Key Insights

- PEPE, the #4 memecoin, has gained 20% in the last week and could rally further to $0.00001431 if it breaks a key resistance level.

- ORDI is up 11% in 24 hours and shows signs of a parabolic rally to $107 based on technical indicators.

- Flare is up over 12% this week and could surge by 70% to 115% if it breaks $0.056.

- Fetch.AI is consolidating after a breakout and could rally between 23% to 60% based on the Fibonacci retracement tool.

- Uniswap is recovering from a recent price drop to $10 and could climb back to $20 if it breaks $13.12.

2024 has been a fantastic year for Bitcoin.

It reached a new all-time high price of $73,679 on March 13, and in the time since, it has been hovering around the $70,000 mark, hoping for a bounce and potential new all-time high before the halving hits in less than three weeks.

As expected, the altcoins are waking up on Bitcoin’s heels, and every day is a new opportunity for some fresh new 10x gains.

Here are some of the altcoins with the best upside potential to keep an eye out for this coming week.

1. Pepecoin ($PEPE)

It only feels right that a memecoin should be first.

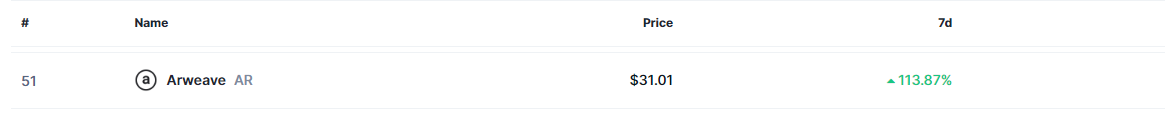

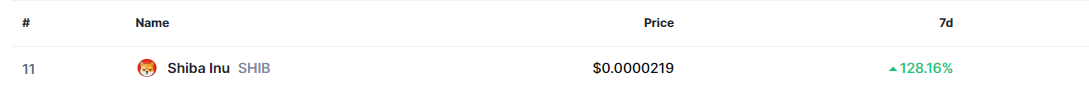

The memecoin market has been performing well over the last few weeks. This crypto market niche has been helped mostly by the price explosion and climb of the top three memecoins, including PEPE.

PEPE in the charts

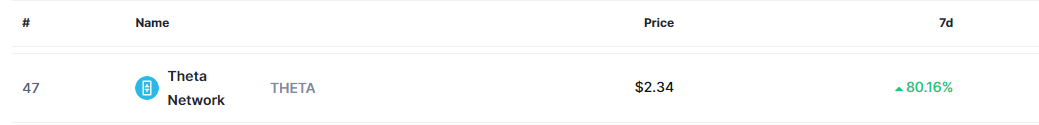

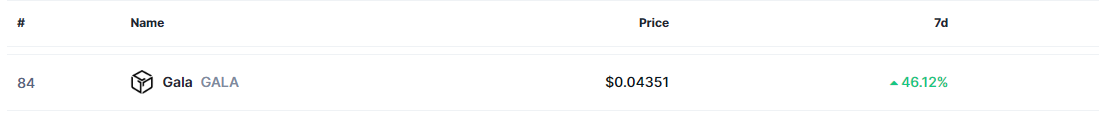

At the time of writing, PEPE has gained around 9% in the last 24 hours, and is up by around 20% in the last week, as illustrated above.

PEPE in the charts

According to the charts, we are looking at the aftermath of a valid rebound from $0.000006 from PEPE as of 19 March.

The cryptocurrency has spent the last few weeks consolidating between $0.00000719 and $0.00000866 and is now looking at a break and close above the $0.00000866 resistance.

This week, we might see PEPE rally further upwards and break above its previous (and psychological) local high of $0.00001084.

This is the price level to watch.

If we see a break and close above $0.00001084, PEPE will have all of the fuel it needs to power through to the next resistance at $0.00001431.

2. ORDI

Ordi has been showing signs of a valid wake-up for weeks now.

According to data from CoinMarketCap, the cryptocurrency is up by around 11% in the last 24 hours at the time of writing, and by another 15% over the last week.

ORDI’s price performance

According to the charts, we are looking at a rebound, after the cryptocurrency hit the ascending trendline shown below.

ORDI in the charts

This rebound has become even more glaring, considering ORDI’s break above its 25-day moving average of around $67.5.

The cryptocurrency trades at around $71 at the time of writing and can launch a parabolic rally, straight up to the next resistance at $107 at any time.

3. Flare ($FLR)

According to data from CoinMarketCap, Flare has also been incredibly bullish on the daily and weekly timeframes.

The cryptocurrency is up by around 9.64% over the last 24 hours as of writing and by another 12.35% over the last week.

Flare’s price performance

In the charts, Flare seems pretty interesting.

First of all, we had a break above the $0.023 resistance on 2 February, before a rally to $0.056.

The bears caught up to the bulls from here, and launched a serious decline to around $0.028 again, as shown below.

Flare’s price action

What we can see above is a rebound from this $0.028, which will more than likely lead to a retest and even a possible break above $0.056 in the long run.

If we do see this break above $0.056 on Flare, the cryptocurrency might be poised to rally up to anywhere between $0.06297 and $0.079, which would be 70% and 115% rallies respectively, from current price levels.

4. Fetch.AI ($FET)

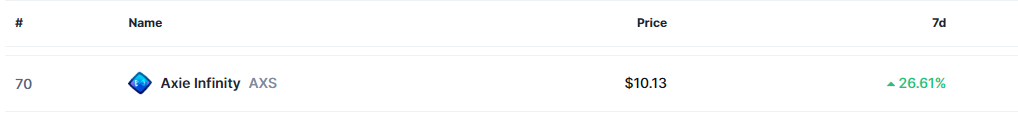

FET hasn’t been as impressive as the rest on the daily timeframe, with less than 2% in the bag over the last 24 hours.

However, we are also looking at a 28% weekly gain on the cryptocurrency in the weekly timeframe, indicating that we might have something here.

FET’s price performance

According to the charts, we are looking at a valid break above the $3.12 resistance on FET.

FET in the charts

The cryptocurrency is in its consolidation phase after this breakout, explaining its low volatility on the lower timeframes.

FET has a strong chance of completing this consolidation this week, and if this happens, we might be ready for a massive rally to anywhere between $3.83 to $4.97, according to the Fibonacci retracement tool.

5. Uniswap ($UNI)

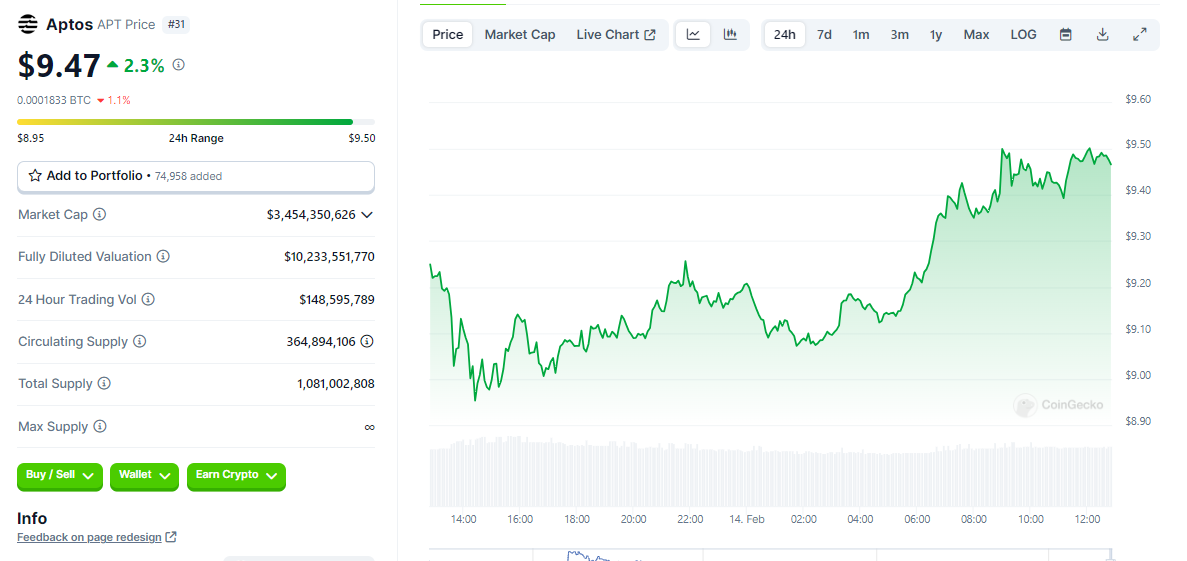

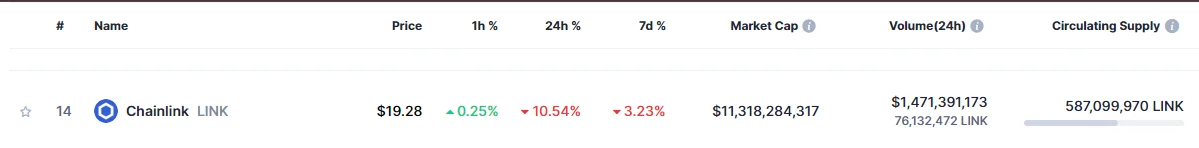

Uniswap, according to CoinMarketCap, is up by around 4.4% over the last day, and by around 10.7% in the last week.

Uniswap’s price performance

Uniswap’s price action is slightly different from the others, in that the last decline from around $17 brought it under the next available support, leading to a crash to $10.

Uniswap’s price action

However, as shown by the chart above, the cryptocurrency has recovered from the $10 zone and is now looking for a break above the $13.15 resistance.

If Uniswap manages to break above, we might be looking at a possible rally back to the $17 resistance, before a jab at the psychological $20 resistance or even higher.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.