a staggering $24 million of the total, according to Will Sheehan, Founder of Parsec.

Pac Finance confirmed the error and promised that the affected users have been contacted, and will be compensated.

Thank you for letting us know Will. We are aware of the issue and are in contact with the impacted users, actively developing a plan with them to mitigate the issue.

In our effort to adjust the LTV, we tasked a smart contract engineer to make the necessary changes. However, it…

— Pac Finance (@pac_finance) April 11, 2024

Gen Z And Millennials Are Choosing Crypto Over Stocks, Report From Policygenius Shows

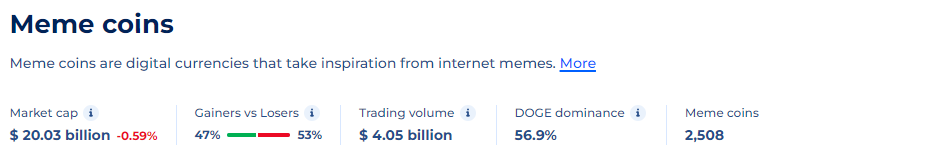

According to a recent report from Policygenius, one in five American adults own and have used crypto at least once.

This is a huge step in the long road towards global crypto adoption, and Satoshi Nakamoto’s dream may finally be coming true.

Per the report, Young Americans (Gen Z and Millennials in particular), are more likely than older generations to own crypto than equities/stocks.

Results of the Policygenius survey

This indicates a significant shift in the choice of financial assets and investing strategy.

The survey was conducted on 4,063 adult respondents in the United States, between October 16 and October 19 last year, and showed that these young adults are more likely than older ones, to invest in alternative assets like crypto and NFTs.

The report also showed that around 18% of Gen Z respondents own stocks, compared to around 28% of Gen X adults, and a massive 45% of Baby Boomer

US Is One Of The Top Bitcoin Holders In The World, Followed By Germany And The UK

According to recent findings from Arkham Intelligence, the U.S. government has come out as the largest Bitcoin holder among countries all over the world, with approximately $14.7 billion worth of BTC.

Governmental crypto whales

The U.S. government presently has 212,847 BTC in its treasury accounts, according to Arkham data. This puts the country directly on par with the likes of MicroStrategy, which has 214,246 BTC, currently valued at $14.8 billion.

Moreover, aside from Bitcoin, the US holds massive amounts of other crypto assets, like Ethereum, and stablecoins like USDC and Tether (USDT), which are worth around $200 million.

Right after the US, we have the United Kingdom, with around $4.2 billion in Bitcoin assets, and then the German government with almost $3.4 billion.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.