- Lido DAO is nearing 10 million ETH staked on its platform, showcasing impressive growth despite concerns about the Shapella upgrade.

- Lido currently holds about 72% of the liquid-staked ETH market, highlighting its dominance in the Ethereum staking space.

- The protocol’s TVL has doubled since February 2023, indicating strong community adoption and interest in Lido.

- Lido remains among the top ETHÂ staking withdrawers post-Shapella, suggesting that users trust the protocol.

- $LDO’s price currently faces headwinds but shows potential for a bullish reversal based on technical analysis.

Lido, a staking service, should have gone down after the introduction of the Shapella upgrade on the Ethereum network, which allowed staked Ether to be withdrawn from the network for the first time.

However, nearly a year after this upgrade, Lido is still going strong and has already achieved a massive milestone.

The staking protocol has now come remarkably close to reaching 10 million ETH staked on its platform. This achievement comes amid a growing demand for liquid staking solutions in the Ethereum ecosystem.

Lido DAO’s Impressive Growth

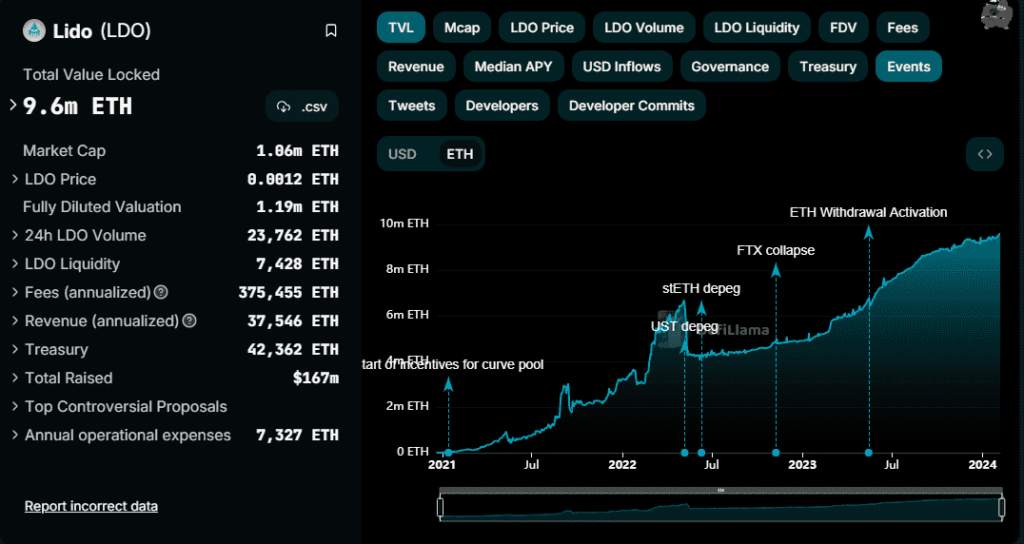

According to data from DefiLlama, as of this week, Lido DAO had 9.61 million ETH (which is worth $21.76 billion) staked on its platform.

To comprehend how huge this figure is, this is about 72% of the 13.10 million ETH, or $30.12 billion, in liquid ETH staked on the market.

Considering how this protocol had a lot less than 100,000 ETH staked in December 2022, the current 9.61 million ETH is a major step up.

DefiLlama data also shows that the ETH staked in the Lido protocol has spiked from around 5 million ETH in February 2023 to where it currently sits.

This shows that between February 2023 and now, the project’s TVL has almost doubled, indicating that the Ethereum community is strongly adopting it and is interested in it.

The fact that Lido DAO has reached this milestone despite the Shapella upgrade from November 2023 makes its growth even more remarkable.

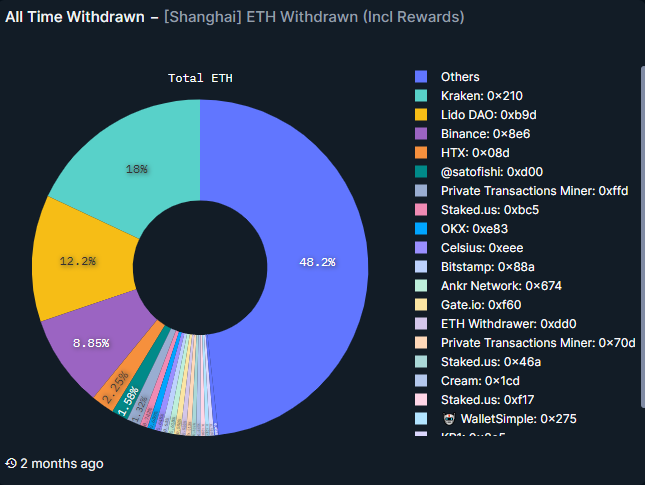

So far, alongside Coinbase and Kraken, Nansen ranks Lido DAO as one of the top three companies that have removed ETH from the beacon chain since the Shapella update.

This indicates that Lido DAO is drawing in new users while still keeping its current user base, which is a testament to the security and dependability of the protocol.

What About $LDO Though?

Let’s not forget about $LDO, the native cryptocurrency of the Lido DAO.

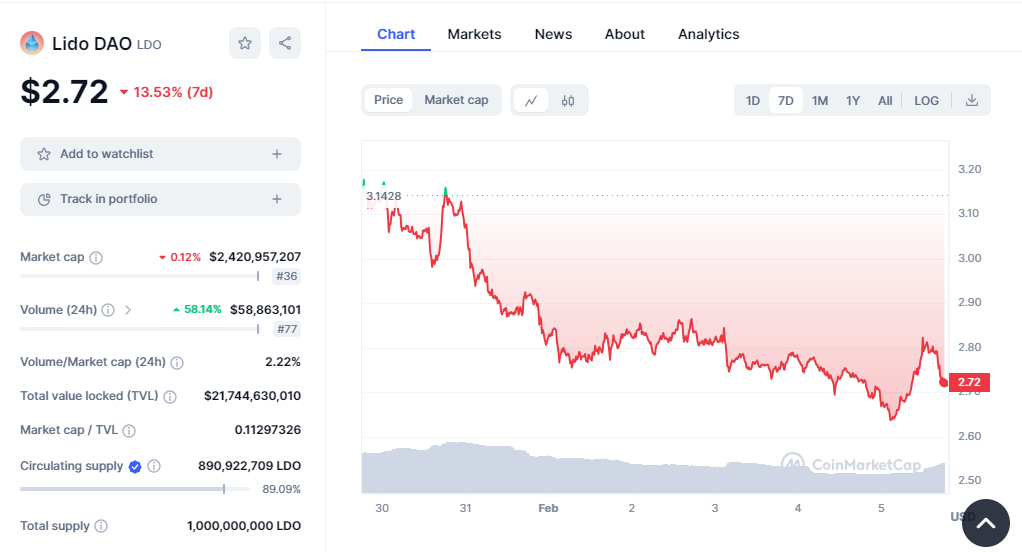

According to CoinMarketCap, $LDO currently trades at around $2.72 and is down by about 13% over the last week.

This shows that despite the success of Lido, $LDO is still trading under some very bearish waves.

However, according to the weekly charts, a recovery may be incoming.

The chart above shows that LDO is trading on top of an ascending trendline, indicating that its bulls are in control.

The chart above also shows that LDO recently faced rejection from the $4 zone, and fell to around $2.7, which had been keeping its price down since mid-2023.

As shown above, LDO is already showing signs of a possible rebound from this price level, indicating that we might see a rebound to $4 very soon on the cryptocurrency.

Conversely, if we end up with a break below $2.7, LDO will likely crash straight down to retest the ascending trendline shown above, at around $1.6 or thereabout.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.