Key Insights

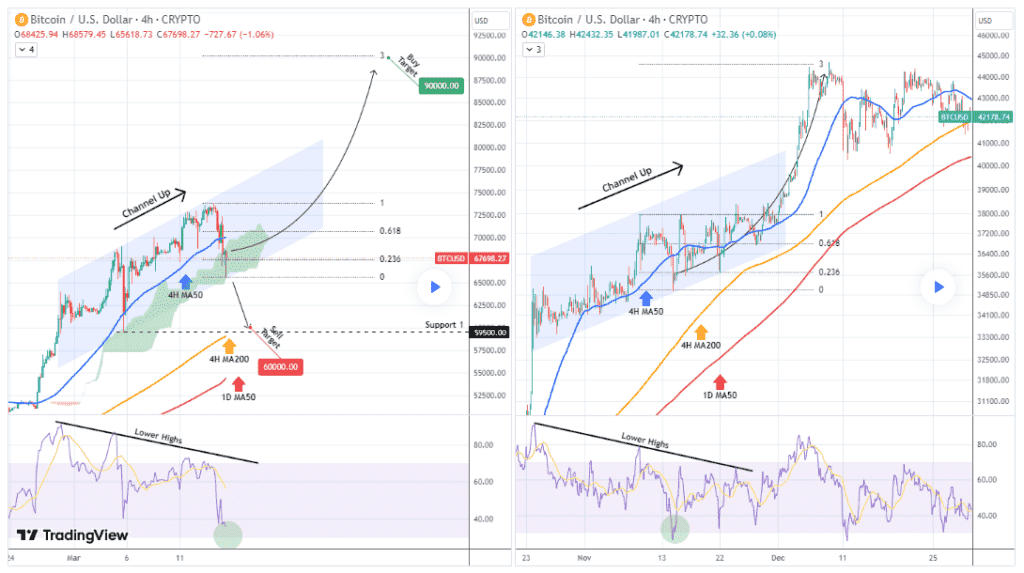

- TradingShot in a recent post, pointed to Bitcoin bouncing off the Ichimoku Cloud and forming a higher low, suggesting an upward trend.

- If the uptrend continues, a breakout towards the 3.0 Fibonacci extension level could see Bitcoin hit $90,000 before the end of March

- The current market pattern resembles December 2023’s price action, which started Bitcoin’s eventual rally to $73,000.

- However, the threat of a drop to as low as $50,000 remains very real.

BTC made the news, in the previous week, after soaring to a new all-time high of around $73,000.

The cryptocurrency has once again declined under the $70,000 zone, amid calls for a sell-off.

However, several analysts still believe in the cryptocurrency’s ability to make one more higher high, before the halving hits.

One of these analysts is TradingShot, and here’s why he believes we might be headed for $90,000 by the end of March.

A Sudden Bitcoin Retracement

The cryptocurrency world was stunned when Bitcoin quickly reversed course and fell to about $65,000, right after breaching $73,000.

Since then, there have been arguments about a historical “pre-halving correction”—a historical phenomenon in the BTC market—where Bitcoin declines by around 40% before halvings

In the middle of all of this confusion, renowned crypto trader Trading Shot just provided insights based on technical indicators, about what to expect from the market.

According to the analyst in a new 15 March post on TradingView, Bitcoin is expected to reach yet another record high before the end of March.

The expert highlighted Bitcoin’s decline below $65,000, stating that it just crossed below the four-hour MA50. This decline pushed Bitcoin into the green Ichimoku Cloud as shown below.

Bitcoin’s Ichimoku Cloud

For the unaware, the Ichimoku Cloud is a powerful indicator, which can be used to predict future price movements and pinpoint important levels of support and resistance.

The expert pointed out that, despite the recent decline, Bitcoin has reached its second higher bottom inside the pattern, suggesting that the positive trend may continue.

Bitcoin’s Possible $90,000 Rally

The expert stressed that the positive trend is expected to continue as long as Bitcoin’s candles close inside the channel-up pattern.

If this happens, we might see a massive breakout towards the 3.0 Fibonacci extension level, which is set at an incredible $90,000.

The trading expert expressed optimism, saying, “As long as the 1D MA50 (red trend-line) holds, we can look forward to a bullish reversal and higher accumulation towards yet another ATH near the end of the month or at worst first week of April.”

Additionally, the expert identified similarities between the current pattern and the December 2023 market.

It turns out that price action, moving averages and even the relative strength index (RSI) sequences are similar, adding to the bullish outlook.

A Word of Warning

The expert did, however, also give a warning.

He says that if Bitcoin breaks below the channel-up pattern, we might see a decline that would take Bitcoin to test the $60,000 mark (around the four-hour MA200).

Overall, in the following days, investors are advised to keep a close eye on certain price levels.

At the time of writing, the $64,750–$66,700 area is considered a significant support zone.

And if we see a break below, we just might revisit the $60,760 and $62,790 levels.

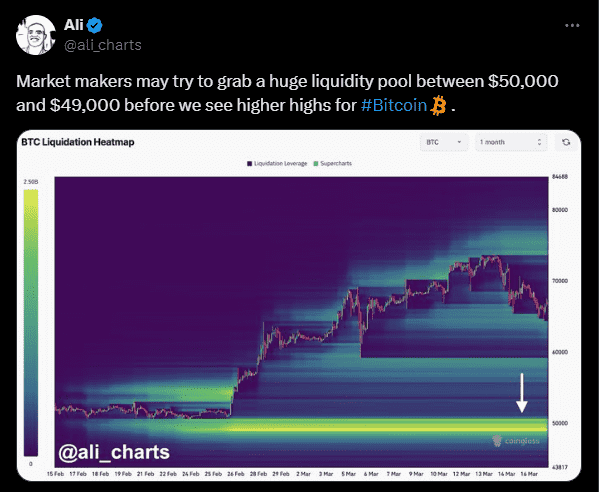

A fresh new liquidity well

All of this is without mentioning a recent tweet from Ali, showing that there might be a fresh $30 billion liquidity pool around $50,000, that the whales may be planning on exploiting.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.