Key Insights:

- Lido has rushed to decentralize its ETH staking platform after the SEC charged it with issuing unregistered securities.

- Lido issues stETH, which is awarded to those who have staked their ETH on its staking platform.

- Lido operates $33 billion worth of staking operations and controls 29% of the total stETH supply, which classifies its token as a security according to the FIT-21 act.

- The decentralization efforts include further decentralizing validators and offloading its extra 9% reserves.

- LidoDAO’s governance token, LDO, crashed 25% a week after the SEC booked Lido.

Lido, the largest staking platform for Ethereum staking with an active portfolio of about $33 billion in staked value, has announced decentralization plans.

Lido’s attempt to decentralize itself came after the SEC charged MetaMask on multiple accounts and booked Lido and Rocketpool for issuing unregistered securities.

Lido, which operates the largest Ethereum staking platform with $33 billion in staked ETH, controls 29% of the stETH token supply. This further complicates the issue as the new FIT law in the US mandates that any project with a token supply of 20% or more with a single entity will be treated as a security and hence under the purview of the SEC.

As a result, Lido is now forced to decentralize quickly or face the wrath of the SEC. Though the decentralization process has already started, the matter still remains largely in the hands of the SEC.

SEC Initiates Action Against Lido

In a case against MetaMask, the SEC has also accused Lido of selling stETH as an unregistered security.

stETH is a liquidity token used by Lido and rewarded to people who stake their ETH on its platform. As an ERC-20 token, it possesses all the characteristics of a cryptocurrency, similar to any other ERC-20 token, such as USDC, USDC, wETH, or Shiba Inu.

The state has a $33 billion market cap, which means users have staked $33 billion worth of ETH with Lido.

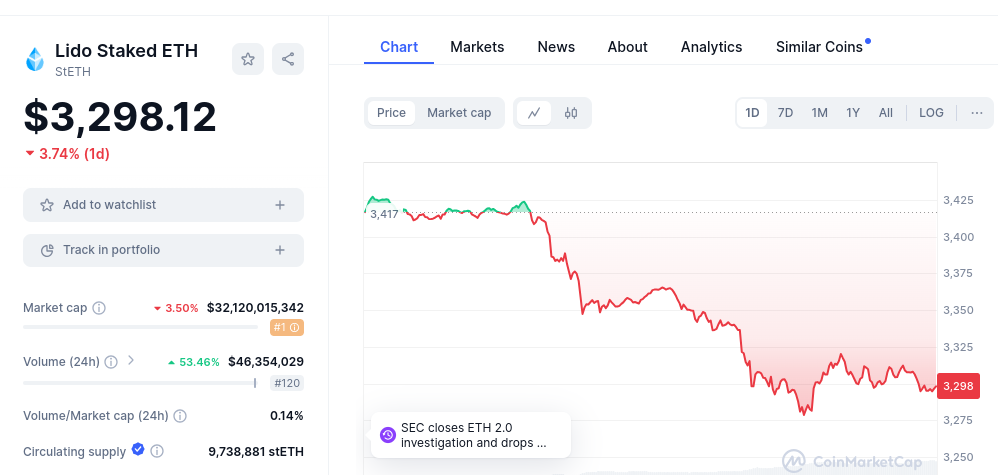

stETH Price and Market Cap

This complicates the case for Lido, the issuer of the stETH token. According to the SEC, offering Lido’s stETH amounts to issuing illegal securities.

To complicate the matter further, the new FIT-21 act, which regulates crypto in the US, recognizes Lido as a security and, therefore, could be regulated by the SEC.

As per the act, the project is classified as security if a cryptocurrency has 20% or more concentration with a single owner (individual or legal entity). Since Lido controls 29% of all stETH, the act could be used by the SEC to prosecute Lido legally.

To avoid that scenario, Lido has decided to go fully decentralized.

Lido’s Race Against Time

Lido has decided to go fully decentralized to avoid being subject to the SEC’s regulatory powers and win its case against the regulator, which is known for its anti-crypto stance.

The decentralization attempt has multiple goals, two of which are at the highest priority.

First, Lido must ensure it retains less than 20% of the stETH supply. This is a basic criterion for escaping the SEC’s regulatory powers.

Secondly, Lido has decided to decentralize its validators further and include some ETH nodes to increase its validator count. This could also benefit Lido and make its platform safer.

However, Lido’s efforts might not be enough. It still has to negotiate with the SEC to drop charges because when Lido was accused, it had a crypto that could be termed security under the prevailing law (FIT-21), and Lido could face legal consequences.

Future Outlook of Lido’s Token and stETH

Lido primarily issues two tokens: stETH, the token you get when you stake ETH, and the LidoDAO governance token LDO.

Lido’s price at press time was $1.73, a 10% drop over the last 24 hours. In the previous week, Lido’s price had dropped 25% from $2.46 to $1.73. The token, a governance token of the LidoDAO, has been one of the most sold cryptos.

However, the price of stETH might not fall much because of its peg with Ethereum (ETH). At press time, it was still pegged to the ETH ($3295) with a $3 premium, i.e., at $3298.

As the case precedes, we expect the token to de-peg, and if Lido does not get any success against the SEC, it might crash.

Disclaimer: Voice of Crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.