Binance

- BNB

(BNB) - Price $617.93

- Market Cap

$84.21 B

BNB is similar to Ethereum in that it operates on a dual-chain structure, which includes the BNB Beacon Chain and the BNB Smart Chain (BSC).

The Beacon Chain is mainly for governance and staking operations, and uses a system based on Tendermint Byzantine Fault Tolerance.

This helps achieve fast transaction finality. The Smart Chain, which is often called BSC, runs parallel to the Beacon Chain and is the layer that offers smart contract functionality.

BSC is designed to be compatible with the Ethereum Virtual Machine (EVM). This makes it easier for developers to build or migrate their Dapps from one to the other.

Binance Technical Info

| Metric | Detail |

| Token Name | Binance Coin |

| Symbol | BNB |

| Initial Standard | ERC-20 (on Ethereum) |

| Current Standard | BEP-2 (on BNB Beacon Chain), BEP-20 (on BNB Smart Chain) |

| Consensus Mechanism | Proof of Staked Authority (PoSA) for BNB Smart Chain, Tendermint BFT for BNB Beacon Chain |

| Max Supply | 200,000,000 BNB (initial amount) |

| Target Final Supply | 100,000,000 BNB (due to burning) |

| Circulating Supply | Approximately 139 Million BNB (varies due to burning) |

| Launch Date | July 2017 |

Binance News

Overview of Binance

BNB, or Binance Coin, is the native cryptocurrency for the entire BNB Chain. It was initially created in 2017, was as a utility token for the Binance exchange. Initially, it was an ERC-20 token built on the Ethereum blockchain.

Later, the coin migrated to its own chain (the Binance Chain), before becoming the main asset of the BNB Chain.

The token serves multiple functions. For example, on the Binance exchange, holders receive discounts on trading fees when they use BNB to pay for them.

The percentage of the discount decreases over time, which means that it is a deflationary cryptocurrency.

Who founded Binance Coin?

Changpeng Zhao, commonly known as CZ, was the founder of BNB and Binance.

He is one of the most popular crypto entrepreneurs and is the co-founder and former CEO of the exchange.

BNB was first launched in July 2017 via an ICO for the Binance platform. The token’s history is therefore tied to the Binance exchange.

Unique features of Binance

BNB is special for many reasons, and one of these is its dual-chain architecture.

The BNB Beacon Chain and the BNB Smart Chain (BSC) run parallel to each other and are designed to communicate effectively.

The Beacon Chain handles the staking and governance functions, while the Smart Chain focuses on executing smart contracts that power Dapps.

This separation of functions makes the Binance chain great at allowing for high transaction throughput and quick transaction finality.

Another interesting aspect is the BNB Chain’s Proof of Staked Authority (PoSA). PoSA blends elements from Proof of Stake (PoS) and Proof of Authority (PoA).

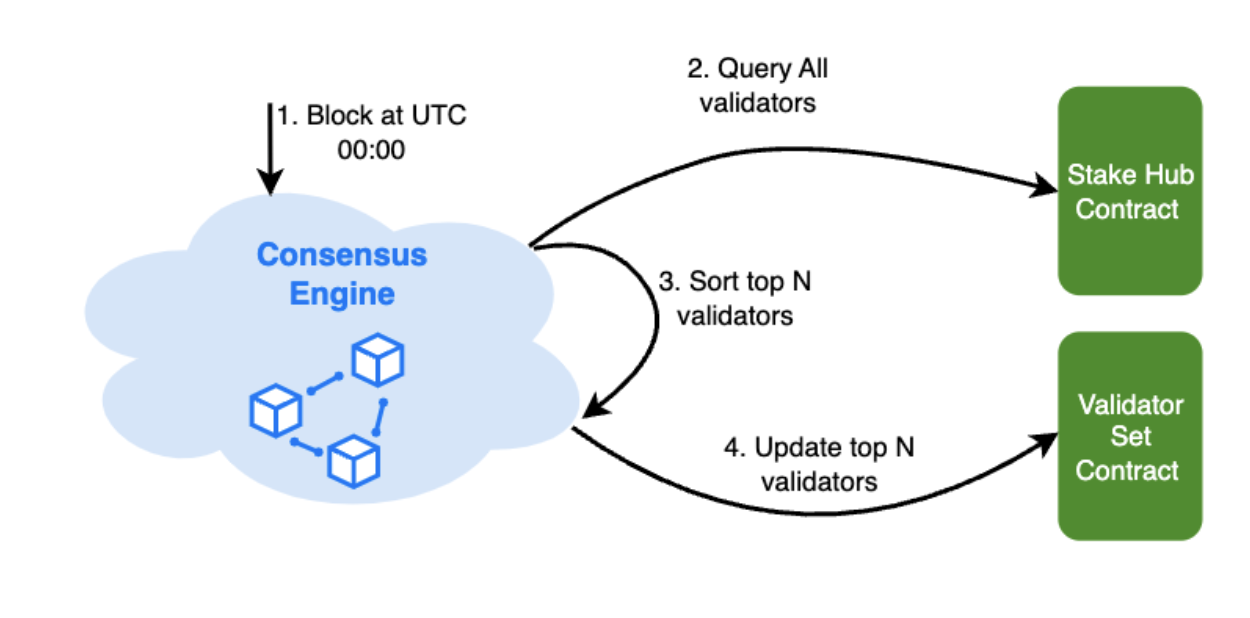

A limited set of validators secures the network. These validators are elected daily by BNB stakers, and candidates must stake a minimum amount of BNB to be eligible.

The limited number of validators allows the network to process transactions very quickly and with low fees. In other words, the Binance chain favours speed and efficiency over decentralisation.

How Binance works

BNB itself is used for several important functions. Mostly, it acts as a means to pay for transaction fees, or gas, across the entire BNB Chain network.

When users send tokens, interact with smart contracts or execute trades on DEXs built on the network, they must pay a small fee in BNB.

The Biannce’s chain’s PoSA means that validators are responsible for confirming and adding new transaction blocks to the chain.

These validators are selected based on the amount of BNB they have staked and their reputation. The validator set is intentionally small and helps the chain’s high speeds.

Validators then earn transaction fees as a reward for their work in securing the network.

Management of Binance

Governance happens on-chain and uses the BNB token. Token holders, including validators, can vote on network upgrades and changes to the protocol via staking.

The security of the BNB Smart Chain is also managed by the elected validator set.

These 21 validators are responsible for confirming transactions and maintaining the network’s integrity.

Changes to the protocol, known as BNB Evolution Proposals (BEPs), are also regularly put forward and voted on by the community.

For example, the recent BEP-95 proposal introduced the real-time burning of gas fees, which was a major change to the token’s economic model.

Security measures for the Binance network

The BNB network relies on its consensus mechanism for security. Proof of Staked Authority is a combination of two approaches: Proof of Stake (PoS) and Proof of Authority (PoA).

PoS requires validators to hold and stake BNB, while the PoA aspect involves a rotating elected validators who publicly stake their reputation.

Slashing also works as a punishment mechanism. If a validator attempts to validate inaccurate transactions, double-sign blocks or shows instability, a portion of their staked BNB can be permanently taken away.

This mechanism makes an attack on the network very expensive for a hacker.

Binance Technology upgrades

The Binance chain has been focused on the token’s economic model from the start.

One of the most important upgrades was the BEP-95, which implemented a real-time burning mechanism for gas fees.

This made the deflationary process continuous and automatic with every block produced.

Future upgrades are underway, with each designed to improve the network’s decentralisation and reliability.

Where to buy Binance (BNB)

BNB is one of the most available digital assets to buy in the crypto market. The token is the native asset of the Binance exchange. Binance also happens to be the largest platform globally.

Many other major centralized cryptocurrency exchanges also list BNB for trading against other cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Crypto wallets for Binance

Users need a compatible crypto wallet to hold, manage and interact with the BNB Chain.

For centralised holding, users can keep their BNB directly on the Binance exchange. This is convenient for trading, but also means that the exchange holds the funds’ private keys.

Users can also choose options like Trust Wallet or Metamask for decentralised holdings. And for an extra kick of security, wallets like Ledger or Trezor are great bets.

Resources for Binance

Anyone can find information and even technical documentation on resources like

- BNB Chain official website

- Biannce Academy

- BSCScan

FAQs

Yes, BNB likely has a future. However, it is important to note that its “future” is tied to the success of Binance as a platform. If Binance goes under, BNB will likely follow.

No one can accurately predict the price of any digital asset, including BNB. However, analyst expectations go between $5,000 and $10,000 before the next bull run.

The BNB Smart Chain is secured by the Proof of Staked Authority (PoSA) consensus model.

Investors must also consider storing BNB in a secure, self-custodial wallet.

The decision depends entirely on the user’s priorities and use case. Ethereum (ETH) is the native asset of the Ethereum blockchain and is the leading smart contract platform.

However, users sometimes shy away because of its high transaction fees and network congestion.

BNB, on the other hand, is less established, but has great growth potential, fast transaction speeds and very low fees.