Key Insights:

- XRP ETFs are scheduled for approval along with Solana ETFs within 10 Feb 2025.

- Dogecoin ETF sees its first application from Bitwise.

- Bitwise has applied for the incorporation of a Dogecoin Delaware Trust.

- Altcoin ETFs could push crypto markets towards an intense altcoin season.

- The CME website also indicates that the CFTC could become the de jure and de facto crypto regulator.

The Chicago Mercantile Exchange (CME) staging website shows that the exchange could list XRP and Solana ETFs on or before 10 February 2025. Previously, such indications for Bitcoin and Ethereum ETFs accurately predicted their approval on 10 Jan 2024 and 30 May 2024, respectively.

XRP and Solana ETFs on CME Staging Subdomain

It is also noted that both ETFs could be listed along with their future contracts. A combined launch of derivatives and spot ETFs could push these altcoins toward greater heights.

Derivatives provide depth to spot ETFs and lift them because of the leverage they provide to their buyers. Leverage trading offers higher gains and, therefore, remains highly popular. This is the reason why Bitcoin Futures ETFs and futures trade significantly more volume than Bitcoin spot ETFs.

Markets expect the Trump administration to approve the XRP and Solana ETFs in 2025. Several applicants and experts like VanEck and Eric Balchunas previously estimated their approval around May 2025. Early approval was expected under Trump, but it was not as soon as it seems from the CME website.

CME is the listing platform of these ETFs and has been named in their S-1 and Section 19b-4 applications.

The website further shows that both the XRP and SOL futures were CFTC-regulated, which is completely opposite of what the SEC earlier thought. Former SEC Chairperson Gary Gensler vehemently opposed altcoin ETFs, saying that they were under the SEC’s jurisdiction. However, with the CME website showing XRP and Solana futures as CFTC-regulated, we might see cryptocurrencies eventually being totally regulated by the CFTC.

If the CFTC ends up being the crypto regulator, cryptocurrencies would generally be classified as commodities, removing the scope of any regulatory action from the SEC in the future. This development could also end all the pending cases filed by the SEC against crypto companies and projects.

Bitwise Starts Application Process For Dogecoin ETF

Bitwise has started another application process for a Dogecoin ETF after a Solana and an XRP ETF. It has filed for a Delaware Trust company in the US state of Delaware.

BREAKING: BITWISE FILES $DOGE ETF IN DELEWARE

IT’S HAPPENING pic.twitter.com/xDXzhHZWDn

— Bark (@barkmeta) January 22, 2025

ETF issuers incorporate ETFs in the USA as Delaware Trusts. The shares of these trusts are then listed in exchange for public trading. Bitcoin and Ethereum ETFs also followed similar listing patterns.

A Dogecoin ETF has a very high chance of approval because of Elon Musk. Earlier, Elon had incorporated the Dogecoin mascot in his Department of Government Efficiency (now removed). His presence inside the US Government could push the DOGE ETF towards approval. Elon Musk has been

Dogecoin Mascot Added to Department of Government Efficiency (now removed)

Can Altcoin ETFs Bring Stronger Alt Season?

Approving all the pending altcoin ETFs would open the floodgates to other cryptocurrencies and change how cryptos are legally perceived.

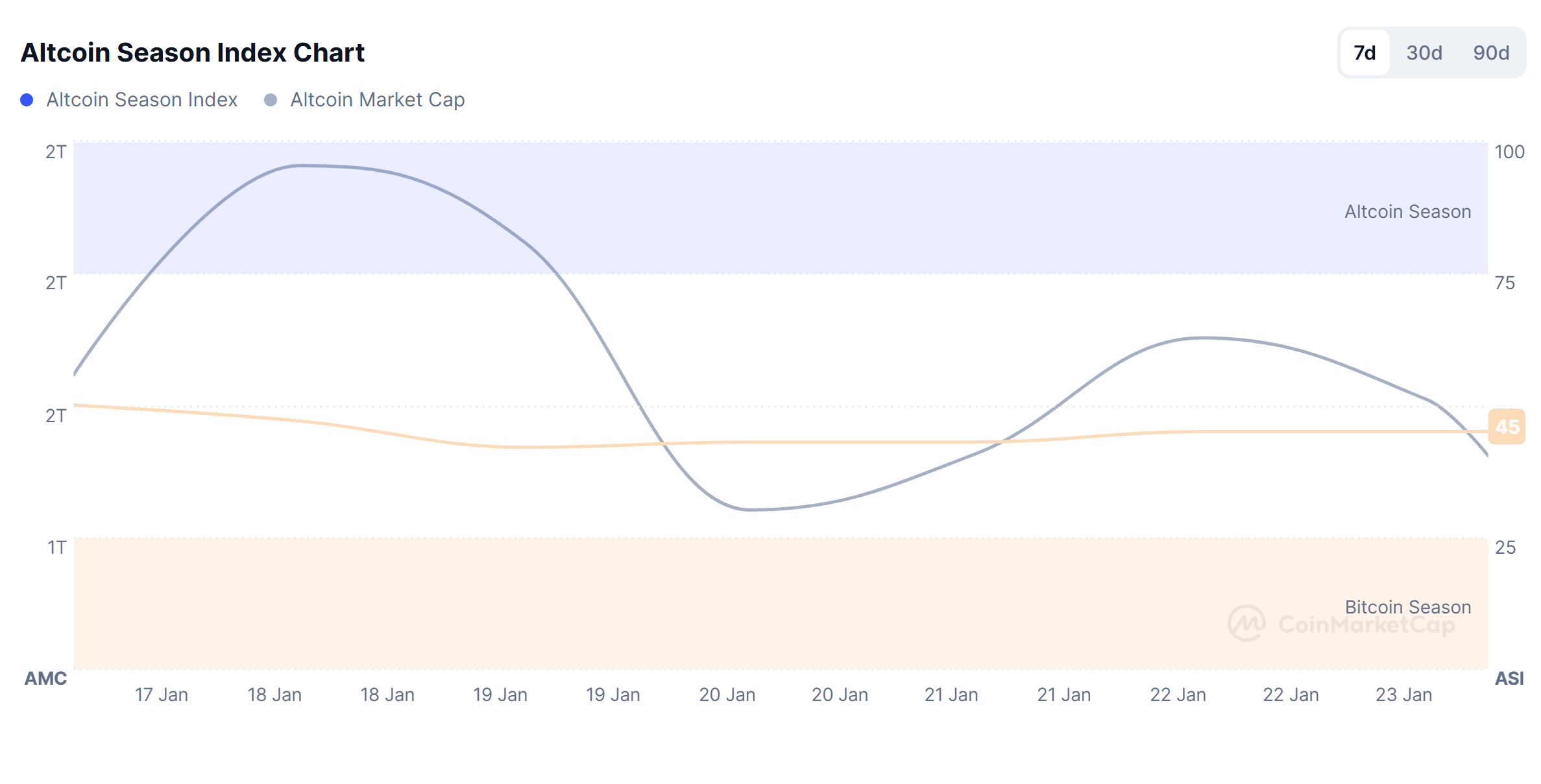

More altcoin ETFs could bring much-needed liquidity into the markets, which seemed to halt the growth of altcoin markets after the US Fed’s weak guidance. At press time, the altcoin season index chart showed a score of 45/100 while the altcoin market cap was at $1.52 trillion.

Altcoin Season Index at 45 on 23 Jan 2025

Even if only these three ETFs are approved in 2025, more retailers could shift towards them due to their convenience.

Further, with the rise in cryptocurrency scams and the expertise required for self-custody, altcoin ETFs would shift more retailers towards centralized crypto custody. Astonishingly, it is the exact opposite of the principle of self-custody in the crypto world.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.