Key Insights

- The Bitcoin halving was a success, on 20 April.

- Bitcoin price is currently consolidating but has rallied since the halving.

- US Bitcoin ETFs are seeing inflows after five consecutive days of outflows, following the halving hype.

- Mining company stocks have also been surging.

- Based on the laws of diminishing returns, Bitcoin might move up by around 360%, reaching $300,000 before the 2028 halving.

The Bitcoin halving was a success!

The pioneer blockchain network successfully posted its 840,000th block, cutting miner rewards once again by half, from 6.25 Bitcoin to 3.125 Bitcoin per block.

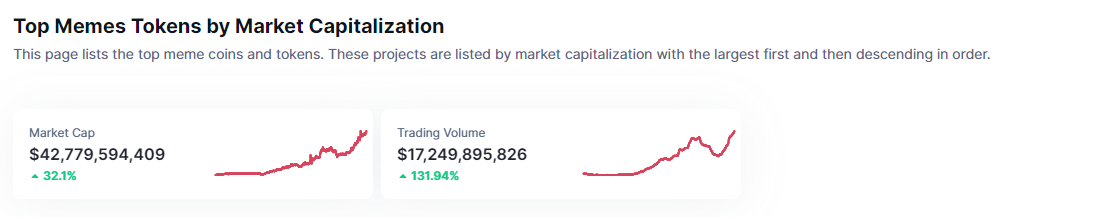

As expected, several changes have started to take effect throughout the market, from ETF inflows to miner stocks skyrocketing, to actual price predictions of what the price of Bitcoin might be when the next halving takes effect in 2028.

Here are all the things you need to know about the market’s reactions to the 20 April 2024 halving, as well as what to expect from the flagship cryptocurrency in 2024.

The Market Reacts

At the time of writing, the price of Bitcoin remains in its consolidation between the $61,000 and $64,000 zones, with a current price of $63,872.

Bitcoin’s current price

The current price of Bitcoin came after an initial rally to $65,481 after the halving and is part of a larger Bitcoin attempt to break above the $71,000 resistance.

Moreover, five of the spot Bitcoin ETFs in the US overshadowed the GBTC outflows, bringing in $30.4 million to the market after five consecutive days of outflows, according to Farside data.

Riot platforms stock skyrockets

Furthermore, Bitcoin mining stocks like Riot Platforms’s $RIOT, Marathon Digital’s $MARA and Clean Spark’s $CLSK increased right before the halving, by as much as 10%, 9.78% and 5.98% respectively, over the last day.

What to Expect from Price?

What is interesting about this year’s halving is that at the time of the last halving, Bitcoin traded at around $8,618, as outlined by MicroStrategy chairman, Michael Saylor, here:

The last Bitcoin halving

Somehow, between the May 2020 halving and May 2022, Bitcoin had spiked by as much as 800% to the $69,000 all-time high.

But what does this tell us?

Historically, Bitcoin rallies by several hundred per cent after every halving.

For example, from its creation in 2009 until the first halving in 2012, Bitcoin rallied by as much as 12,400% from only a few cents to $12.50.

Moreover, Bitcoin price jumped 5,200% to $650 by the 2016 halving, doing the same again by 1,200% to $8,500 by the 2020 halving.

From all of the above, we can deduce that the law of diminishing returns holds, considering how the effects of Bitcoin halvings typically decline after each halving.

We can also see that Bitcoin’s rallies typically decline by as much as 45% every time we see a halving.

To this end, we can expect around a 360% rally from this cycle, as well as a cycle high of around $300,000 BTC or thereabouts, before the 2028 halving (assuming a current price of $70,000).

Bitcoin’s rally prediction

Keep in mind that this high will happen somewhere in between these two halving events and that Bitcoin will likely be closer to $60,000 again, during the next bear market bottom.

Moreover, keep in mind that the Software engineer and author of the Bitcoin novel, “The Final Flaw” expects Bitcoin to hit $477,972 at the 2028 halving.

For those of you playing along at home:

If this rate of return continues #Bitcoin will be $477,972 at the next halving in 2028.

2032 Halving: $3,567,960

2036 Halving: $26,681,860

2040 Halving: $199,566,400 https://t.co/91EVBPbE9J

— Michael R. Sullivan (@SullyMichaelvan) April 20, 2024

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.