Key Insights

- The crypto market remains slightly bearish over the last day, with Bitcoin and Ethereum struggling to gain ground.

- Over $200 million in liquidations swept through the market, with bears holding a slight edge over the bulls

- Bitcoin needs to hold above $67,000 to avoid dragging the market further down.

- A break below $3,500 for Ethereum could lead to a retest of $3,200 or lower.

- BONK and PEPE might be positioned for rebounds if they break key resistance levels.

The crypto market hasn’t done much over the last 24 hours, by way of recovery.

We have a 1% decline in the total market cap, suggesting that the market is still in the middle of a slightly bearish consolidation.

Bitcoin is still underneath the $68,000 zone and currently trades at around $67,300. Ethereum on the other hand, is barely above the $3,500 zone.

In sum, here is what the crypto heatmap looks like:

The crypto market’s heatmap

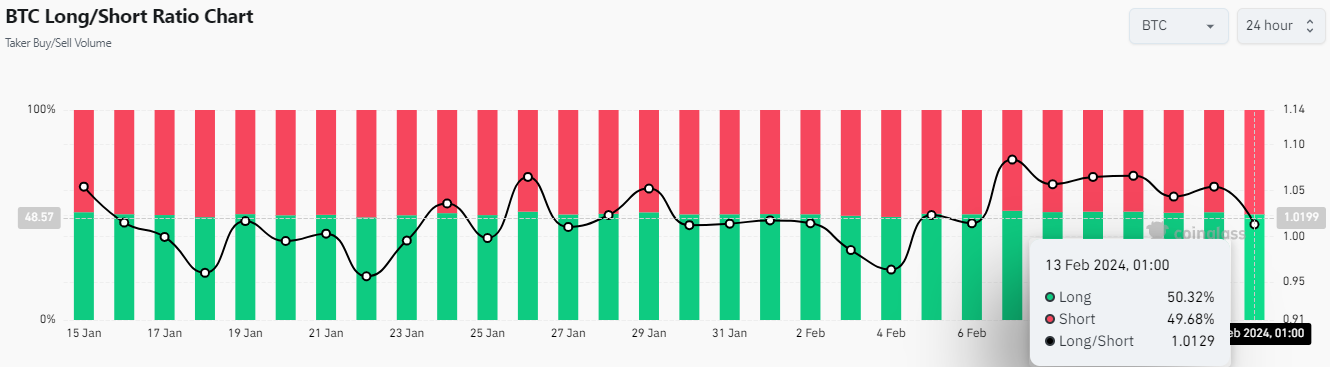

The liquidation figures have shot up over the last day, with more than $200 million taken from the leveraged traders overall.

The crypto market’s liquidation heatmap

As shown in the snapshot above, we have around $206 million worth of liquidations, with around $164 million taken from the bulls, and $41.9 million taken from the bears.

Today, in sum, we can conclude that the bears have a slightly stronger hold over the market and that the market is still in a consolidation phase at the time of writing.

Will We See a Recovery for Bitcoin?

Bitcoin started to crash yesterday, even breaking under the ascending trendline shown below, and ending up at an intra-day low of $66,051.

Bitcoin’s price performance

Judging by the long lower wick of the candlestick shown above, the bulls swung into action and pushed the cryptocurrency into a recovery, before the bears could pull it any lower.

At the time of writing, Bitcoin is attempting to consolidate and solidify its footing above the $57,000 zone.

If we see another break below $57,000, the aftereffects might be devastating, dragging the flagship cryptocurrency closer to the $60,000 zone.

What Next for Ethereum?

As shown by the Ethereum chart, the cryptocurrency lost its grounding above the $3,800 zone on Tuesday and entered a freefall.

Ethereum looks to be stable at the time of writing, just like Bitcoin.

Ethereum’s price performance

However, while Bitcoin has some semblance of the bulls’ attempt to save it from falling further, Ethereum’s candlestick for 11 June has a relatively smaller wick, leading to a shaky outlook for the cryptocurrency.

If this consolidation around $3,500 turns out to be a bullish reversal, we might see Ethereum attempt to retake the $3,800 zone.

However, if the bears succeed at another break and close below $3,500, Ethereum might be retesting the $3,200 zone or lower.

Will We See a BONK Rebound?

As shown by the chart below, BONK appears to have found stability on top of the ascending trendline and could be in for a rebound move from current price levels.

A possible BONK recovery

The memecoin trades at around $0.00002870 at the time of writing, and already seems to be in the middle of this rebound move.

The price level to look out for from here would be the $0.00002950 zone.

If we see a break and close above this price level, BONK will be poised to finalize its recovery, and will likely surge upwards by another 55% or so, past the $0.00004450 high from late May.

Same Story on PEPE?

On the subject of memecoin recoveries, PEPE seems to be doing pretty well for itself.

PEPE’s price recovery

As shown in the charts, the memecoin seems to have found support around the $0.000111 zone and is using this price level as a base for a recovery move to the upside.

The trigger to look out for would be a break above the $0.00001522. If we see a decisive break and close above this price level, we just might be seeing a new PEPE all-time high this week, or before long.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.