Key Insights:

- The crypto markets corrected after a bull-trap rally led to a crash.

- Short sellers in retail markets and derivatives used the US Crypto Reserve news to create exit liquidity.

- Crypto markets have yet again reached critical support levels.

- Top cryptos that might see an imminent accumulation and recovery include Bitcoin, Ethereum, XRP, Solana, Litecoin, and Cardano.

Markets Fell After a US Crypto Reserve-led News

Crypto markets again fell after the US Crypto Reserve announcement. The markets saw a massive rally last weekend that almost recovered from the past week’s loss. Bitcoin fell from $85k levels after regaining the $93k price. Last week, it had fallen to $82k from $98k. All of these events happened in the last 4 days.

Bitcoin’s Price Volatility in the Last 7 Days

This huge rise and fall in the crypto markets happened due to several reasons. Let us understand each event one by one.

Last Week’s Fall

Crypto markets fell from a high of $3.2 trillion last week to $2.6 trillion due to a combination of factors like liquidity troubles, impatience of short-term investors, and massive short-selling in derivatives as well as in ETF markets.

This fall was expected as crypto markets rose massively in the last 4 months without any consolidation or major price correction, something that was not typical for financial markets.

Weekend Rally

Over the weekend, Donald Trump had announced that the US National Digital Assets Stockpile would be a multi-asset one, including Ethereum, XRP, Solana, and Cardano, besides Bitcoin.

As a result, Cardano rose 45%, XRP rose 30%, Solana rose 20%, and Ethereum rose almost 20%.

The overall crypto market cap also rose to $3.06 trillion, recovering from the lows of $2.6 trillion a couple of days ago.

This Week’s Fall

The current week’s fall was most probably due to selling by short-term investors in the markets. Those investors that were in the red following last week’s crash were desperately searching for exit liquidity, and the US President’s tweet acted as a way out for them.

Bull post to create exit liquidity for you and your friends. #Trump #Bitcoin #xrp #sol #ada pic.twitter.com/1PsTn5Q6KR

— CUTN Crypto (@CUTNCrypto) March 2, 2025

Retail Investors Became Exit Liquidity

As top investors exited the markets after the reserve-led surge, it was the retail ones that were left with crypto bought at higher levels. Such a situation is called a bull-trap where people buying at higher levels are trapped. Those who are selling at the top (mostly whales and institutions) use them as exit liquidity.

The market top formed when Bitcoin was at $93k and was one of the key moves that trapped retail buyers who were in hope of seeing better prices.

Nevertheless, Bitcoin accumulation by the US National Digital Assets Stockpile is expected to start around mid-2024. In the near term, the markets could continue to consolidate around current levels unless there is some more positive news from the Trump administration.

Derivatives Segment Signals Hope, Recovery Soon

Crypto derivatives offer a good amount of insight into how the markets could behave in the near term. We have used Bitcoin derivatives as it dominates 60% of the crypto markets.

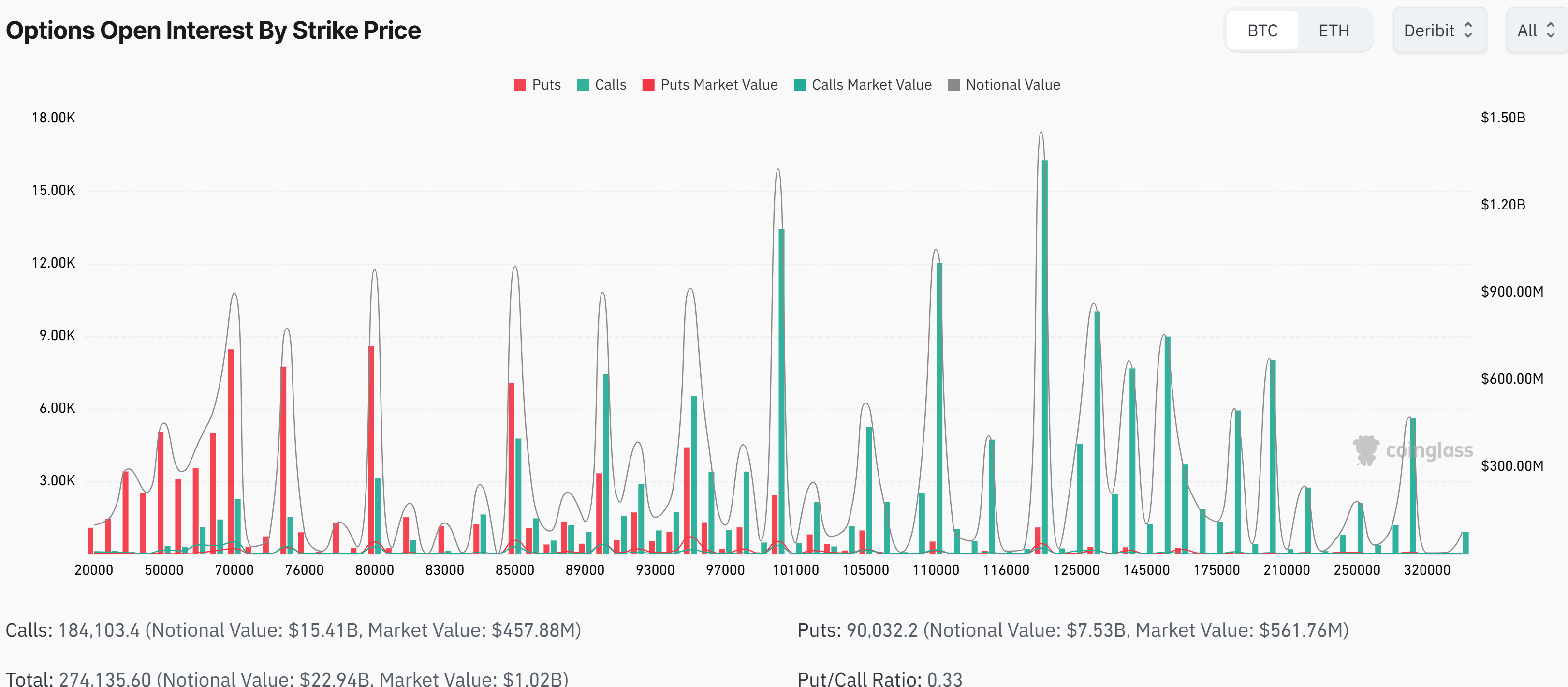

Bitcoin Derivative Data by Strike Price

This week, we see that bears are exiting the market. In the derivatives chain. Call options have increased in the last few days, and as per Coinglass, there is a net $15 billion in short contracts in the market. Last Sunday, despite a rise in the market, the call option value was at a net $16.5 billion.

There is also a slight increase in the Put/Call Ratio, which indicates the number of short sellers (call sellers) is decreasing in the markets. This indicates that markets could turn neutral from bearish in the near term.

Based on these data, we expect crypto markets to recover in the short term to above $3 trillion levels from the current $2.7 trillion.

What Cryptos Could Recover Soon?

Only a few fundamentally strong cryptocurrencies are expected to recover quickly when short covering hits the markets. A few of them are Bitcoin, Ethereum, XRP, Solana, Litecoin, and Cardano.

XRP, Solana, and Cardano benefit from dual fundamental triggers of Crypto Reserves and upcoming ETFs.

Litecoin has whale accumulation on its side, along with an active ETF application.

Finally, Bitcoin and Ethereum could grow more bullish due to Bitcoin’s institutional accumulation and Ethereum’s historical valuation charts.

Disclaimer: This article is intended solely for informational purposes and should not be construed as financial advice. Investing in cryptocurrencies involves substantial risk, including the possible loss of your capital. Readers are encouraged to perform their own research and seek guidance from a licensed financial advisor before making any investment decisions. Voice of Crypto does not endorse or promote any specific cryptocurrency, investment product, or trading strategy mentioned in this article.