Fundamental Analysis

Fundamental analysis in crypto is related to finding out the true intrinsic value of the project. This involves understanding and carefully studying various internal and external factors to evaluate, whether a project is overvalued or undervalued.

Factors that are considered while computing fundamental analysis fall down towards the macroeconomic situation of the country, the cash flows for the company, the profit scenarios, and development opportunities in the industry.

The most widely used metrics in the fundamental analysis are project metrics, financial metrics, and on-chain metrics:

-

Project Metrics

This involves various metrics such as the background of the project being evaluated for gauging the experience and the maturity of the team to pull off a successful crypto project.

Moreover, whitepaper and tokenomics are studied to Understand the overview of the project, including technical details like use cases, supply & demand, and token distribution information. It never hurts to consider outside opinion or third-party reviews or any reference to the information.

Not forgetting the utility of the tokens or the crux of existence for a crypto project is really important in evaluating a project’s intrinsic pulp in addition to the information and knowledge about the relevant competitors in this space.

-

Financial Metrics

Such type of metrics provides a quantitative backing for the fundamental research. Julie involves studying and evaluating the market capitalization, liquidity, and volume for a particular cryptocurrency project on a centralized exchange As both of the above-mentioned metrics are very important in understanding how easy it is to buy a cryptocurrency and how big it is in terms of monetary value.

Even circulating supply for the project, scripted tokens are used to measure the inflationary aspects of a project.

-

On-Chain Metrics

This set of metrics involves understanding and studying the on-chain signals or components that provide great insight into the internal status of a blockchain network.

For example, just measuring hash power, active addresses, and transactional value in fees says a lot about a blockchain network like the demand of the network.,the average Fees required to transfer monetary sums or find out the stability of a blockchain network.

Technical Analysis

Technical analysis is generally another type of disciplinary analysis where the use of statistics is required to understand and gauge the price chart, volumes, and other trend data.

In other words, technical analysis is the study of price and volume.

The root model of the technical analysis is based on the understanding that the past movements in security paired with the current changes can contribute a lot to understanding the future position of such securities in the market.

Technical analysis is very dynamic and can be used on stocks, bonds, futures, forex, crypto, and currency pairs.

Technical analysis occasionally uses a mix or singularly implication of price charts, volume charts, trend indicators, momentum oscillators, moving averages, trend patterns, chart patterns, and support and resistance levels.

Sentiment Analysis

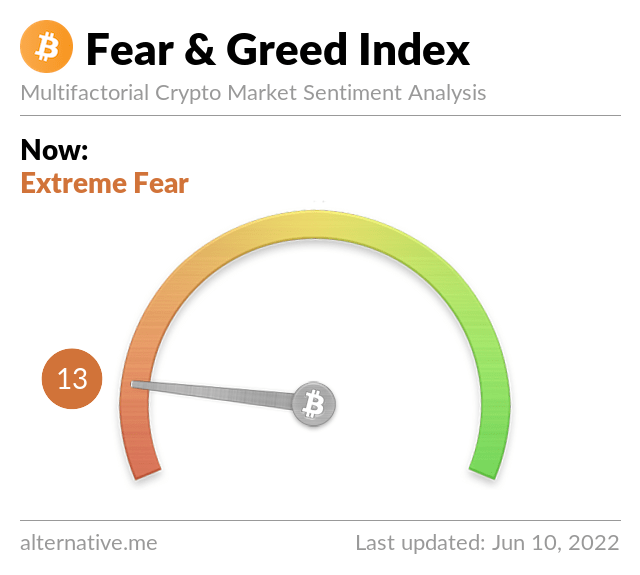

Using a sentimental analysis in crypto markets is a general illustration of market participants’ expressions and opinions about an asset. It produces a graph visual presentation illustrating and conveying the crowd psychology of trading and the development of a crypto project as reflected through social and trading metrics.

Funding rates, fear and greed index, whale monitoring, and Google Trend analysis are a few of the common examples of sentimental analysis in crypto.