The Bitcoin Fear and Greed Index

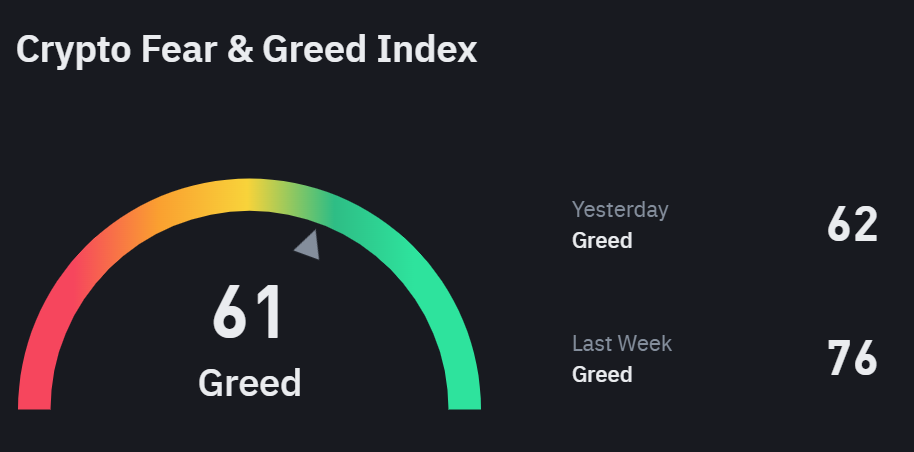

The Bitcoin Fear and Greed Index shows the prevalent bearish (fear) or bullish(greed) sentiments in Bitcoin. It is a score ranging from 0 to 100, with the lower levels indicating fear and higher levels indicating greed for Bitcoin’s price.

Data from various sources, such as BTC’s price volatility, momentum, social media sentiments, surveys, BTC’s dominance, and price trends, are collected and composed into a single score of 0 to 100.

How to Read the Index?

A score closer to zero shows extreme fear towards Bitcoin, while a score near 100 shows extreme greed. All scores between 0 and 100 show the degree of bearishness or bullishness in the markets.

The index has been divided into five continuous ranges that indicate the degree of bearishness or bullishness.

- A score below 25 indicates extreme fear, and it represents a situation where Bitcoin is extremely bearish, for example, after a 25% intraday crash.

- A score between 25 and 45 shows moderate fear or simply fear and indicates that the dominant trend in Bitcoin is bearish.

- A score between 45 and 55 could be said to be neutral, and this indicates shifting trends in Bitcoin.

- A score between 55 and 75 shows greed, which means that the general trend in Bitcoin is bullish.

- A score between 75 and 100 shows extreme greed and indicates extremely bullish sentiments in Bitcoin.

These sentiments do not mean that all the cryptocurrencies will be bearish or bullish. They mean that the general trend in Bitcoin is bearish or bullish. However, since Bitcoin dominates more than 50% of the crypto markets by market cap, a bearish or bullish phase in Bitcoin generally influences the direction of the overall markets.

Factors Influencing the Index Score

Volatility

Volatility refers to the price fluctuation in Bitcoin with respect to USD. This influences the market sentiments because higher volatility often results in panic behavior in traders and investors who find it difficult to make money in those markets.

Volume and Momentum

Higher volume often signals greater participation in the crypto markets, while lower volumes show skepticism. Further, with spikes in volumes, the markets expect a larger shift in price.

Social Media Sentiments

Social media sentiments are primarily processed through an AI-based NLP algorithm that processes them and builds signals based on posts and comments.

Bitcoin Dominance

Bitcoin’s dominance plays a major role in shaping the index as greater dominance of Bitcoin shows a greater affinity towards it and lower focus on altcoins.

Trends

Trends contribute a decent share in the index calculation and are primarily used to gauge market participation and the state of bullishness or bearishness.

Bitcoin Fear and Greed Index vs Crypto Fear and Greed Index

Though the two might look the same and are often used interchangeably, both indexes are very different.

- Bitcoin Fear and Greed Index only takes into account the price, behavior, and sentiment towards Bitcoin. It has nothing to do with other cryptocurrencies.

- Crypto Fear and Greed Index, on the other hand, takes into account the sentiments in the wider markets, including Bitcoin.

The reason why both of them often show the same scores is that Bitcoin dominates 50% of the crypto markets and hence influences the price trend in other cryptos.

Frequently Asked Questions

1. Is the price of Bitcoin influenced by anything other than greed and fear?

Yes, the price of Bitcoin mainly depends on the demand and supply of it. Greater demand creates a supply shock and increases the price, whereas lower demand causes excess supply, resulting in a price crash. Other factors that influence Bitcoin’s price are ETF markets, corporate buying, whale activity, and retail sentiments.

2. How meaningful and trustworthy is “the fear & greed index” (trading, websites, statistics, bitcoin)?

The Bitcoin Fear and Greed Index is trustworthy but should not be used as a sole tool to trade Bitcoin. This is because user sentiments drive these tools and we have seen many times that the price is influenced by a lot of other factors: whale activity, ETF markets, and demand and supply dynamics. Even when the sentiment is fear, the price may move up by 10%-12%, like on 10 Jan 2024. Hence, such indexes should only be a component of your trading setup.

3. For those who sell Bitcoin based on the Fear and Greed index, what sell or exit strategy do you follow?

When there is a change in sentiment, I typically change my trades accordingly. For example, if my trade is bullish and the index drops to neutral or drops 10 points intraday, I exit the trade. Similarly, if my trade is bearish and the sentiment changes to neutral or the index score moves up by 10, I exit the trade.